Answered step by step

Verified Expert Solution

Question

1 Approved Answer

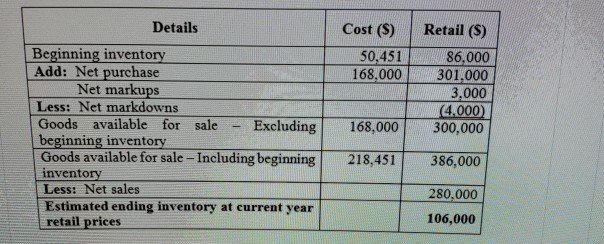

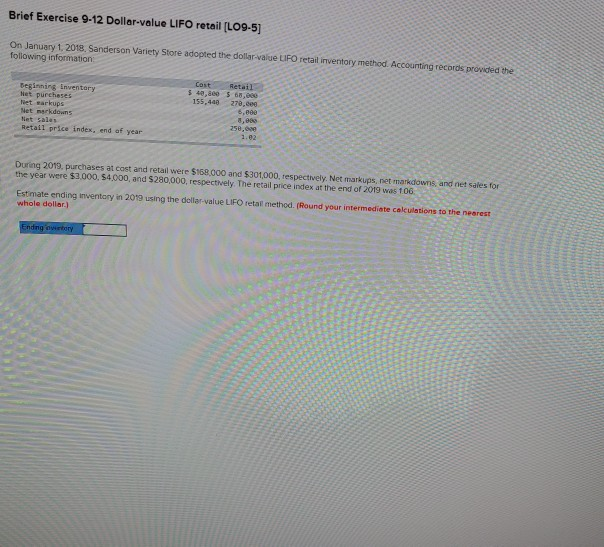

How do I come to Beginning inventory cost 50,451 and retail 86,000 from the cost 40,800 and retail 68,000 presented in the problem I've included?

How do I come to Beginning inventory cost 50,451 and retail 86,000 from the cost 40,800 and retail 68,000 presented in the problem I've included?

Details Retail (S) Cost (9) 50,451 168,000 86,000 301.000 3,000 (4.000) 300,000 168,000 Beginning inventory Add: Net purchase Net markups Less: Net markdowns Goods available for sale - Excluding beginning inventory Goods available for sale - Including beginning inventory Less: Net sales Estimated ending inventory at current year retail prices 218,451 386,000 280,000 106,000 Brief Exercise 9-12 Dollar-value LIFO retail L09-5) On January 1, 2018, Sanderson Variety Store adopted the dollar value LIFO retail inventory method. Accounting records provided the following information Cast Retail 155,440 270,000 Beginning inventory Het purchases Net sarkups et merkon tiet Salas Retail price index, and of year During 2019. purchases at cost and retail were $150.000 and $300.000, respectively. Net markups, net markdowns, and net sales for the year were $3.000, 54,000, and 5280,000, respectively. The retail price index at the end of 2019 was 106. Estimate ending inventory in 2019 using the dollar-value LIFO retal method (Round your intermediate calculations to the nearest whole dollar) Ending wetery

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started