Answered step by step

Verified Expert Solution

Question

1 Approved Answer

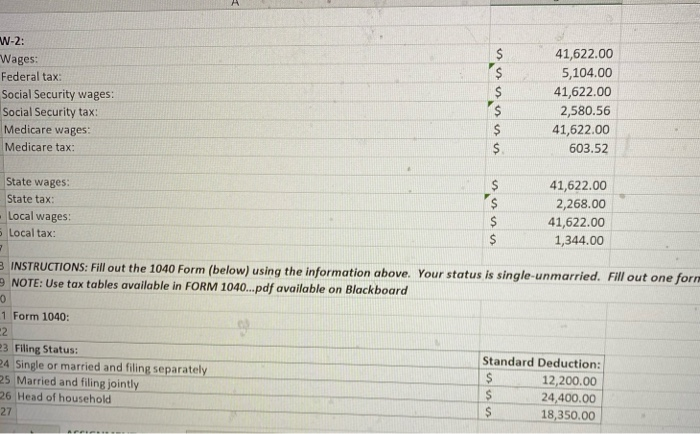

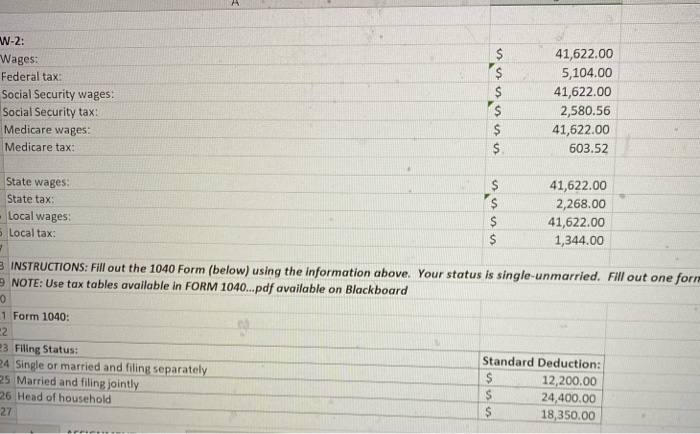

How do i complete table A $ W-2: Wages: Federal tax: Social Security wages: Social Security tax: Medicare wages: Medicare tax: $ $ $ $

How do i complete table

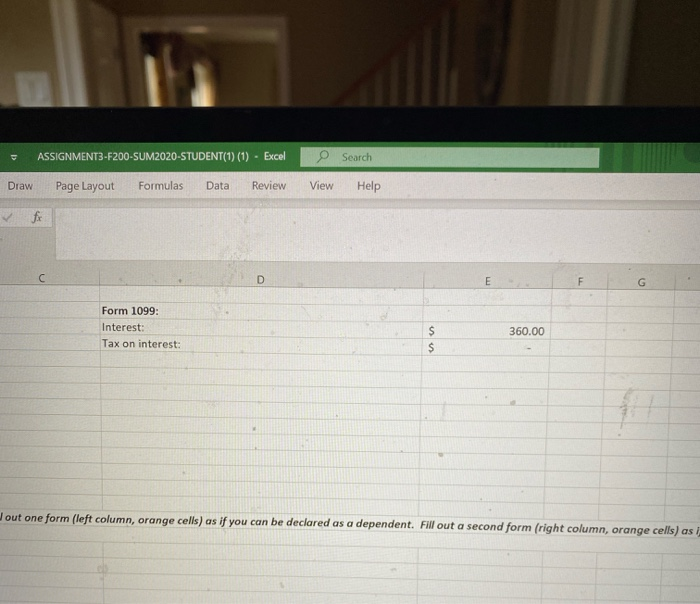

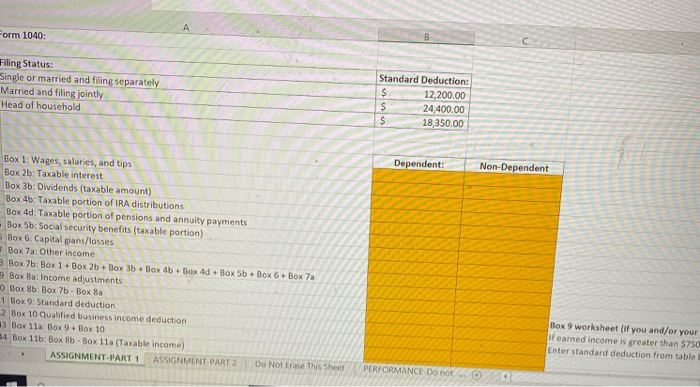

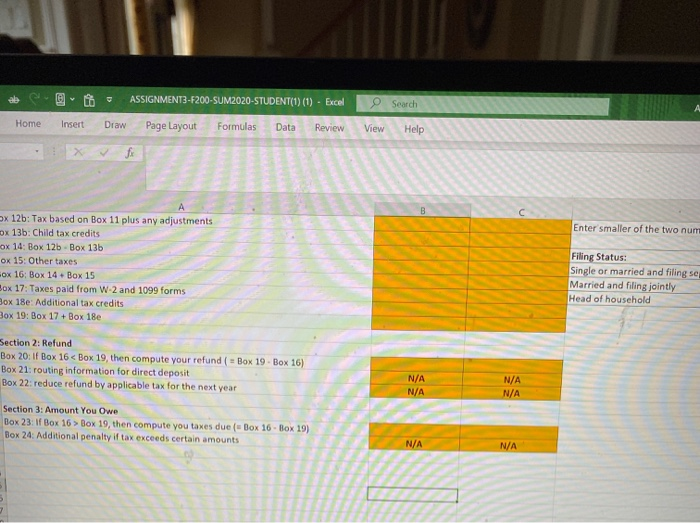

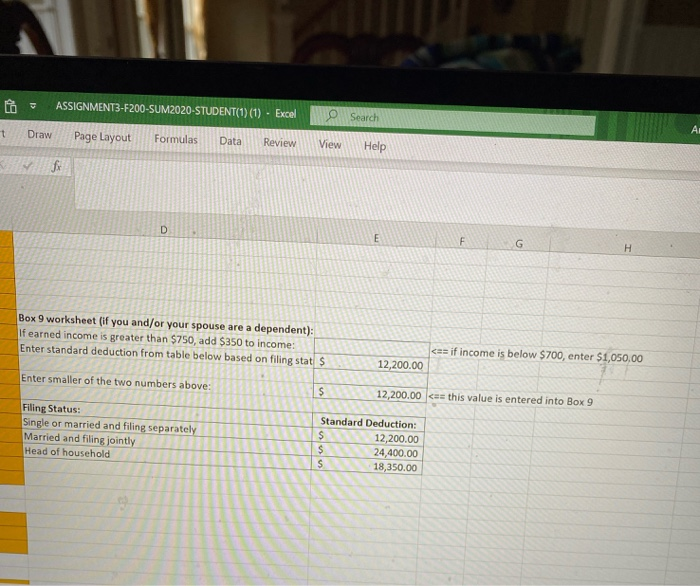

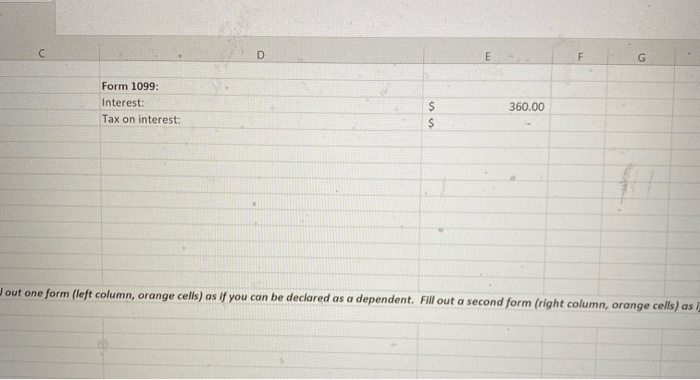

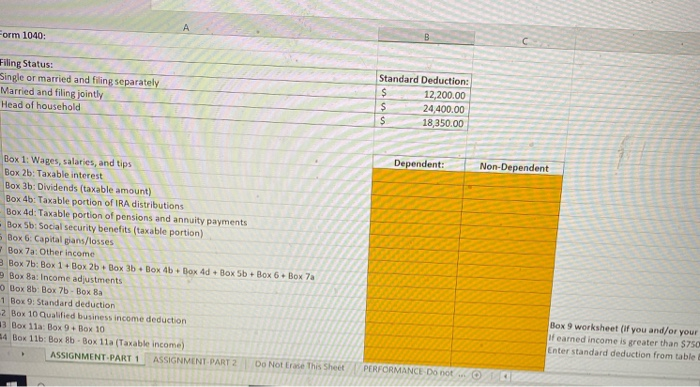

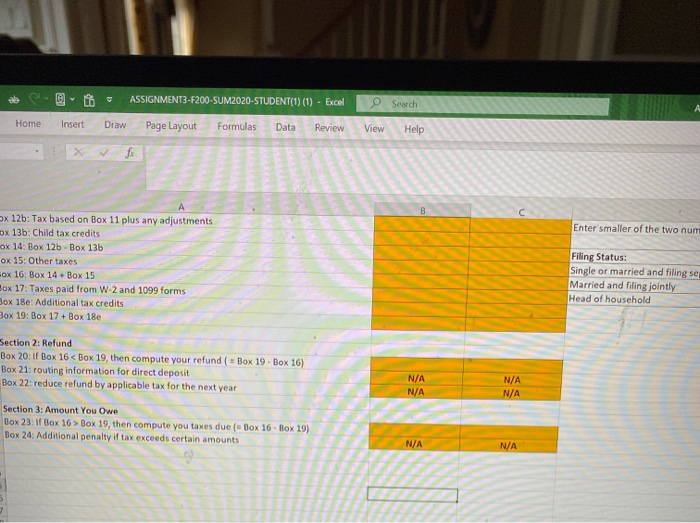

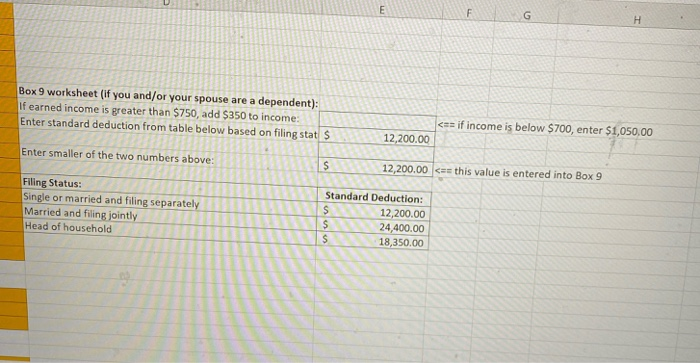

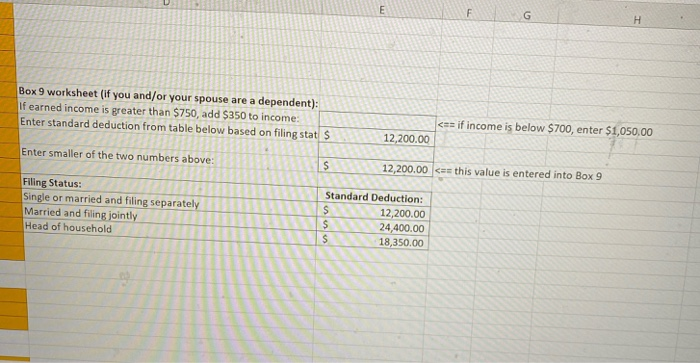

A $ W-2: Wages: Federal tax: Social Security wages: Social Security tax: Medicare wages: Medicare tax: $ $ $ $ $ 41,622.00 5,104.00 41,622.00 2,580.56 41,622.00 603.52 State wages: State tax: Local wages Local tax: $ $ $ 41,622.00 2,268.00 41,622.00 1,344.00 $ 3 3 INSTRUCTIONS: Fill out the 1040 Form (below) using the information above. Your status is single-unmarried. Fill out one form NOTE: Use tax tables available in FORM 1040...pdf available on Blackboard 1 Form 1040: 2 23 Filing Status: 24 Single or married and filing separately 25 Married and filing jointly 26 Head of household 27 Standard Deduction: $ 12,200.00 $ 24,400.00 $ 18,350.00 ASSIGNMENT3-F200-SUM2020-STUDENT(1) (1) - Excel O Search Draw Page Layout Formulas Data Review View Help C D E F G Form 1099: Interest: Tax on interest: 360.00 $ $ Jout one form (left column, orange cells) as if you can be declared as a dependent. Fill out a second form (right column, orange cells) as A Form 1040: C Filing Status: Single or married and filing separately Married and filling jointly Head of household Standard Deduction: $ 12,200.00 $ 24,400.00 $ 18,350.00 Dependent: Non-Dependent Box 1: Wages, salaries, and tips Box 2b: Taxable interest Box 36: Dividends (taxable amount) Box 4b: Taxable portion of IRA distributions Box 4d: Taxable portion of pensions and annuity payments Box 5b: Social security benefits (taxable portion) Box 6. Capital gans/losses # Box 7a: Other income Box 7b: Box 1 Box 2b + Box 3b + Box 4bDax 4d Box 5b + Box 6+ Box 7a Box Ba: Income adjustments O Box 8b: Box 7b-Box Ba 1 Box 9: Standard deduction 2 Box 10 Qualified business income deduction 13 Box lla: Box 9 + Box 10 14 Box 11b: Box 8b - Box 11a (Taxable income) ASSIGNMENT.PART 1 ASSIGNMENT PART 2 Do Not Erase This Sheet Box 9 worksheet (if you and/or your If earned income is greater than $750 Enter standard deduction from table PERFORMANCE-Do not ASSIGNMENT3-F200-SUM2020-STUDENT(1) (1) - Excel Search Home Insert Draw Page Layout Formulas Data Review View Help fi B Enter smaller of the two num x 12b: Tax based on Box 11 plus any adjustments ox 135: Child tax credits ox 14: Box 12b - Box 13b Ox 15: Other taxes ox 16: Box 14 + Box 15 Box 17: Taxes paid from W-2 and 1099 forms Box 18e: Additional tax credits Box 19: Box 17 + Box 18e Filing Status: Single or married and filing se Married and filing jointly Head of household Section 2: Refund Box 20: If Box 16 Box 19, then compute you taxes due (Box 16 - Box 19) Box 24: Additional penalty if tax exceeds certain amounts N/A N/A ASSIGNMENT3-F200-SUM2020-STUDENT(1) (1) - Excel Search t . Draw Page Layout Formulas Data Review View Help fi D E F G H Box 9 worksheet (if you and/or your spouse are a dependent): If earned income is greater than $750, add $350 to income: Enter standard deduction from table below based on filing stat $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started