Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do I complete this question Question 1 XYZ Capital is a hedge fund with 100 million of initial investment capital. They charge a 2%

how do I complete this question

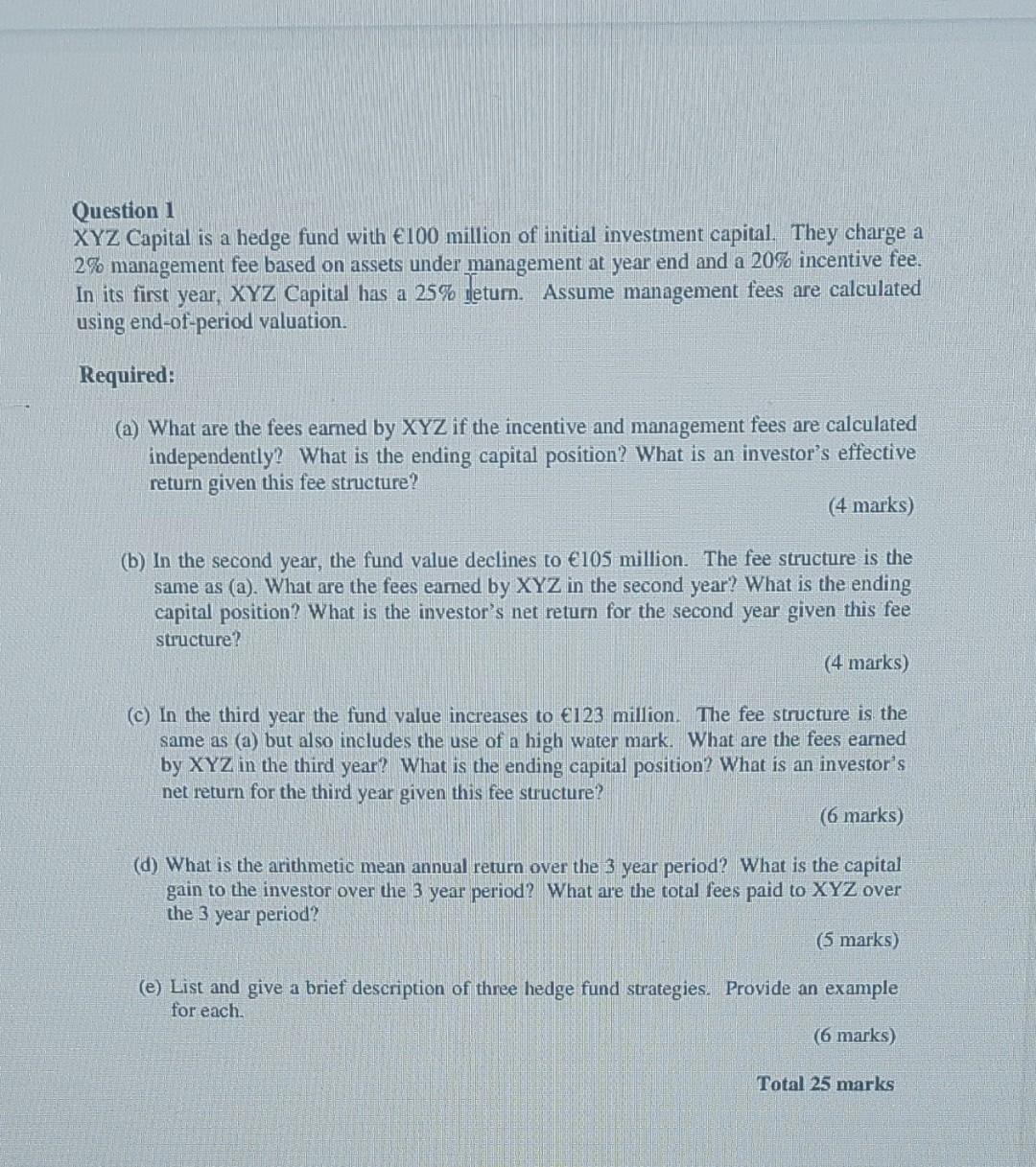

Question 1 XYZ Capital is a hedge fund with 100 million of initial investment capital. They charge a 2% management fee based on assets under management at year end and a 20% incentive fee. In its first year, XYZ Capital has a 25% Ieturn. Assume management fees are calculated using end-ot-period valuation. Required: (a) What are the fees earned by XYZ if the incentive and management fees are calculated independently? What is the ending capital position? What is an investor's effective return given this fee structure? (4 marks) (b) In the second year, the fund value declines to 105 million. The fee structure is the same as (a). What are the fees eamed by XYZ in the second year? What is the ending capital position? What is the investor's net return for the second year given this fee structure? (4 marks) (c) In the third year the fund value increases to 1123 million. The fee structure is the same as (a) but also includes the use of a high water mark. What are the fees earned by XYZ in the third year? What is the ending capital position? What is an investor's net return for the third year given this fee structure? ( 6 marks) (d) What is the arithmetic mean annual return over the 3 year period? What is the capital gain to the investor over the 3 year period? What are the total fees paid to XYZ over the 3 year period? (5 marks) (e) List and give a brief description of three hedge fund strategies. Provide an example for each. (6 marks) Question 1 XYZ Capital is a hedge fund with 100 million of initial investment capital. They charge a 2% management fee based on assets under management at year end and a 20% incentive fee. In its first year, XYZ Capital has a 25% Ieturn. Assume management fees are calculated using end-ot-period valuation. Required: (a) What are the fees earned by XYZ if the incentive and management fees are calculated independently? What is the ending capital position? What is an investor's effective return given this fee structure? (4 marks) (b) In the second year, the fund value declines to 105 million. The fee structure is the same as (a). What are the fees eamed by XYZ in the second year? What is the ending capital position? What is the investor's net return for the second year given this fee structure? (4 marks) (c) In the third year the fund value increases to 1123 million. The fee structure is the same as (a) but also includes the use of a high water mark. What are the fees earned by XYZ in the third year? What is the ending capital position? What is an investor's net return for the third year given this fee structure? ( 6 marks) (d) What is the arithmetic mean annual return over the 3 year period? What is the capital gain to the investor over the 3 year period? What are the total fees paid to XYZ over the 3 year period? (5 marks) (e) List and give a brief description of three hedge fund strategies. Provide an example for each. (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started