Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do i determine the missing Year 0 numbers/balances from this information? Additional info: Retailer, Inc buys 60% of its inventory from suppliers who manufacture

How do i determine the missing Year 0 numbers/balances from this information?

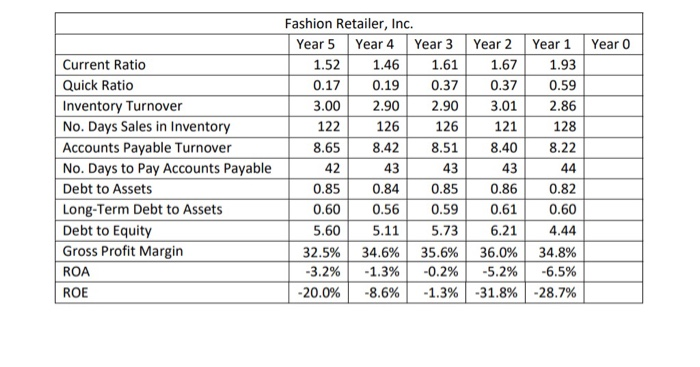

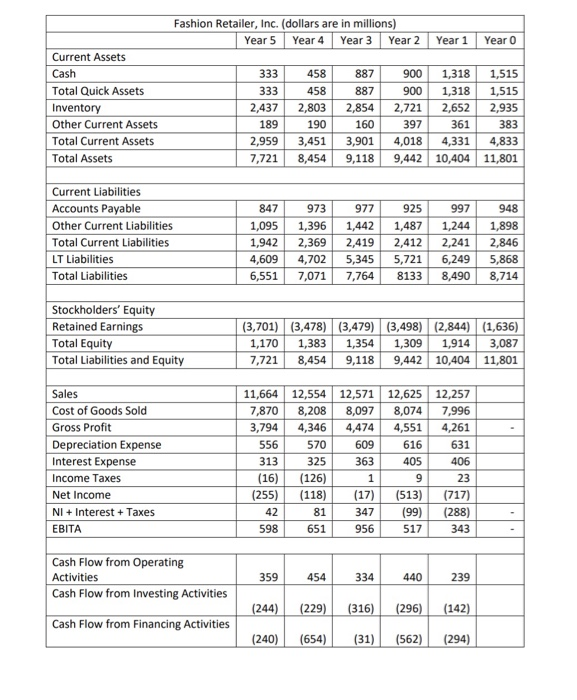

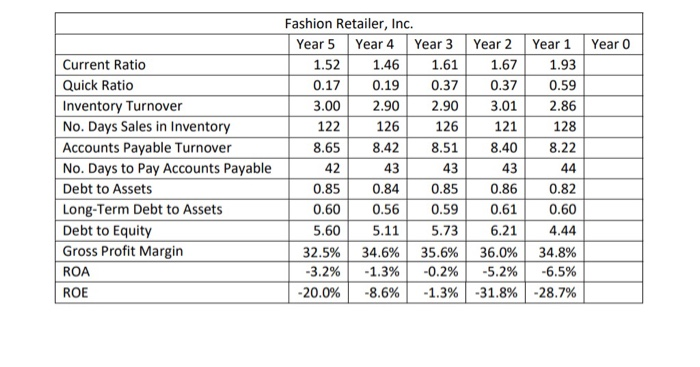

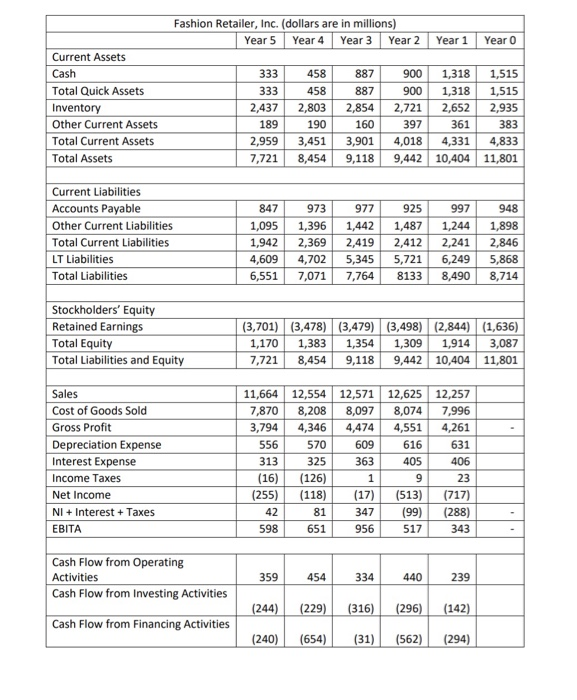

Year 0 Year 2 1.67 0.37 3.01 121 8.40 Current Ratio Quick Ratio Inventory Turnover No. Days Sales in Inventory Accounts Payable Turnover No. Days to Pay Accounts Payable Debt to Assets Long-Term Debt to Assets Debt to Equity Gross Profit Margin ROA ROE Fashion Retailer, Inc. Year 5 Year 4 Year 3 1.52 1.46 1.61 0.17 0.19 0.37 3.00 2.90 2.90 122 126 126 8.65 8.42 8.51 42 43 43 0.85 0.84 0.85 0.60 0.56 0.59 5.60 5.11 5.73 32.5% 34.6% 35.6% -3.2% -1.3% -0.2% -20.0% -8.6% -1.3% 43 Year 1 1.93 0.59 2.86 128 8.22 44 0.82 0.60 4.44 34.8% -6.5% -28.7% 0.86 0.61 6.21 36.0% -5.2% -31.8% Fashion Retailer, Inc. (dollars are in millions) Year 5 Year 4 Year 3 Year 2 Year 1 Year 0 Current Assets Cash Total Quick Assets Inventory Other Current Assets Total Current Assets Total Assets 333 333 2,437 189 2,959 7,721 458 458 2,803 190 3,451 8,454 887 900 887 900 2,8542,721 160 397 3,901 4,018 9,118 9,442 1,318 1,318 2,652 361 4,331 10,404 1,515 1,515 2,935 383 4,833 11,801 Current Liabilities Accounts Payable Other Current Liabilities Total Current Liabilities LT Liabilities Total Liabilities 847 1,095 1,942 4,609 6,551 973 1,396 2,369 4,702 7,071 977925 1,442 1,487 2,4192,412 5,345 5,721 7,764 8133 997 1,244 2,241 6,249 8,490 948 1,898 2,846 5,868 8,714 Stockholders' Equity Retained Earnings Total Equity Total Liabilities and Equity (3,701) 1,170 7,721 (3,478) 1,383 8,454 (3,479) 1,354 9,118 (3,498) 1,309 9,442 (2,844) 1,914 10,404 (1,636) 3,087 11,801 Sales Cost of Goods Sold Gross Profit Depreciation Expense Interest Expense Income Taxes Net Income NI + Interest + Taxes 12,257 7,996 4,261 631 11,664 7,870 3,794 556 313 (16) (255) 42 598 12,554 8,208 4,346 570 325 (126) (118) 81 651 12,571 12,625 8,097 8,074 4,474 4,551 609 616 363 405 406 23 (17) 347 956 (513) (99) 517 (717) (288) 343 Cash Flow from Operating Activities Cash Flow from Investing Activities 359 454 334 440 239 Cash Flow from Financing Activities (244) (240) (229) (654) (316) (31) (296) (562) (142) (294)

Additional info: Retailer, Inc buys 60% of its inventory from suppliers who manufacture in China. Retailer Inc does not have accounts receivables.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started