Answered step by step

Verified Expert Solution

Question

1 Approved Answer

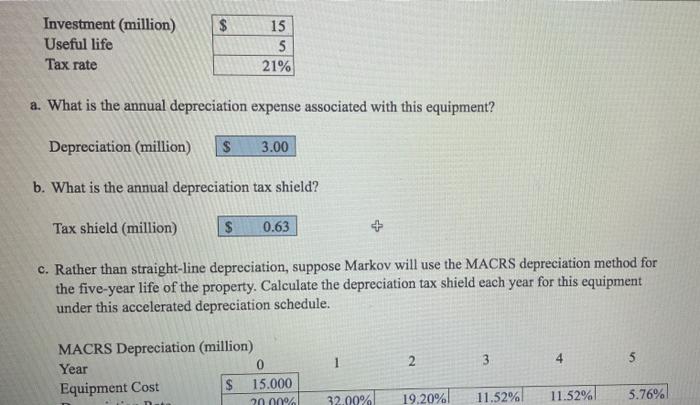

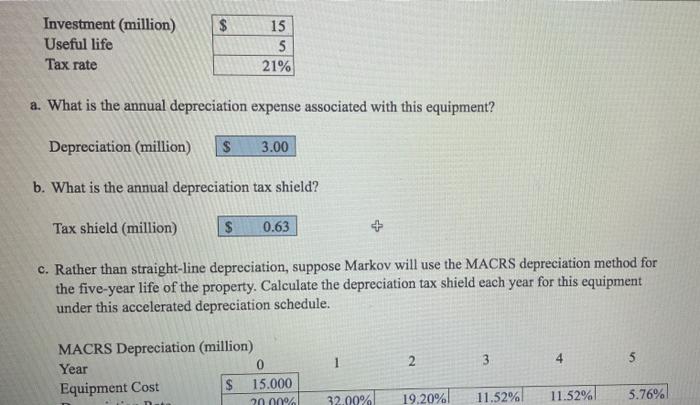

how do i do part c in excel $ Investment (million) Useful life Tax rate 15 5 21% a. What is the annual depreciation expense

how do i do part c in excel

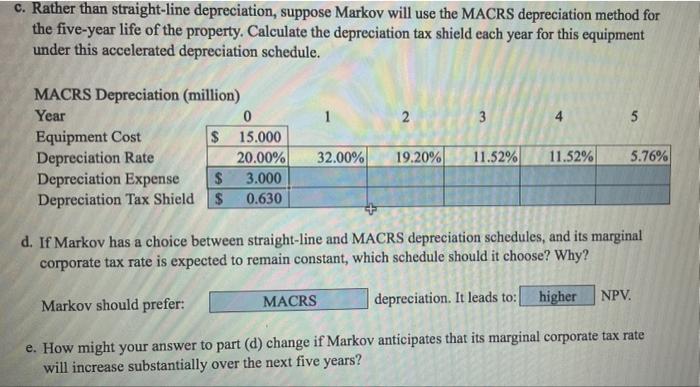

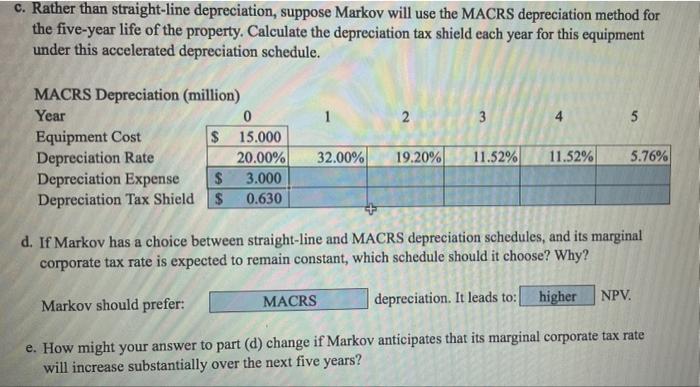

$ Investment (million) Useful life Tax rate 15 5 21% a. What is the annual depreciation expense associated with this equipment? Depreciation (million) $ 3.00 b. What is the annual depreciation tax shield? Tax shield (million) $ 0.63 c. Rather than straight-line depreciation, suppose Markov will use the MACRS depreciation method for the five-year life of the property. Calculate the depreciation tax shield each year for this equipment under this accelerated depreciation schedule. 1 2 3 5 MACRS Depreciation (million) Year 0 Equipment Cost $ 15.000 32.00% 20 0094 19.20% 11.52% 11.52% 5.76% c. Rather than straight-line depreciation, suppose Markov will use the MACRS depreciation method for the five-year life of the property. Calculate the depreciation tax shield each year for this equipment under this accelerated depreciation schedule. 2 3 5 MACRS Depreciation (million) Year 0 Equipment Cost $ 15.000 Depreciation Rate 20.00% Depreciation Expense $ 3.000 Depreciation Tax Shield S 0.630 32.00% 19.20% 11.52% 11.52% 5.76% d. If Markov has a choice between straight-line and MACRS depreciation schedules, and its marginal corporate tax rate is expected to remain constant, which schedule should it choose? Why? MACRS Markov should prefer: NPV. depreciation. It leads to: higher e. How might your answer to part (d) change if Markov anticipates that its marginal corporate tax rate will increase substantially over the next five years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started