Answered step by step

Verified Expert Solution

Question

1 Approved Answer

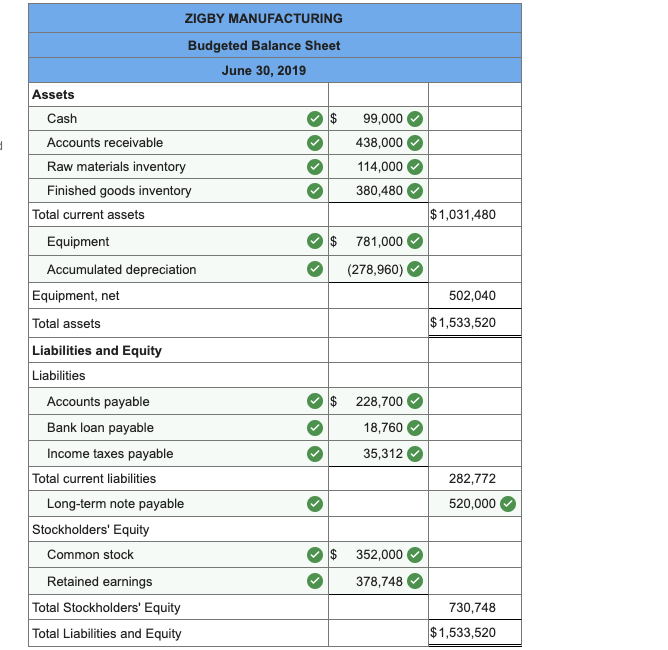

How do I do question 11 (last two pictures)? $1,031,480 502,040 ZIGBY MANUFACTURING Budgeted Balance Sheet June 30, 2019 Assets Cash $ 99,000 Accounts receivable

How do I do question 11 (last two pictures)?

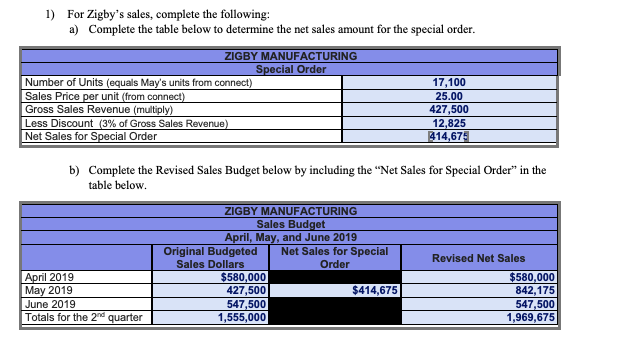

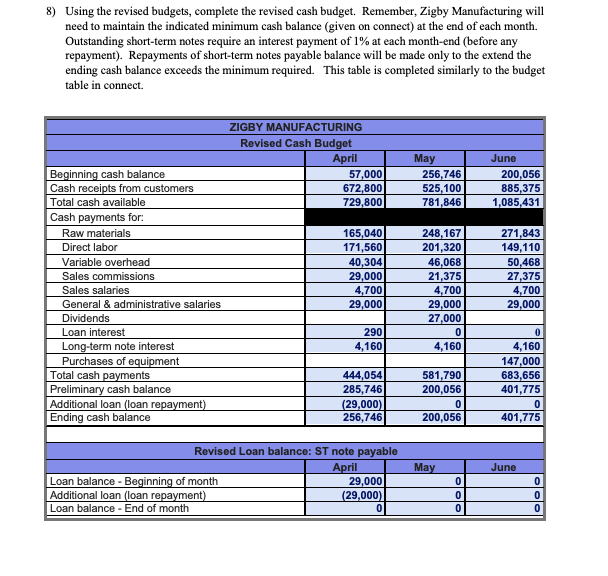

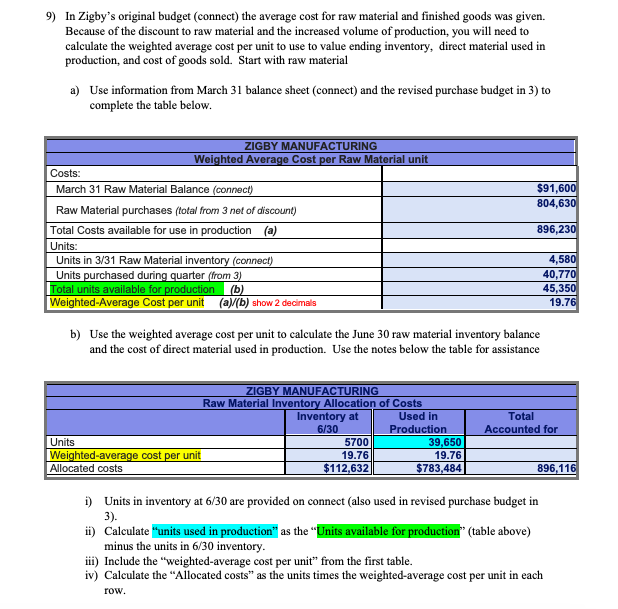

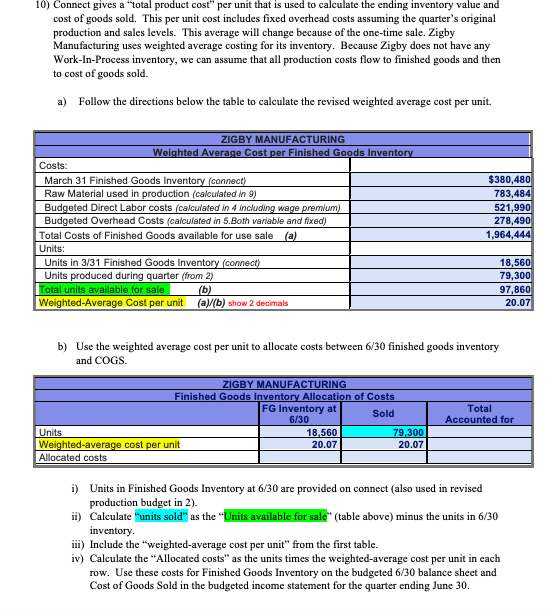

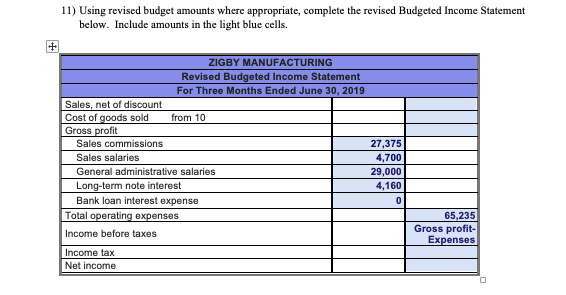

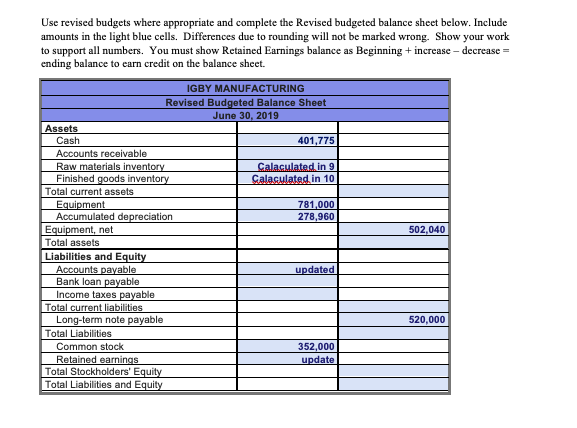

$1,031,480 502,040 ZIGBY MANUFACTURING Budgeted Balance Sheet June 30, 2019 Assets Cash $ 99,000 Accounts receivable 438,000 Raw materials inventory 114,000 Finished goods inventory 380,480 Total current assets Equipment $ 781,000 Accumulated depreciation (278,960) Equipment, net Total assets Liabilities and Equity Liabilities Accounts payable $ 228,700 Bank loan payable 18,760 Income taxes payable 35,312 Total current liabilities Long-term note payable Stockholders' Equity Common stock $ 352,000 Retained earnings 378,748 Total Stockholders' Equity Total Liabilities and Equity $1,533,520 282,772 520,000 730,748 $1,533,520 1) For Zigby's sales, complete the following: a) Complete the table below to determine the net sales amount for the special order. ZIGBY MANUFACTURING Special Order Number of Units (equals May's units from connect) Sales Price per unit (from connect) Gross Sales Revenue (multiply) Less Discount (3% of Gross Sales Revenue) Net Sales for Special Order 17,100 25.00 427,500 12,825 414,675 b) Complete the Revised Sales Budget below by including the Net Sales for Special Order" in the table below. ZIGBY MANUFACTURING Sales Budget April, May, and June 2019 Original Budgeted Net Sales for Special Sales Dollars Order $580,000 427,500 $414,675 547,500 1,555,000 April 2019 May 2019 June 2019 Totals for the 2nd quarter Revised Net Sales $580,000 842,175 547,500 1,969,675 8) Using the revised budgets, complete the revised cash budget. Remember, Zigby Manufacturing will need to maintain the indicated minimum cash balance (given on connect) at the end of each month. Outstanding short-term notes require an interest payment of 1% at each month-end (before any repayment). Repayments of short-term notes payable balance will be made only to the extend the ending cash balance exceeds the minimum required. This table is completed similarly to the budget table in connect. ZIGBY MANUFACTURING Revised Cash Budget April 57,000 672,800 729,800 May 256,746 525,100 781,846 June 200,056 885,375 1,085,431 Beginning cash balance Cash receipts from customers Total cash available Cash payments for: Raw materials Direct labor Variable overhead Sales commissions Sales salaries General & administrative salaries Dividends Loan interest Long-term note interest Purchases of equipment Total cash payments Preliminary cash balance Additional loan (loan repayment) Ending cash balance 165,040 171,560 40,304 29,000 4,700 29,000 248,167 201,320 46,068 21,375 4,700 29,000 27,000 0 4,160 271,843 149,110 50,468 27,375 4,700 29,000 290 4,160 444,054 285,746 (29,000) 256,746 581,790 200,056 0 200,056 0 4,160 147,000 683,656 401,775 0 401,775 May June Revised Loan balance: ST note payable April Loan balance - Beginning of month 29,000 Additional loan (loan repayment) (29,000) Loan balance - End of month 0 ololo Ooo 9) In Zigby's original budget (connect) the average cost for raw material and finished goods was given. Because of the discount to raw material and the increased volume of production, you will need to calculate the weighted average cost per unit to use to value ending inventory, direct material used in production, and cost of goods sold. Start with raw material a) Use information from March 31 balance sheet (connect) and the revised purchase budget in 3) to complete the table below. $91,600 804,630 ZIGBY MANUFACTURING Weighted Average Cost per Raw Material unit Costs: March 31 Raw Material Balance (connect) Raw Material purchases (total from 3 net of discount) Total Costs available for use in production Units: Units in 3/31 Raw Material inventory (connect) Units purchased during quarter (from 3) Total units available for production (b) Weighted-Average Cost per unit (a) (b) show 2 decimals 896,230 4,580 40,770 45,350 19.76 b) Use the weighted average cost per unit to calculate the June 30 raw material inventory balance and the cost of direct material used in production. Use the notes below the table for assistance ZIGBY MANUFACTURING Raw Material Inventory Allocation of Costs Inventory at Used in 6/30 Production Units 5700 39,650 Weighted-average cost per unit 19.76 19.76 Allocated costs $112,632 $783,484 Total Accounted for 896,116 1) Units in inventory at 6/30 are provided on connect (also used in revised purchase budget in 3). ii) Calculate "units used in production" as the Units available for production" (table above) minus the units in 6/30 inventory. iii) Include the "weighted average cost per unit from the first table. iv) Calculate the "Allocated costs as the units times the weighted average cost per unit in each row. 10) Connect gives a total product cost" per unit that is used to calculate the ending inventory value and cost of goods sold. This per unit cost includes fixed overhead costs assuming the quarter's original production and sales levels. This average will change because of the one-time sale. Zigby Manufacturing uses weighted average costing for its inventory. Because Zigby does not have any Work-In-Process inventory, we can assume that all production costs flow to finished goods and then to cost of goods sold. a) Follow the directions below the table to calculate the revised weighted average cost per unit. ZIGBY MANUFACTURING Weighted Average Cost per Finished Goods Inventory Costs: March 31 Finished Goods Inventory (connect) Raw Material used in production calculated in 9) Budgeted Direct Labor costs (calculated in 4 including wage premium) Budgeted Overhead Costs (calculated in 5.Both variable and fixed) Total Costs of Finished Goods available for use sale (a) Units: Units in 3/31 Finished Goods Inventory connect) Units produced during quarter (from 2) Total units available for sale (b) Weighted-Average Cost per unit (a) (b) show 2 decimals $380,480 783,484 521,990 278,490 1,964,444 18,560 79,300 97,860 20.07 b) Use the weighted average cost per unit to allocate costs between 6/30 finished goods inventory and COGS. ZIGBY MANUFACTURING Finished Goods Inventory Allocation of Costs FG Inventory at Sold 6/30 Units 18,560 79,300 Weighted-average cost per unit 20.07 20.07 Allocated costs Total Accounted for 1) Units in Finished Goods Inventory at 6/30 are provided on connect (also used in revised production budget in 2). ii) Calculate "units sold" as the Units available for sale" (table above) minus the units in 6/30 inventory iii) Include the "weighted average cost per unit" from the first table. iv) Calculate the "Allocated costs" as the units times the weighted average cost per unit in each row. Use these costs for Finished Goods Inventory on the budgeted 6/30 balance sheet and Cost of Goods Sold in the budgeted income statement for the quarter ending June 30. Use revised budgets where appropriate and complete the Revised budgeted balance sheet below. Include amounts in the light blue cells. Differences due to rounding will not be marked wrong. Show your work to support all numbers. You must show Retained Earnings balance as Beginning + increase - decrease = ending balance to earn credit on the balance sheet. IGBY MANUFACTURING Revised Budgeted Balance Sheet June 30, 2019 Assets Cash 401,775 Accounts receivable Raw materials inventory Calaculated in 9 Finished goods inventory Calasulated in 10 Total current assets Equipment 781,000 Accumulated depreciation 278,960 Equipment, net 502,040 Total assets Liabilities and Equity Accounts payable updated Bank loan payable Income taxes payable Total current liabilities Long-term note payable 520,000 Total Liabilities Common stock 352,000 Retained earnings update Total Stockholders' Equity Total Liabilities and EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started