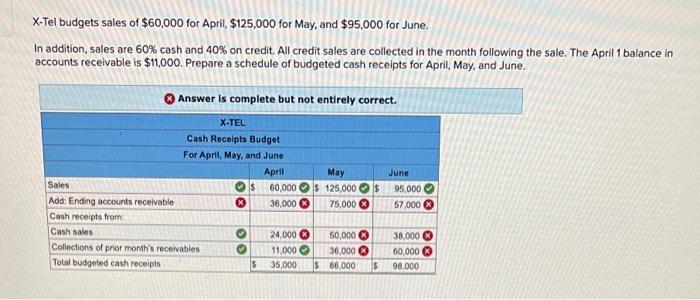

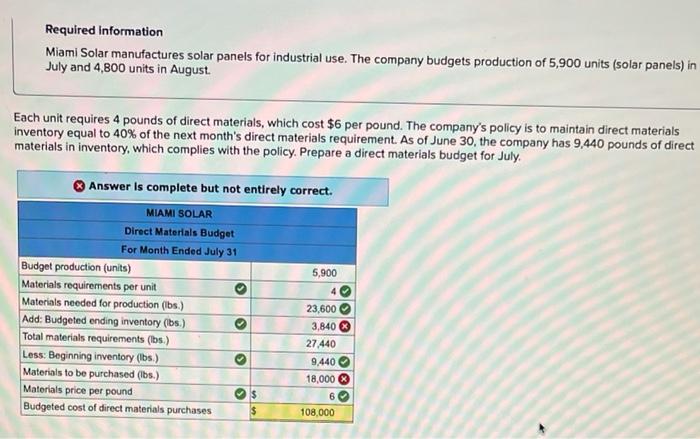

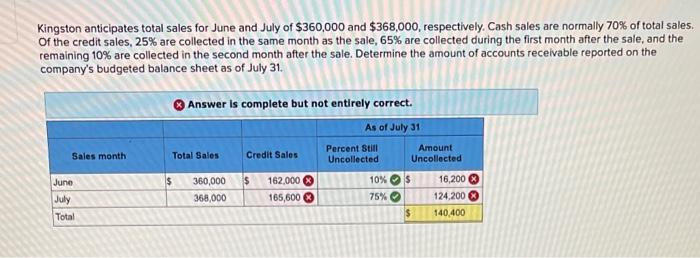

X-Tel budgets sales of $60,000 for April, $125,000 for May, and $95,000 for June. In addition, sales are 60% cash and 40% on credit. All credit sales are collected in the month following the sale. The April 1 balance in accounts receivable is $11,000. Prepare a schedule of budgeted cash receipts for April, May, and June. Answer is complete but not entirely correct. X-TEL Cash Receipts Budget For April, May, and June April May June Sales $ 60,000 $ 125,000 $ 95,000 Add: Ending accounts receivable 36,000 75,000 57.000 Cash receipts from: Cash sales 24,000 50,000 38,000 Collections of prior month's receivables 11,000 36,000 60,000 Total budgeted cash receipts 5 35,000 $ 86,000 $ 98,000 Required information Miami Solar manufactures solar panels for industrial use. The company budgets production of 5,900 units (solar panels) in July and 4,800 units in August Each unit requires 4 pounds of direct materials, which cost $6 per pound. The company's policy is to maintain direct materials inventory equal to 40% of the next month's direct materials requirement. As of June 30, the company has 9,440 pounds of direct materials in inventory, which complies with the policy. Prepare a direct materials budget for July Answer is complete but not entirely correct. MIAMI SOLAR Direct Materials Budget For Month Ended July 31 Budget production (units) 5,900 Materials requirements per unit Materials needed for production (lbs.) 23,600 Add: Budgeted ending inventory (bs) 3,840 Total materials requirements (bs) 27440 Less: Beginning inventory (lbs) 9,440 Materials to be purchased (lbs.) 18,000 Materials price per pound 6 Budgeted cost of direct materials purchases $ 108,000 > Kingston anticipates total sales for June and July of $360,000 and $368,000, respectively. Cash sales are normally 70% of total sales. of the credit sales, 25% are collected in the same month as the sale, 65% are collected during the first month after the sale, and the remaining 10% are collected in the second month after the sale. Determine the amount of accounts receivable reported on the company's budgeted balance sheet as of July 31. Answer is complete but not entirely correct. As of July 31 Percent Still Amount Total Sales Credit Sales Uncollected Uncollected Sales month $ $ $ June July Total 360,000 368,000 162.000 165,600 10% 75% 16,200 124.200 140.400 3 $