Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do I do this? Bramble Inc. manufactures a variety of consumer products. The company's founders have run the company for 30 years and are

how do I do this?

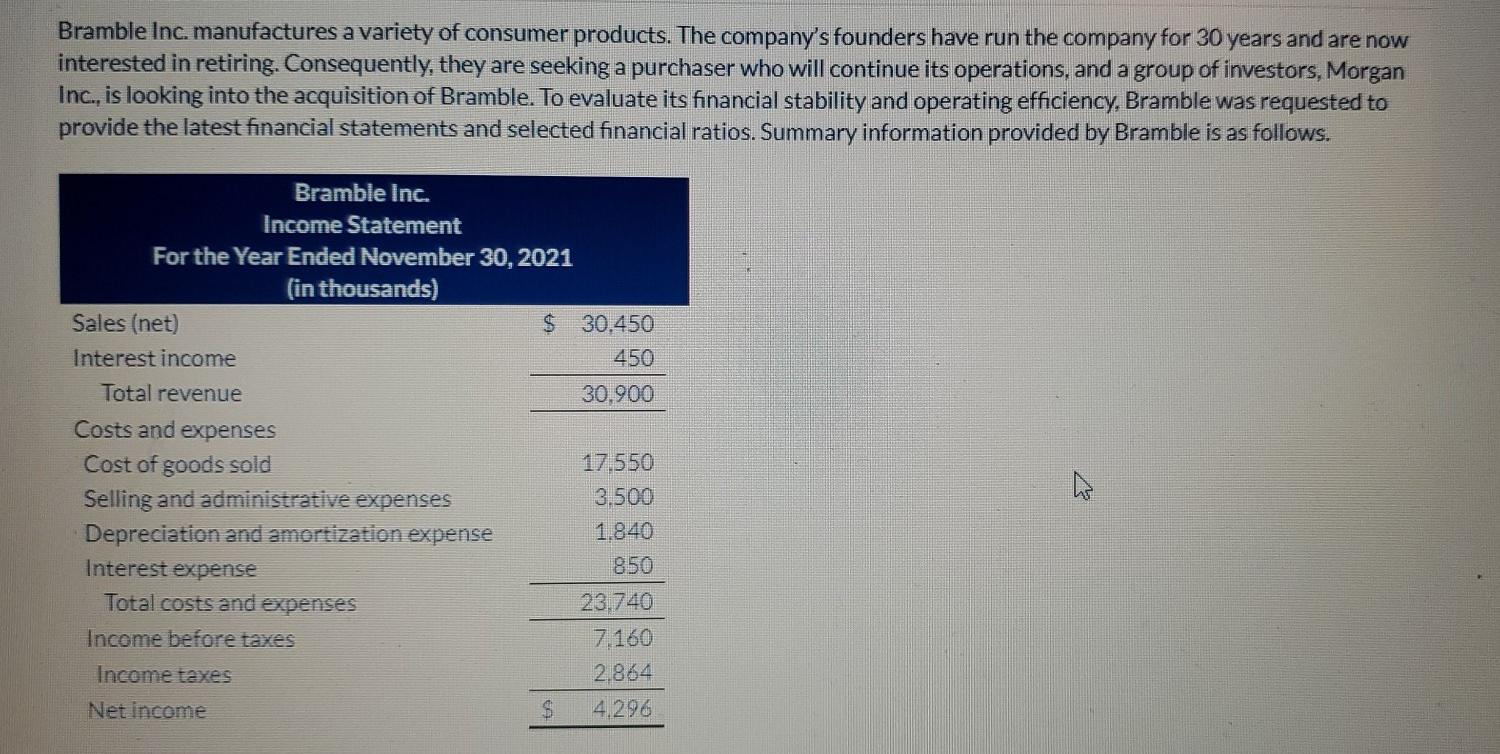

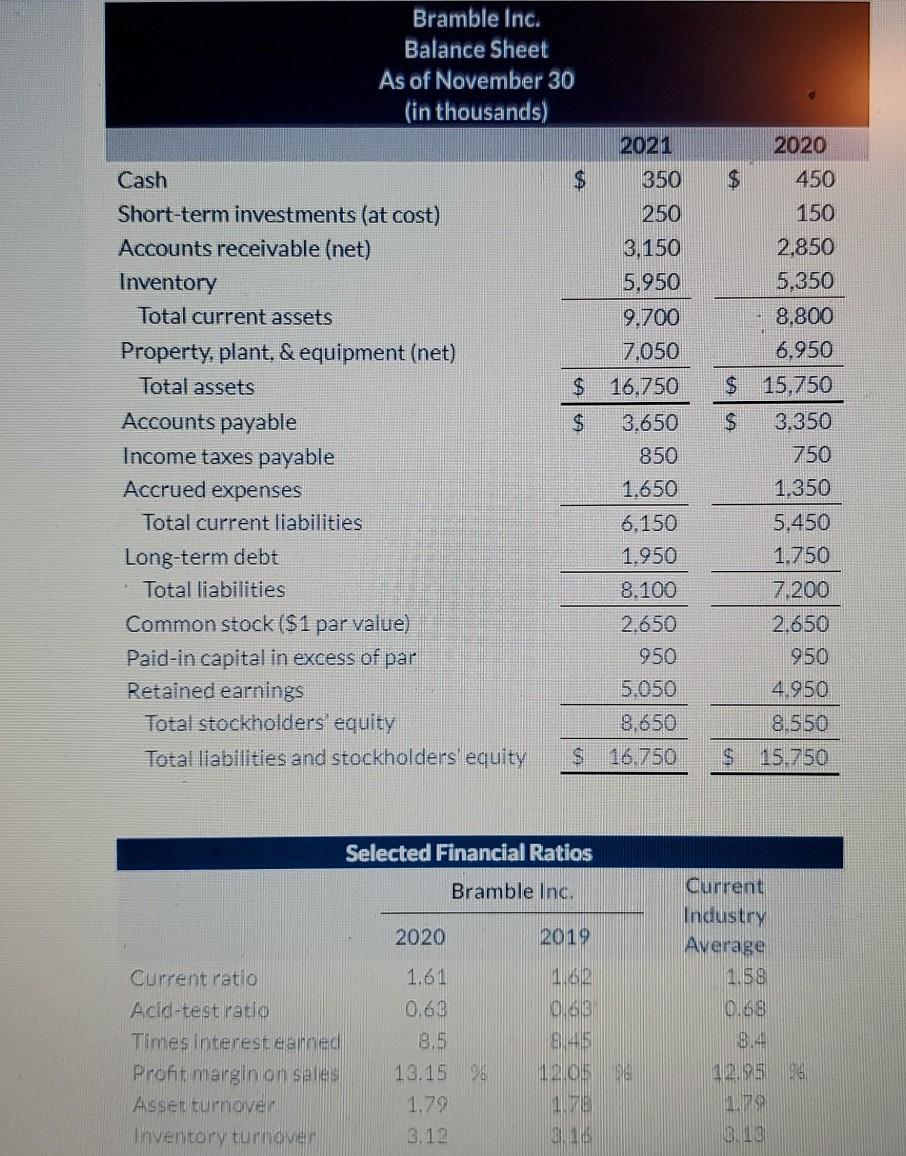

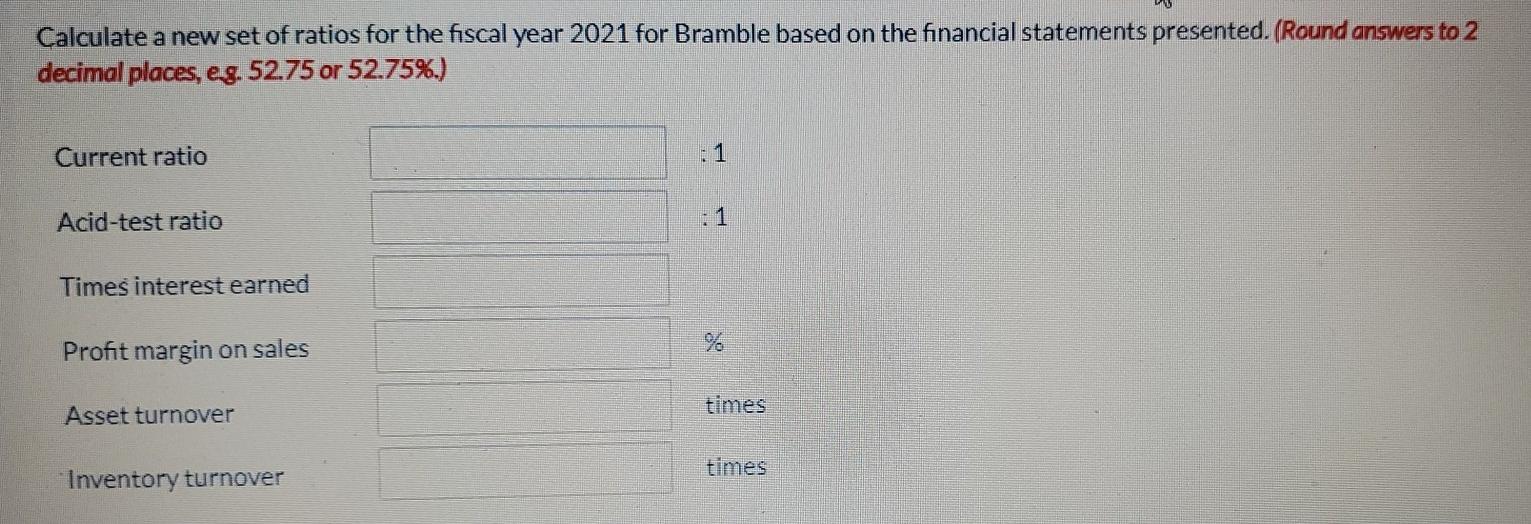

Bramble Inc. manufactures a variety of consumer products. The company's founders have run the company for 30 years and are now interested in retiring. Consequently, they are seeking a purchaser who will continue its operations, and a group of investors, Morgan Inc., is looking into the acquisition of Bramble. To evaluate its financial stability and operating efficiency, Bramble was requested to provide the latest financial statements and selected financial ratios. Summary information provided by Bramble is as follows. Bramble Inc. Income Statement For the Year Ended November 30, 2021 (in thousands) Sales (net) $ 30.450 Interest income 450 Total revenue 30.900 Costs and expenses Cost of goods sold 17.550 Selling and administrative expenses 3.500 Depreciation and amortization expense 1.840 Interest expense 850 Total costs and expenses 23,740 Income before taxes 7.160 Income taxes 2.864 Net income 4,296 2020 450 150 Bramble Inc. Balance Sheet As of November 30 (in thousands) 2021 Cash 350 Short-term investments (at cost) 250 Accounts receivable (net) 3,150 Inventory 5,950 Total current assets 9.700 Property, plant, & equipment (net) 7.050 Total assets $ 16.750 Accounts payable $ 3.650 Income taxes payable 850 Accrued expenses 1.650 Total current liabilities 6.150 Long-term debt 1.950 Total liabilities 8.100 Common stock ($ 1 par value) 2.650 Paid-in capital in excess of par 950 Retained earnings 5.050 Total stockholders equity 8.650 Total liabilities and stockholders' equity $ 16.750 2,850 5.350 8,800 6.950 $ 15,750 $ 3.350 750 1.350 5.450 1.750 7 200 2.650 950 4.950 8.550 $ 15.750 Selected Financial Ratios Bramble Inc. 2020 2019 1.61 0.63 1.02 0 0 845 Current ratio Acid-test ratio Tines interest earned Profit margin on seles Asset turnover Inventory turnover Current Industry Average 1,58 0.68 8.4 42.9596 1179 0.13 13.15 90 1.79 3.12 17 910 Calculate a new set of ratios for the fiscal year 2021 for Bramble based on the financial statements presented. (Round answers to 2 decimal places, eg. 52.75 or 52.75%.) Current ratio Acid-test ratio Times interest earned Profit margin on sales Asset turnover times times Inventory turnover

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started