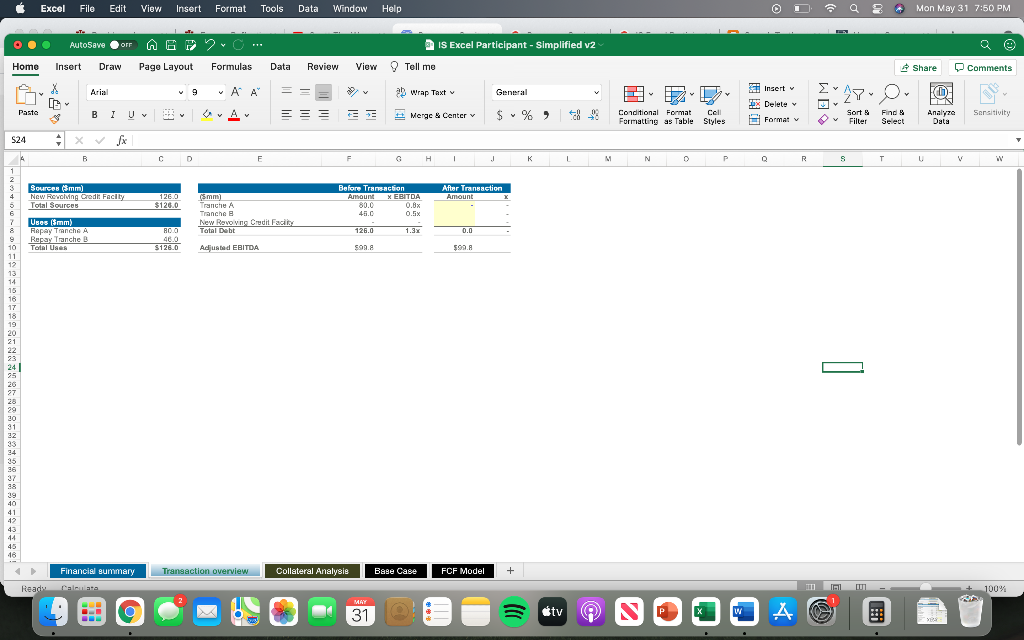

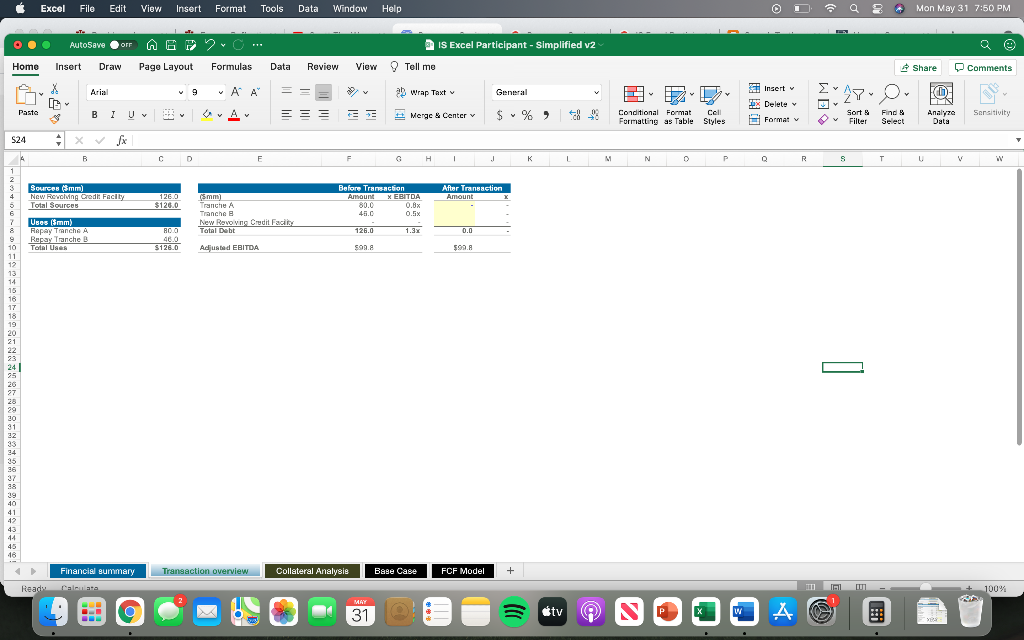

How do I find the after transaction?

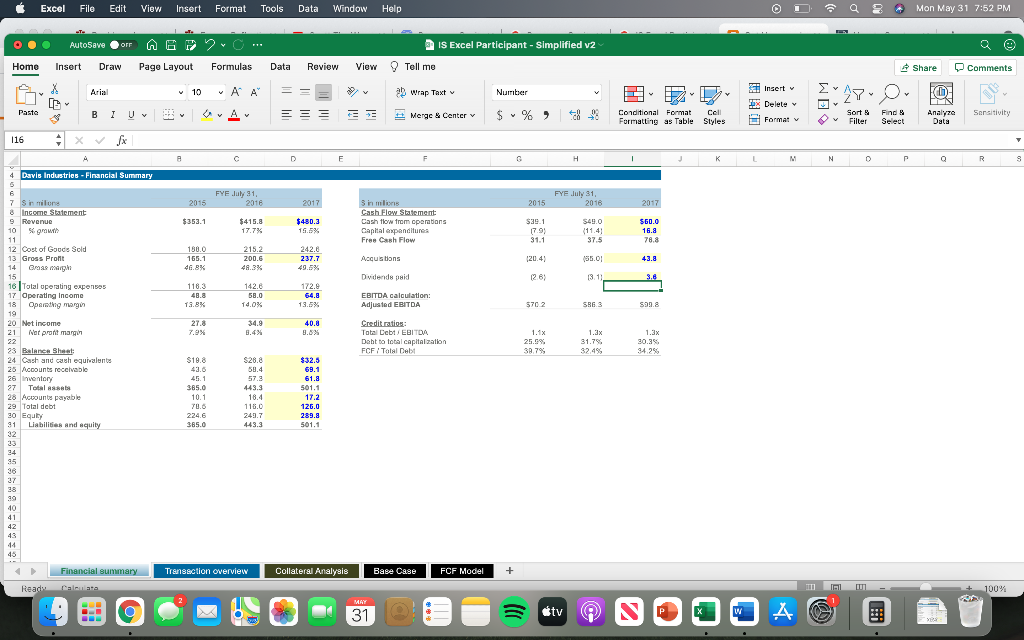

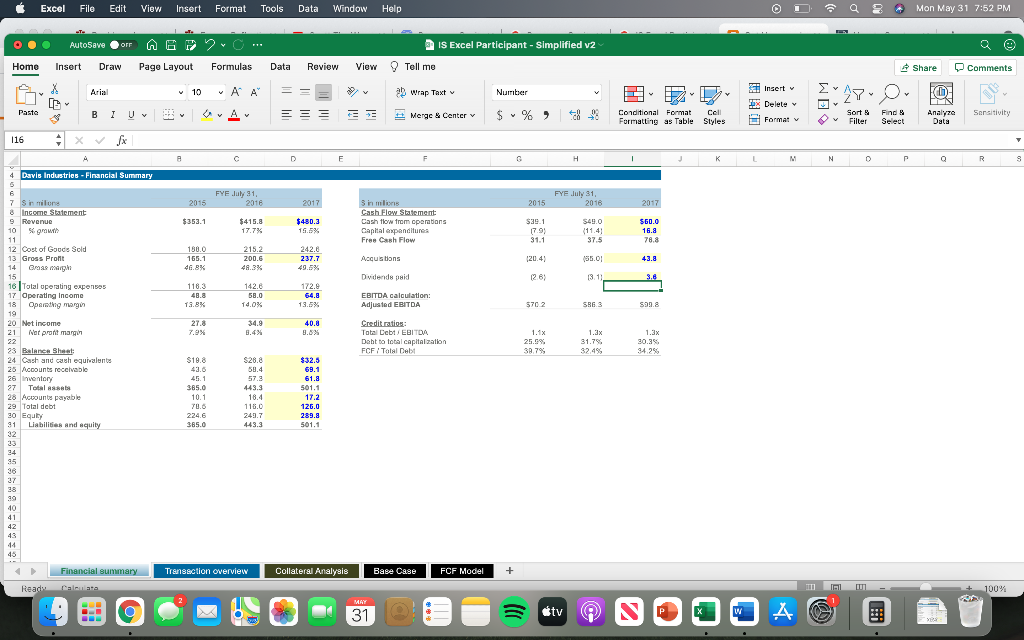

Excel File Edit View Insert Format Tools Data Window Help Mon May 31 7:50 PM AutoSave on AGO. IS Excel Participant - Simplified v2 e Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X Sv Arial 9 AF A 9 39 Wrap Taxt General Insert Ix Delete Ayo Pasta Uv = = = A Y 3 Analyze $ %> Merge & Center Conditional Format Ce Table Coll Styles Sarsitivity Sort Filter Format v Find Select Data S24 B C D F F ! J N 0 R S T V w Sources (mm) New Revolving credi: Facity Total Sources After Transaction Amount 126.0 $126.0 Before Transaction Amount X EBITDA BA 0.8x 45.0 0.5% (mm) Tranche Tranches New Rovo vn Credit Facility Tatal Debt R0.0 126.0 1.3x UBOS (5mm) Repay Tranche A Repay Tranche B Total Uses 0.0 10 $126.0 Adjusted EBITDA 592 17 19 20 = 98 39 40 44 45 46 Financial summary Transaction overview Collateral Analysis Base Case FCF Model + Ready Calculate 100% MAY 31 tv 4 Excel File Edit View Insert Format Tools Data Window Help Mon May 31 7:52 PM AutoSave on AGIC... IS Excel Participant - Simplified v2 e Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X Arial 10 - A 9 2 Wrap Taxt Number Insert box Delete Format v 27 Paste BIU Y Av A = = = 3 Merge & Center $ % 7 Conditional Format Cell Ce! as Table Sort Filter Find Select Sensitivity Analyze Data v 116 B D E G H K L N Q R S 4 Davis Industries - Financial Summary FYE July 31 2018 FYE July 31, 2016 2015 2017 2015 2017 $353.1 $480.3 15.5% 3 in millions Cash Flow Statement Cash flow from cparations Capital expenditures Free Cash Flow 17.7% $39.1 17.9 31.1 $49.0 (11.4 37.5 $60.0 16.8 78.8 130.0 165.1 215.2 200.6 242.0 237.7 Acquistions 43.8 7 Simons 8 Income Statement 9 Revenue 10 gawin 11 12 Cost of Gouds Sold 13 Gross Pront 14 Craas might) 15 16 Total operating expenses 17 Operating Income 18 Operating margin 19 20 Net income 21 Nar pront margin Dvidends paid (26) 3.6 118.3 48.8 13.8% 142.6 58.0 14.0% 172.0 64.8 13.6% EBITDA. calculation: Adjusted EBITDA 570 2 SRG $99.8 27.8 7.9% 34.9 40.0 Credit ratios: Total Debt EBITDA Daht to total capitalzation FCF / Total Debi 1.12 25.0% 1.3 31.7% 32.4% 1.3x 30.35 34.2% $32.5 69.1 23 Balance Sheet 24 Cash and cash equivalente 25 Accounts receivable 26 Inventory 27 Totalsts 28 Accounts payable 29 Total debt 30 Equity 31 Liabilities and equity 32 $19.8 43.6 45 365.0 10.1 70.6 224.6 365.0 $26. 59.4 57.9 443.3 18.4 118.0 249.7 443.3 501.1 17.2 126.0 289.a 501.1 34 95 40 41 42 14 45 Transaction overview Collateral Analysis Base Case FCF Model + Financial summary Read Calculate 100% MAY 31 tv 4 Excel File Edit View Insert Format Tools Data Window Help Mon May 31 7:50 PM AutoSave on AGO. IS Excel Participant - Simplified v2 e Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X Sv Arial 9 AF A 9 39 Wrap Taxt General Insert Ix Delete Ayo Pasta Uv = = = A Y 3 Analyze $ %> Merge & Center Conditional Format Ce Table Coll Styles Sarsitivity Sort Filter Format v Find Select Data S24 B C D F F ! J N 0 R S T V w Sources (mm) New Revolving credi: Facity Total Sources After Transaction Amount 126.0 $126.0 Before Transaction Amount X EBITDA BA 0.8x 45.0 0.5% (mm) Tranche Tranches New Rovo vn Credit Facility Tatal Debt R0.0 126.0 1.3x UBOS (5mm) Repay Tranche A Repay Tranche B Total Uses 0.0 10 $126.0 Adjusted EBITDA 592 17 19 20 = 98 39 40 44 45 46 Financial summary Transaction overview Collateral Analysis Base Case FCF Model + Ready Calculate 100% MAY 31 tv 4 Excel File Edit View Insert Format Tools Data Window Help Mon May 31 7:52 PM AutoSave on AGIC... IS Excel Participant - Simplified v2 e Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X Arial 10 - A 9 2 Wrap Taxt Number Insert box Delete Format v 27 Paste BIU Y Av A = = = 3 Merge & Center $ % 7 Conditional Format Cell Ce! as Table Sort Filter Find Select Sensitivity Analyze Data v 116 B D E G H K L N Q R S 4 Davis Industries - Financial Summary FYE July 31 2018 FYE July 31, 2016 2015 2017 2015 2017 $353.1 $480.3 15.5% 3 in millions Cash Flow Statement Cash flow from cparations Capital expenditures Free Cash Flow 17.7% $39.1 17.9 31.1 $49.0 (11.4 37.5 $60.0 16.8 78.8 130.0 165.1 215.2 200.6 242.0 237.7 Acquistions 43.8 7 Simons 8 Income Statement 9 Revenue 10 gawin 11 12 Cost of Gouds Sold 13 Gross Pront 14 Craas might) 15 16 Total operating expenses 17 Operating Income 18 Operating margin 19 20 Net income 21 Nar pront margin Dvidends paid (26) 3.6 118.3 48.8 13.8% 142.6 58.0 14.0% 172.0 64.8 13.6% EBITDA. calculation: Adjusted EBITDA 570 2 SRG $99.8 27.8 7.9% 34.9 40.0 Credit ratios: Total Debt EBITDA Daht to total capitalzation FCF / Total Debi 1.12 25.0% 1.3 31.7% 32.4% 1.3x 30.35 34.2% $32.5 69.1 23 Balance Sheet 24 Cash and cash equivalente 25 Accounts receivable 26 Inventory 27 Totalsts 28 Accounts payable 29 Total debt 30 Equity 31 Liabilities and equity 32 $19.8 43.6 45 365.0 10.1 70.6 224.6 365.0 $26. 59.4 57.9 443.3 18.4 118.0 249.7 443.3 501.1 17.2 126.0 289.a 501.1 34 95 40 41 42 14 45 Transaction overview Collateral Analysis Base Case FCF Model + Financial summary Read Calculate 100% MAY 31 tv 4