Answered step by step

Verified Expert Solution

Question

1 Approved Answer

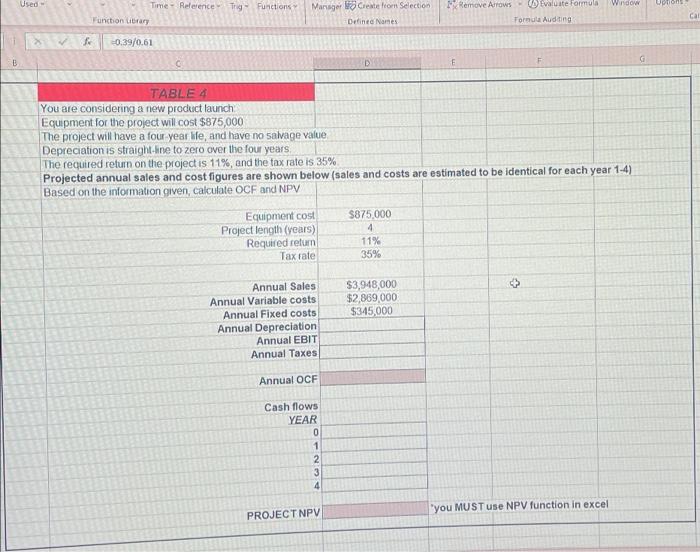

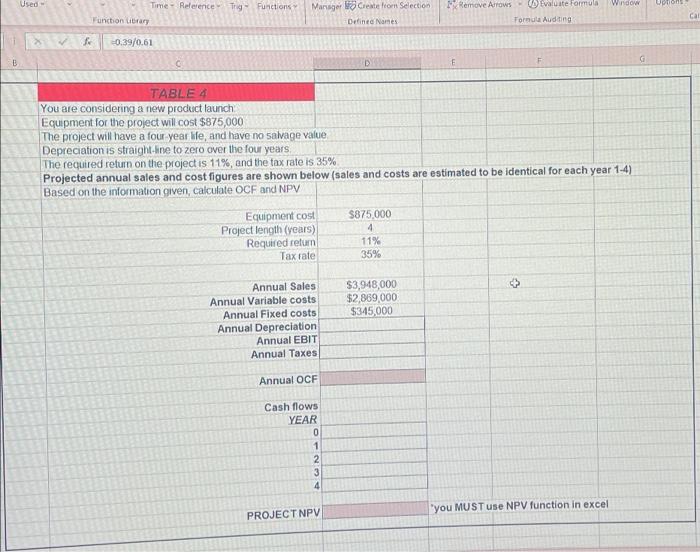

how do i get the year 1 OCF? Used Window Time - Reference Trg - Functions Funchon ubrary Manager Create From Selection Defined Nannes Remove

how do i get the year 1 OCF?

Used Window Time - Reference Trg - Functions Funchon ubrary Manager Create From Selection Defined Nannes Remove Arrows-Evaluate Formula Torn Auditing ca -0.39/0.61 D G TABLE4 You are considering a new product launch Equipment for the project will cost $875,000 The project will have a four year life, and have no salvage value Depreciation is straight line to zero over the four years The required return on the project is 11%, and the tax rate is 35% Projected annual sales and cost figures are shown below (sales and costs are estimated to be identical for each year 1-4) Based on the information given, calculate OCF and NPV Equipment cost $875.000 Project length (years) Required return 11% Tax rate 35% 4 $3,948,000 $2,869,000 $345,000 Annual Sales Annual Variable costs Annual Fixed costs Annual Depreciation Annual EBIT Annual Taxes Annual OCF Cash flows YEAR 0 1 2 3 4 "you MUST use NPV function in excel PROJECT NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started