Answered step by step

Verified Expert Solution

Question

1 Approved Answer

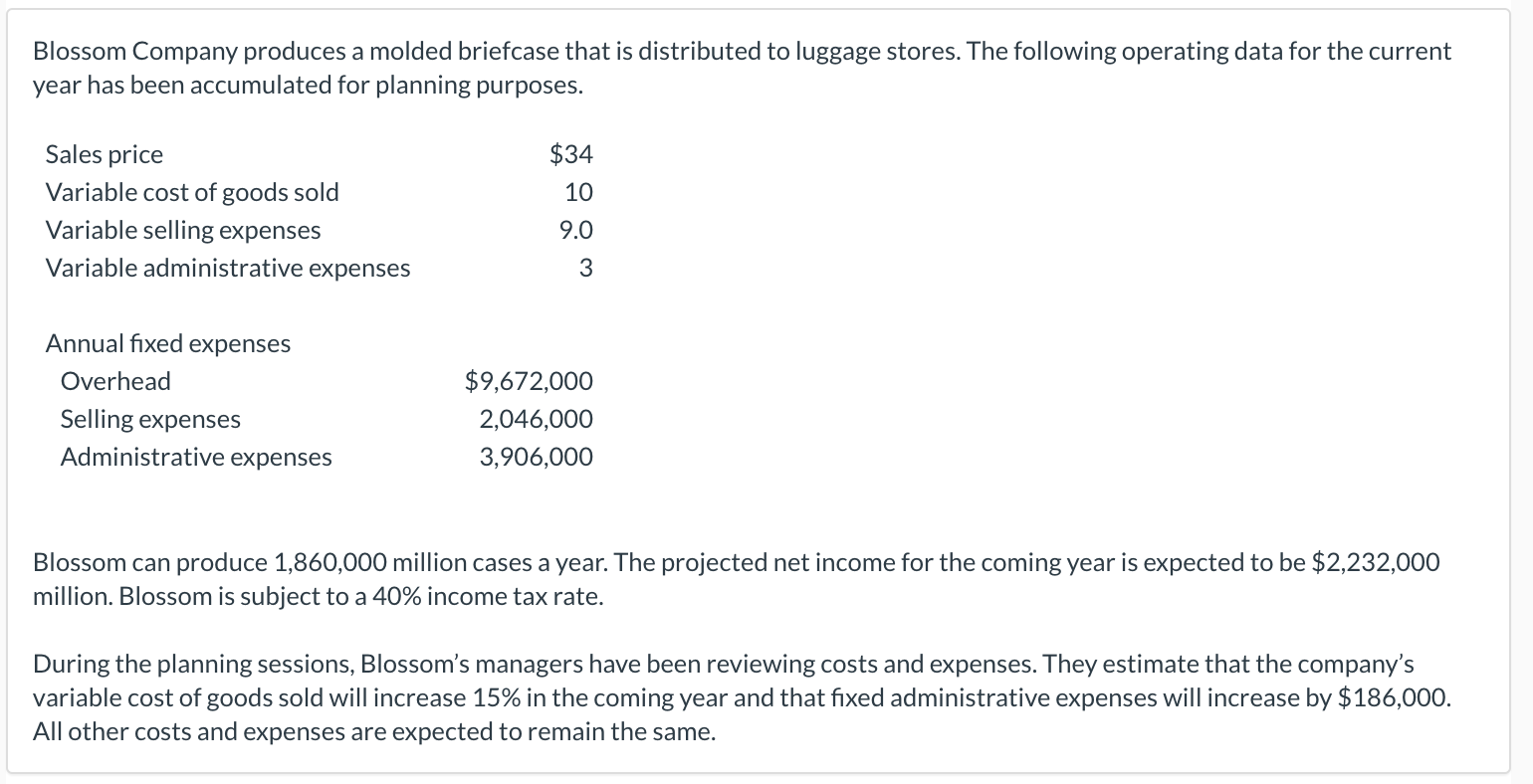

How do I solve (a2)? Blossom Company produces a molded briefcase that is distributed to luggage stores. The following operating data for the current year

How do I solve (a2)?

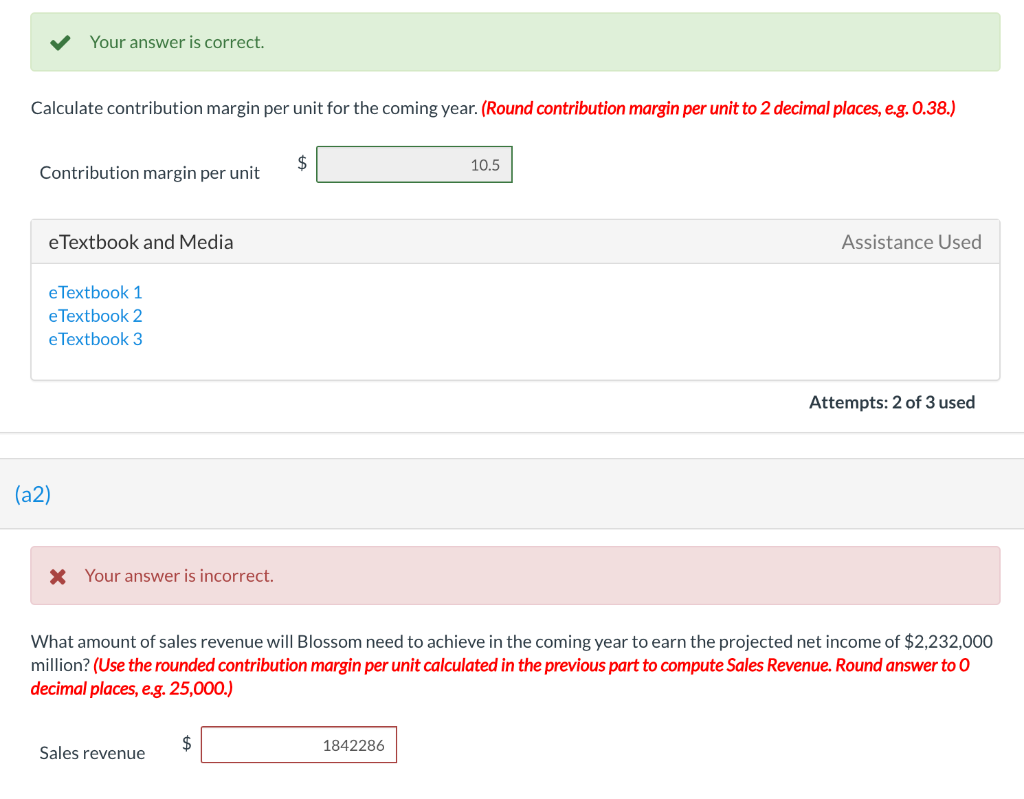

Blossom Company produces a molded briefcase that is distributed to luggage stores. The following operating data for the current year has been accumulated for planning purposes. Sales price Variable cost of goods sold Variable selling expenses Variable administrative expenses $34 10 9.0 3 Annual fixed expenses Overhead Selling expenses Administrative expenses $9,672,000 2,046,000 3,906,000 Blossom can produce 1,860,000 million cases a year. The projected net income for the coming year is expected to be $2,232,000 million. Blossom is subject to a 40% income tax rate. During the planning sessions, Blossom's managers have been reviewing costs and expenses. They estimate that the company's variable cost of goods sold will increase 15% in the coming year and that fixed administrative expenses will increase by $186,000. All other costs and expenses are expected to remain the same. Your answer is correct. Calculate contribution margin per unit for the coming year. (Round contribution margin per unit to 2 decimal places, e.g. 0.38.) $ 10.5 Contribution margin per unit e Textbook and Media Assistance Used e Textbook 1 e Textbook 2 e Textbook 3 Attempts: 2 of 3 used (a2) X Your answer is incorrect. What amount of sales revenue will Blossom need to achieve in the coming year to earn the projected net income of $2,232,000 million? (Use the rounded contribution margin per unit calculated in the previous part to compute Sales Revenue. Round answer to 0 decimal places, e.g. 25,000.) $ 1842286 Sales revenueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started