How do I solve for the change in fixed assets?

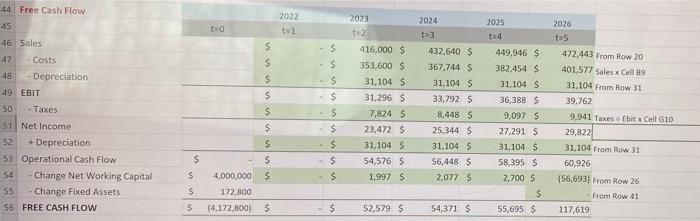

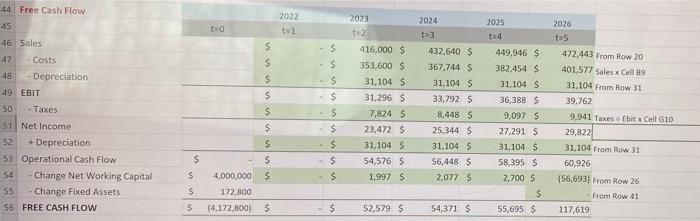

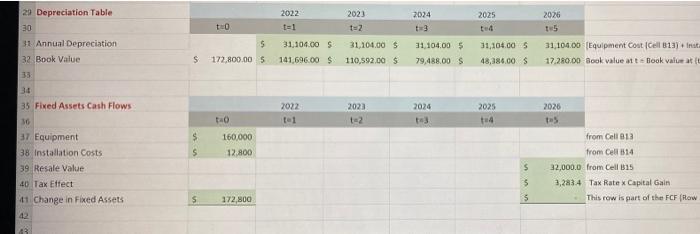

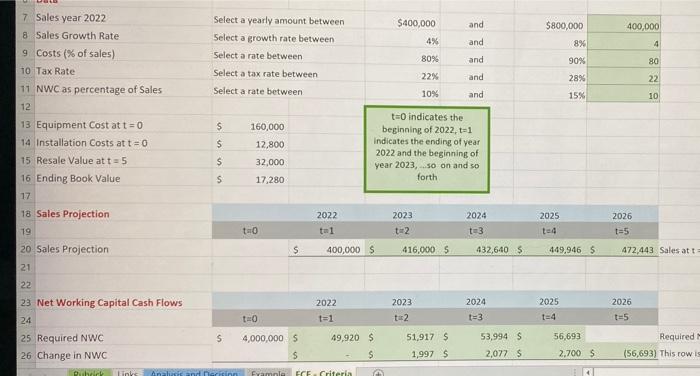

44 Free Cash Flow 45 2022 2023 t2 2025 2024 13 1-4 S S S 46 Sales Costs 48 - Depreciation 49 EBIT 50 - Taxes 51 Net Income 52 +Depreciation 53 Operational Cash Flow 54 - Change Net Working Capital 55 Change Fixed Assets 56 FREE CASH FLOW S 5 S $ $ $ $ $ - $ $ $ $ - S $ 416,000 $ 353,600 $ 31,104 $ 31,296 5 7,824 $ 23,472 $ 31,104 $ 54,576 S 1,997 $ 432,640 S 367,744 5 31,104 $ 33,792 $ 8,448$ 25,344 S 31,104 S 56,448 $ 2,077 $ 449,946 $ 382,454 S 31.104 S 36,388 $ 9,097 5 27.291 $ 31.104 S 58,395$ 2,700 $ S 55,695 $ 2026 t5 472.443 From Row 20 401,577 Sales x Cell 89 31.104 From Row 31 39,762 9,941 Taxes Ebitx Cell G10 29,822 31,104 From Row 31 60,926 (56,693) From Row 26 $ $ $ $ 4,000,000 172,800 (4,172,800) $ $ $ 52,579 $ 54,371 $ From Row 41 117,619 2022 2023 2024 2025 2026 t0 t=1 29 Depreciation Table 30 31 Annual Depreciation 32 Book Value $ 31.104.00 S 141,696.00 $ 31,204.00 $ 110.592.00 $ 31.104.00 5 79,488.00 $ 31,104.00 S 48,386.00 $ 31,104.00 Equipment Cost Cell B13) + frist 17.280.00 Book value at Book valuatio S 172,800.00 5 33 30 35 Fixed Assets Cash Flows 2022 2023 2026 2024 3 2025 4 to 1 $ 5 160,000 12,800 30 37 Equipment 38 Installation Costs 39 Resale Value 40 Tax Effect 41 Change in Fixed Assets 42 from Cell B13 from Cell 14 32,000.0 from Cell B15 3,283.4 Tax Ratex Capital Gain $ 5 5 172,800 5 This row is part of the FCF (Row $400,000 and 400,000 $800,000 8% 4% and 4 7 Sales year 2022 8 Sales Growth Rate 9 Costs (% of sales) 10 Tax Rate 11 NWC as percentage of Sales Select a yearly amount between Select a growth rate between Select a rate between Select a tax rate between Select a rate between 80% and 80 22% and 90% 289 15% 22 10% and 10 12 $ 160,000 $ 12,800 t=0 indicates the beginning of 2022, t=1 Indicates the ending of year 2022 and the beginning of year 2023, ..so on and so forth 13 Equipment Cost att = 0 14 Installation Costs at t=0 15 Resale Value at t=5 16 Ending Book Value 17 18 Sales Projection S 32,000 17,280 S 2022 ta1 2023 t2 2024 t3 2025 ted 2026 t=5 to s 400,000 $ 416,000 5 432,6405 449,9465 472,443 Sales att 20 Sales Projection 21 22 23 Net Working Capital Cash Flows 24 25 Required NWC 26 Change in NWC 2022 2023 t2 2024 t=3 2025 14 2026 t=5 TO t=1 $ 4,000,000 5 49,920 $ $ 51.917 $ 1,997 s 53,994 $ 2,077 $ 56,693 2.700 $ Required (56,693) This rows S Pishar Links Anal inn Example ECE Criterin