Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do I solve this problem step by step? Bernie's Suntan Lotions has been selling herbal, sustainable UV protection for years. The company has been

how do I solve this problem step by step?

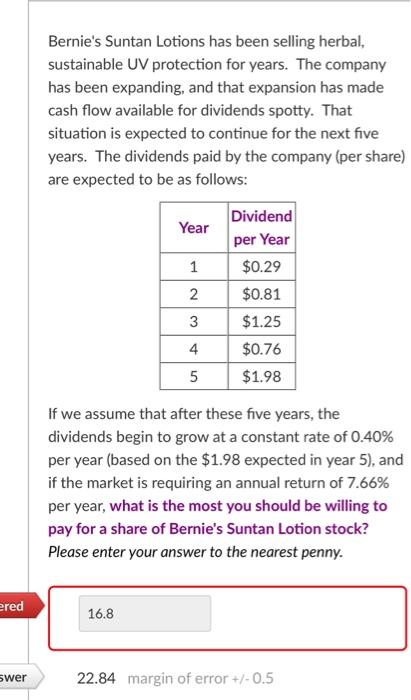

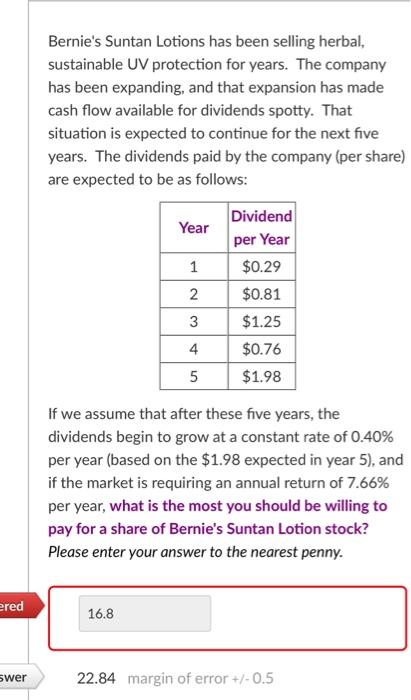

Bernie's Suntan Lotions has been selling herbal, sustainable UV protection for years. The company has been expanding, and that expansion has made cash flow available for dividends spotty. That situation is expected to continue for the next five years. The dividends paid by the company (per share) are expected to be as follows: If we assume that after these five years, the dividends begin to grow at a constant rate of 0.40% per year (based on the $1.98 expected in year 5 ), and if the market is requiring an annual return of 7.66% per year, what is the most you should be willing to pay for a share of Bernie's Suntan Lotion stock? Please enter your answer to the nearest penny

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started