Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do we solve the third question on excel? 2. Lyle is a new BU school of dentistry graduate, age 26. From age 26 to

How do we solve the third question on excel?

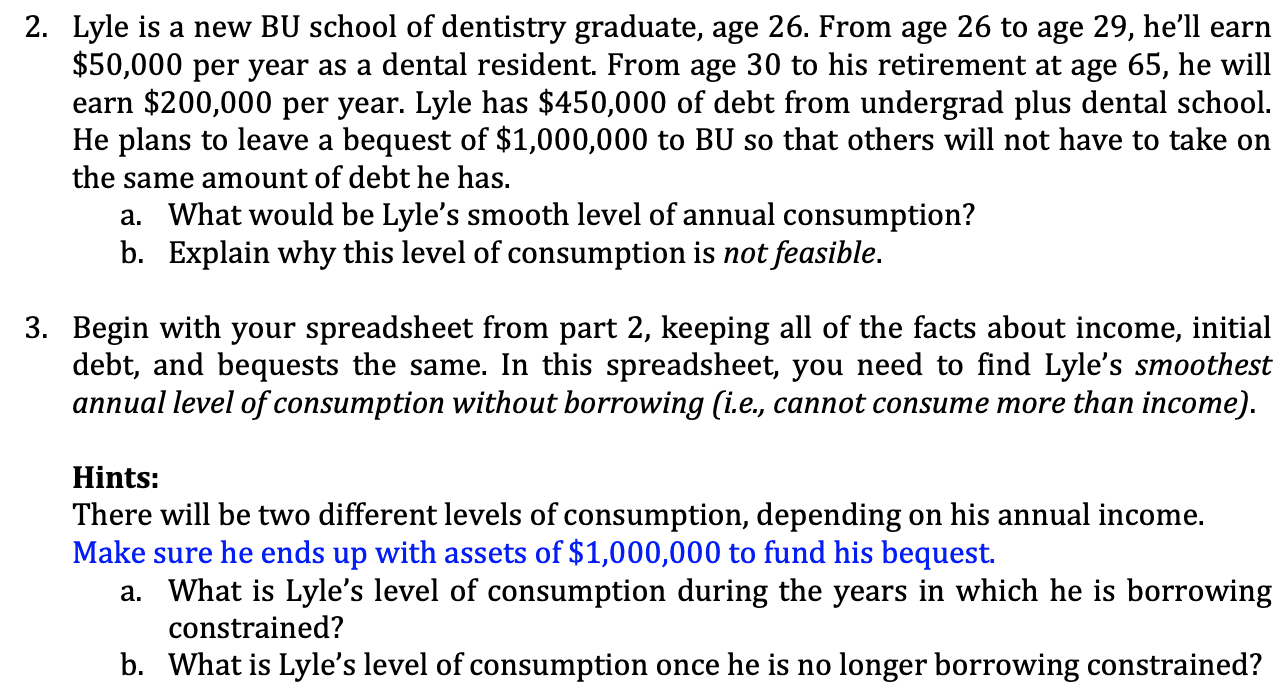

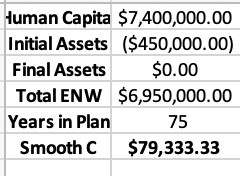

2. Lyle is a new BU school of dentistry graduate, age 26. From age 26 to age 29, he'll earn $50,000 per year as a dental resident. From age 30 to his retirement at age 65, he will earn $200,000 per year. Lyle has $450,000 of debt from undergrad plus dental school. He plans to leave a bequest of $1,000,000 to BU so that others will not have to take on the same amount of debt he has. a. What would be Lyle's smooth level of annual consumption? b. Explain why this level of consumption is not feasible. 3. Begin with your spreadsheet from part 2, keeping all of the facts about income, initial debt, and bequests the same. In this spreadsheet, you need to find Lyle's smoothest annual level of consumption without borrowing (i.e., cannot consume more than income). Hints: There will be two different levels of consumption, depending on his annual income. Make sure he ends up with assets of $1,000,000 to fund his bequest. a. What is Lyle's level of consumption during the years in which he is borrowing constrained? b. What is Lyle's level of consumption once he is no longer borrowing constrained? tuman Capita $7,400,000.00 Initial Assets ($450,000.00) Final Assets $0.00 Total ENW $6,950,000.00 Years in Plan 75 Smooth C $79,333.33Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started