Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do you calculate depreciation of the helicopter and the engine? Orange Farm Limited ('Orange Farm') is a game reserve situated in the Malelane area

How do you calculate depreciation of the helicopter and the engine?

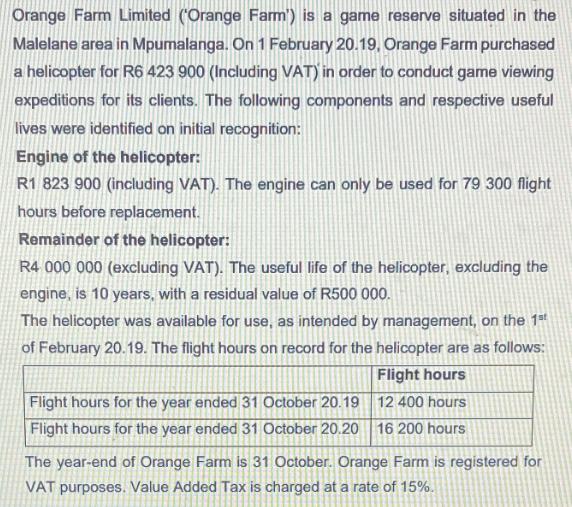

Orange Farm Limited ('Orange Farm') is a game reserve situated in the Malelane area in Mpumalanga. On 1 February 20.19, Orange Farm purchased a helicopter for R6 423 900 (Including VAT) in order to conduct game viewing expeditions for its clients. The following components and respective useful lives were identified on initial recognition: Engine of the helicopter: R1 823 900 (including VAT). The engine can only be used for 79 300 flight hours before replacement. Remainder of the helicopter: R4 000 000 (excluding VAT). The useful life of the helicopter, excluding the engine, is 10 years, with a residual value of R500 000. The helicopter was available for use, as intended by management, on the 1st of February 20.19. The flight hours on record for the helicopter are as follows: Flight hours 12 400 hours 16 200 hours Flight hours for the year ended 31 October 20.19 Flight hours for the year ended 31 October 20.20 The year-end of Orange Farm is 31 October. Orange Farm is registered for VAT purposes. Value Added Tax is charged at a rate of 15%.

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the depreciation of the helicopter and the engine we can use the straightline method of depreciation which allocates the cost of the asse...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started