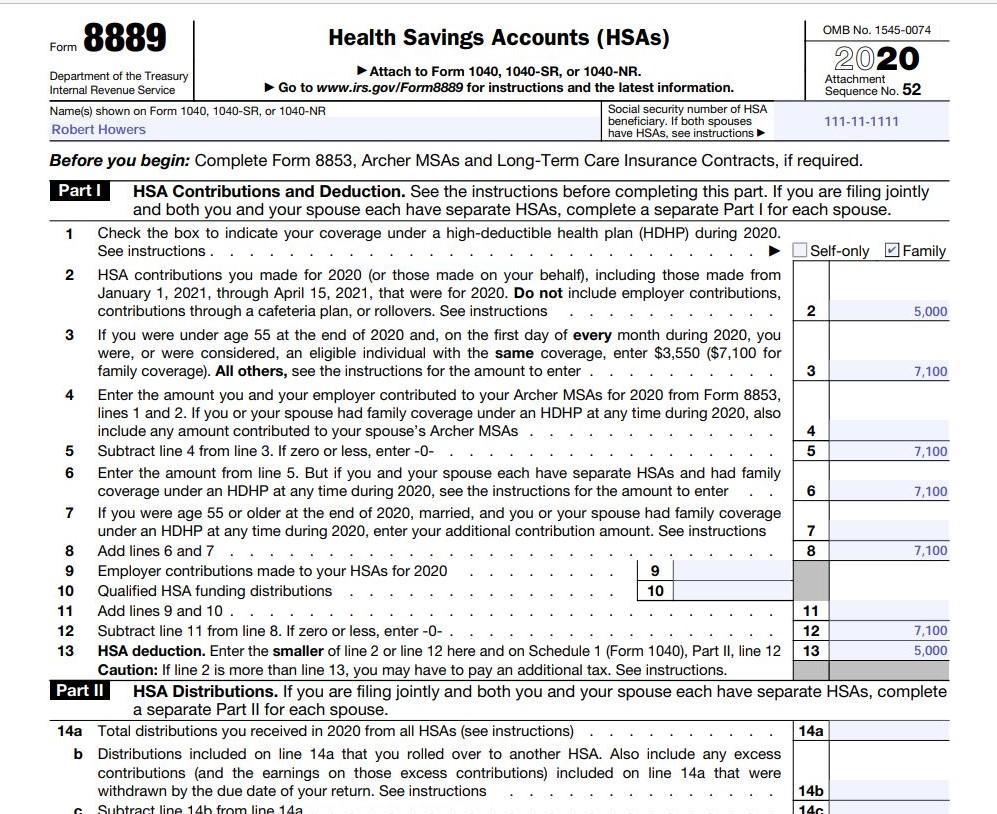

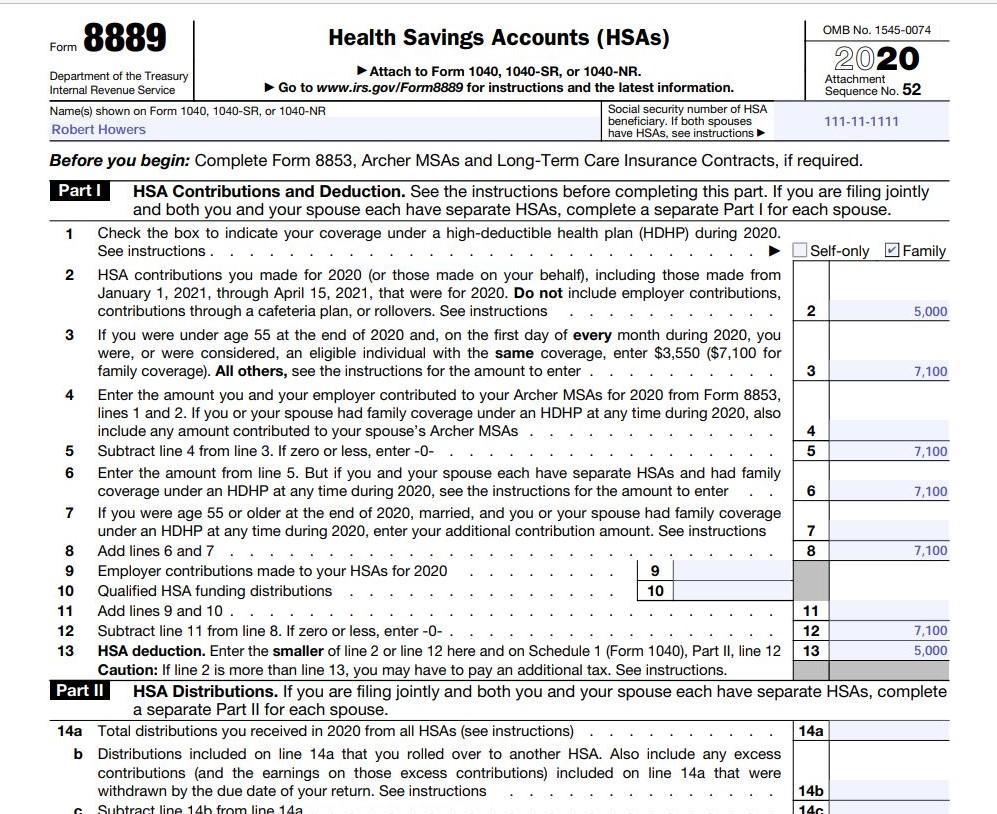

How do you complete form 8880 (Health Savings Accounts (HSAs)) with the following information? (I already did it, I just want to know if is correct)

Robert Howers (SSN:111-11-1111, Date of birth 02/05/1981) recently became a single Dad when his wife left him and their child and a divorce settlement was finalized on 3/2/2019. He and his 12 year old daughter, Aisha (SSN 222-22-2222, date of birth 5/2), live in the marital home with Roberts 72 year old mother. His father died 10 years ago leaving his mother, Beulah (SSN: 333-33-3333 date of Birth 8/16), destitute with only his social security benefits to live on. Beulah receives $11,000 of Social security income annually. Robert provides 85% of his mothers support annually.

Robert received the following in 2020:

$113,000 W-2 salary with $12750 withheld for federal income tax.

Roberts employer provides the family with a high deductible PPO medical insurance policy. Robert funded his family health saving account $5000 in 2020.

8889 Form 1 > OMB No. 1545-0074 Health Savings Accounts (HSAs) 2020 Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. Attachment Internal Revenue Service Go to www.irs.gov/Form8889 for instructions and the latest information. Sequence No. 52 Name(s) shown on Form 1040, 1040-SR, or 1040-NR Social security number of HSA Robert Howers beneficiary. If both spouses 111-11-1111 have HSAs, see instructions Before you begin: Complete Form 8853, Archer MSAs and Long-Term Care Insurance Contracts, if required. Partl HSA Contributions and Deduction. See the instructions before completing this part. If you are filing jointly and both you and your spouse each have separate HSAs, complete a separate Part I for each spouse. Check the box to indicate your coverage under a high-deductible health plan (HDHP) during 2020. See instructions. Self-only Family 2 HSA contributions you made for 2020 (or those made on your behalf), including those made from January 1, 2021, through April 15, 2021, that were for 2020. Do not include employer contributions, contributions through a cafeteria plan, or rollovers. See instructions 2 5,000 3 If you were under age 55 at the end of 2020 and, on the first day of every month during 2020, you were, or were considered, an eligible individual with the same coverage, enter $3,550 ($7,100 for family coverage). All others, see the instructions for the amount to enter. 3 7,100 4 Enter the amount you and your employer contributed to your Archer MSAs for 2020 from Form 8853, lines 1 and 2. If you or your spouse had family coverage under an HDHP at any time during 2020, also include any amount contributed to your spouse's Archer MSAs 5 Subtract line 4 from line 3. If zero or less, enter-O- 5 7,100 6 Enter the amount from line 5. But if you and your spouse each have separate HSAs and had family coverage under an HDHP at any time during 2020, see the instructions for the amount to enter 7,100 7 If you were age 55 or older at the end of 2020, married, and you or your spouse had family coverage under an HDHP at any time during 2020, enter your additional contribution amount. See instructions 7 8 Add lines 6 and 7 .. 7,100 Employer contributions made to your HSAs for 2020 10 Qualified HSA funding distributions 11 Add lines 9 and 10. 11 12 Subtract line 11 from line 8. If zero or less, enter-O-. 12 7,100 13 HSA deduction. Enter the smaller of line 2 or line 12 here and on Schedule 1 (Form 1040), Part II, line 12 13 5,000 Caution: If line 2 is more than line 13, you may have to pay an additional tax. See instructions. Part II HSA Distributions. If you are filing jointly and both you and your spouse each have separate HSAs, complete a separate Part II for each spouse. 14a Total distributions you received in 2020 from all HSAS (see instructions) 14a b Distributions included on line 14a that you rolled over to another HSA. Also include any excess contributions (and the earnings on those excess contributions) included on line 14a that were withdrawn by the due date of your return. See instructions 14b Subtract line 14b from line 14a 14 4 6 8 9 9 10 8889 Form 1 > OMB No. 1545-0074 Health Savings Accounts (HSAs) 2020 Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. Attachment Internal Revenue Service Go to www.irs.gov/Form8889 for instructions and the latest information. Sequence No. 52 Name(s) shown on Form 1040, 1040-SR, or 1040-NR Social security number of HSA Robert Howers beneficiary. If both spouses 111-11-1111 have HSAs, see instructions Before you begin: Complete Form 8853, Archer MSAs and Long-Term Care Insurance Contracts, if required. Partl HSA Contributions and Deduction. See the instructions before completing this part. If you are filing jointly and both you and your spouse each have separate HSAs, complete a separate Part I for each spouse. Check the box to indicate your coverage under a high-deductible health plan (HDHP) during 2020. See instructions. Self-only Family 2 HSA contributions you made for 2020 (or those made on your behalf), including those made from January 1, 2021, through April 15, 2021, that were for 2020. Do not include employer contributions, contributions through a cafeteria plan, or rollovers. See instructions 2 5,000 3 If you were under age 55 at the end of 2020 and, on the first day of every month during 2020, you were, or were considered, an eligible individual with the same coverage, enter $3,550 ($7,100 for family coverage). All others, see the instructions for the amount to enter. 3 7,100 4 Enter the amount you and your employer contributed to your Archer MSAs for 2020 from Form 8853, lines 1 and 2. If you or your spouse had family coverage under an HDHP at any time during 2020, also include any amount contributed to your spouse's Archer MSAs 5 Subtract line 4 from line 3. If zero or less, enter-O- 5 7,100 6 Enter the amount from line 5. But if you and your spouse each have separate HSAs and had family coverage under an HDHP at any time during 2020, see the instructions for the amount to enter 7,100 7 If you were age 55 or older at the end of 2020, married, and you or your spouse had family coverage under an HDHP at any time during 2020, enter your additional contribution amount. See instructions 7 8 Add lines 6 and 7 .. 7,100 Employer contributions made to your HSAs for 2020 10 Qualified HSA funding distributions 11 Add lines 9 and 10. 11 12 Subtract line 11 from line 8. If zero or less, enter-O-. 12 7,100 13 HSA deduction. Enter the smaller of line 2 or line 12 here and on Schedule 1 (Form 1040), Part II, line 12 13 5,000 Caution: If line 2 is more than line 13, you may have to pay an additional tax. See instructions. Part II HSA Distributions. If you are filing jointly and both you and your spouse each have separate HSAs, complete a separate Part II for each spouse. 14a Total distributions you received in 2020 from all HSAS (see instructions) 14a b Distributions included on line 14a that you rolled over to another HSA. Also include any excess contributions (and the earnings on those excess contributions) included on line 14a that were withdrawn by the due date of your return. See instructions 14b Subtract line 14b from line 14a 14 4 6 8 9 9 10