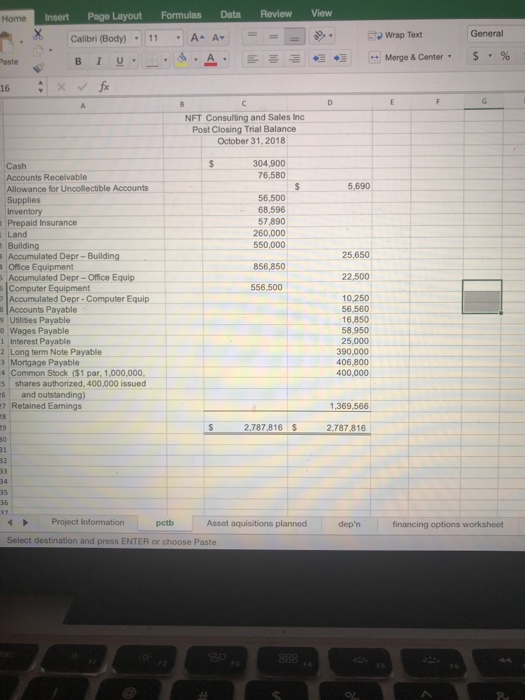

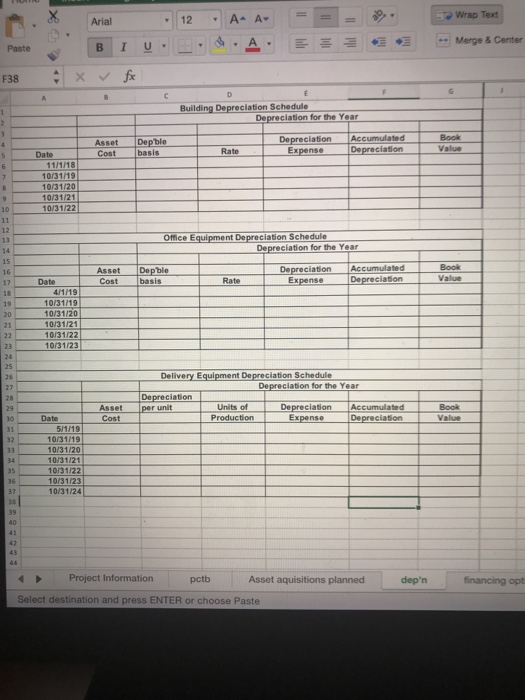

How do you complete the attached depreciation schedules for each of the planned asset purchases using the provided information regarding cost, useful life, and selected method? The direction say you should do only the first 4 years for the building and do the complete useful life life depreciation schedules for all of the other assets

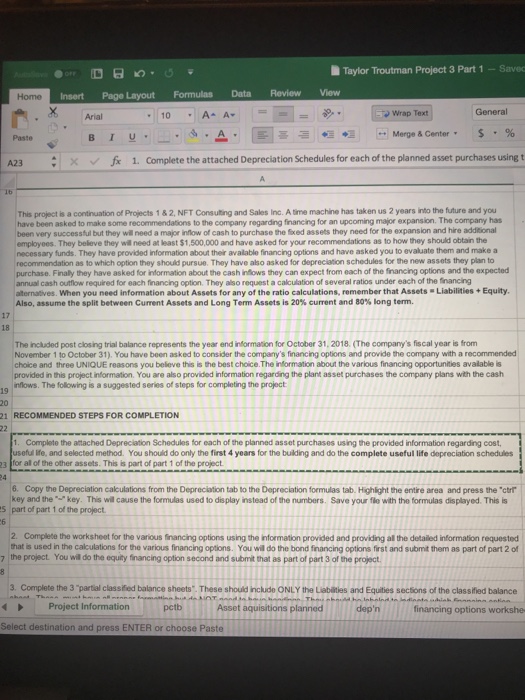

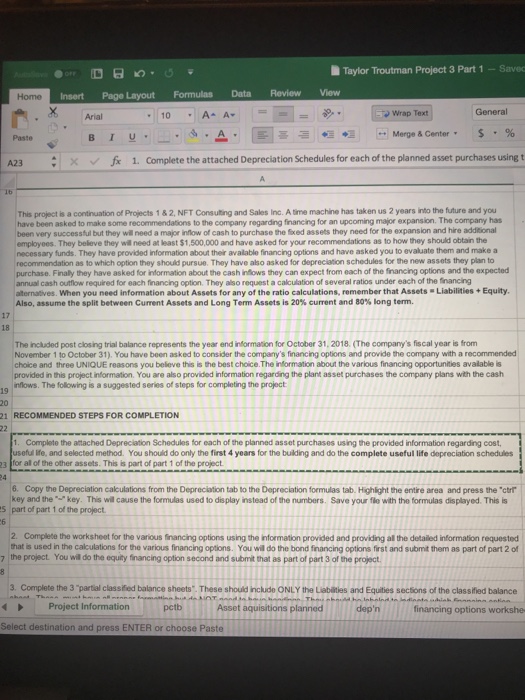

Taylor Troutman Project 3 Part 1 -Save Home Insert Page Layout Formulas Data Review View Wrap Text General Arial B Iu -/ Paste : ? Complete the attached Depreciation Schedules for each of the planned asset purchases using t A23 1. project is a continuation of Projects 1&2, NFT Consuting and Sales Inc. A time machine has taken us 2 years into the future and you have been asked to make some recommendations to the company regarding financing for an upcoming major expansion. The company has been very successful but they will need a major inflow of cash to purchase the fxed assets they need for the expansion and hire additional employees. They believe they will need at least $1,500,000 and have asked for your recommendations as to how they should obtain the necessary funds. They have provided information about their available financing options and have asked you to evaluate them and make a recommendation as to which option they should pursue. They have aso asked for depreciation schedules for the new assets they plan to purchase. Finaly they have asked for information about the cash inlows they can expect from each of the financing options and the expected annual cash outlow required for each financing option. They also request a calculation of several ratios under each of the financing alternatives. When you need information about Assets for any of the ratio calculations, remember that Assets Liabilities Equity. Also, assume the split between Current Assets and Long Term Assets is 20% current and 80% long term. 17 18 The included post closing trial balance represents the year end information for October 31, 2018. (The company's fiscal year is from November 1 to October 31). You have been asked to consider the company's financing options and provide the company with a recommended choice and three UNIQUE reasons you beleve this is the best choice.The information about the various financing opportunities avalable is provided in this project information. You are also provided information regarding the plant asset purchases the company plans with the cash inflows. The following is a suggested series of steps for completing the project 19 20 21 RECOMMENDED STEPS FOR COMPLETION 1. Complete the atached Depreciation Schedules for each of the planned asset purchases using the provided information regarding cost, useful Iife, and selected method. You should do only the first 4 years for the building and do the complete useful life depreciation schedules 3 Ifor al of the other assets. This is part of part 1 of the project 24 6. Copy the Depreciation calculations from the Depreciation tab to the Depreclation formulas tab. Highlight the entire area and press the "ctri key and the key. This wil cause the formulas used to display instead of the numbers. Save your fle with the formulas displayed. This is s part of part 1 of the project 2. Complese the worksheet for the various financing options using the information provided and providing al the detailed information requested that is used in the calculations for the various financing options. You will do the bond financing options first and submit them as part of part 2 of 7the project. You will do the equity financing option second and submit that as part of part 3 of the project 3. Complete the 3"partial classifed balance sheets. These should inckide ONLY the Liabilities and Equities sections of the classified balance Project Information petb Asset aquisitions planned dep'n financing options workshe Select destination and press ENTER or choose Paste