Answered step by step

Verified Expert Solution

Question

1 Approved Answer

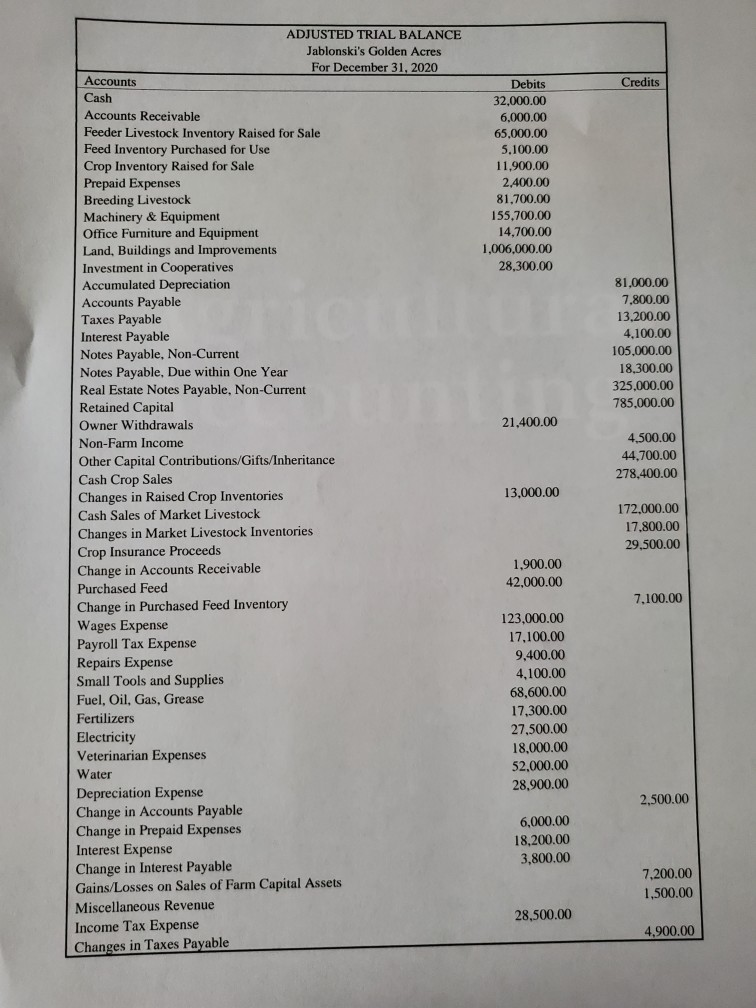

how do you do an income statement and statement of owner equity Credits Debits 32,000.00 6,000.00 65,000.00 5,100.00 11.900.00 2.400.00 81.700.00 155,700.00 14,700.00 1,006,000.00 28,300.00

how do you do an income statement and statement of owner equity

Credits Debits 32,000.00 6,000.00 65,000.00 5,100.00 11.900.00 2.400.00 81.700.00 155,700.00 14,700.00 1,006,000.00 28,300.00 ADJUSTED TRIAL BALANCE Jablonski's Golden Acres For December 31, 2020 Accounts Cash Accounts Receivable Feeder Livestock Inventory Raised for Sale Feed Inventory Purchased for Use Crop Inventory Raised for Sale Prepaid Expenses Breeding Livestock Machinery & Equipment Office Furniture and Equipment Land, Buildings and Improvements Investment in Cooperatives Accumulated Depreciation Accounts Payable Taxes Payable Interest Payable Notes Payable, Non-Current Notes Payable, Due within One Year Real Estate Notes Payable, Non-Current Retained Capital Owner Withdrawals Non-Farm Income Other Capital Contributions/Gifts/Inheritance Cash Crop Sales Changes in Raised Crop Inventories Cash Sales of Market Livestock Changes in Market Livestock Inventories Crop Insurance Proceeds Change in Accounts Receivable Purchased Feed Change in Purchased Feed Inventory Wages Expense Payroll Tax Expense Repairs Expense Small Tools and Supplies Fuel, Oil, Gas, Grease Fertilizers Electricity Veterinarian Expenses 81,000.00 7,800.00 13,200.00 4,100.00 105,000.00 18,300.00 325,000.00 785,000.00 21,400.00 4,500.00 44.700.00 278,400.00 13,000.00 172,000.00 17,800.00 29,500.00 1,900.00 42,000.00 7,100.00 123,000.00 17,100.00 9,400.00 4,100.00 68,600.00 17,300.00 27,500.00 18,000.00 52.000.00 28,900.00 Water 2,500.00 6,000.00 18,200.00 3,800.00 Depreciation Expense Change in Accounts Payable Change in Prepaid Expenses Interest Expense Change in Interest Payable Gains/Losses on Sales of Farm Capital Assets Miscellaneous Revenue Income Tax Expense Changes in Taxes Payable 7,200.00 1,500.00 28,500.00 4,900.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started