Answered step by step

Verified Expert Solution

Question

1 Approved Answer

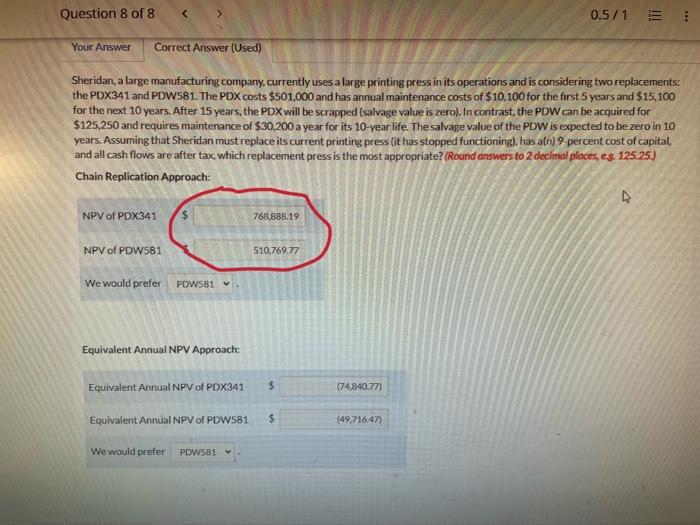

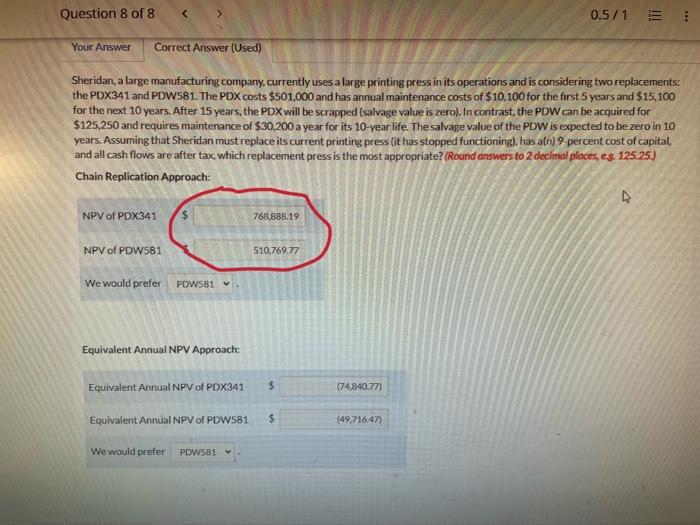

How do you get this two numbers? I can not get them, it's so large Sheridan, a large manufacturing company, currently uses a large printing

How do you get this two numbers? I can not get them, it's so large

Sheridan, a large manufacturing company, currently uses a large printing press in its operations and is considering two replacements: the PDX341 and PDW581. The PDX costs $501,000 and has annual maintenance costs of $10,100 for the first 5 years and $15,100 for the next 10 years. After 15 years, the PDX will be scrapped (salvage value is zero). In contrast, the PDW can be acquired for $125,250 and requires maintenance of $30,200 a year for its 10 -year life. The salvage value of the PDW is expected to be zero in 10 years. Assuming that Sheridan must replace its current printing press (it has stopped functioning), has a(n) 9 percent cost of capital, and all cash flows are after tax, which replacement press is the most appropriate? (Round answers to 2 decimai places, eg. 125.25.) Chain Replication Approach: NPV of PDX 341 NPV of PDW581 We would prefer Equivalent Annual NPV Approach

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started