Question: How do you solve for MIRR without using excel ? I'm having trouble with the formula at the very bottom that gives you .22 capita,

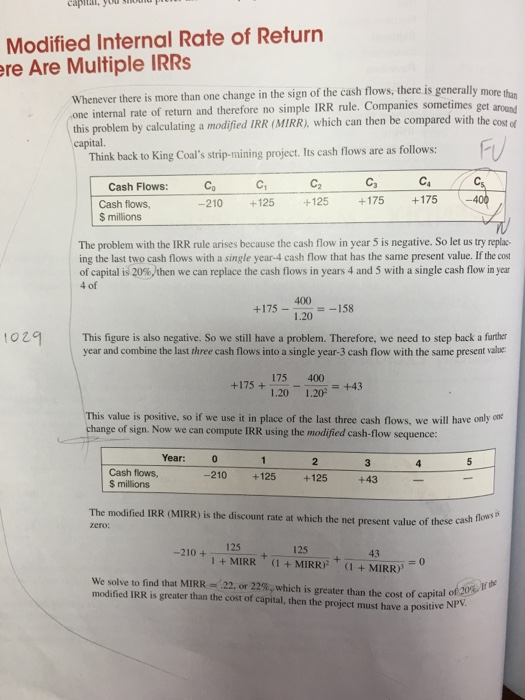

capita, y Modified Internal Rate of Return re Are Multiple IRRs Whenever there is more than one change in the sign of the cash flows, there is generally more one internal rate of return and therefore no simple IRR rule. Companies sometimes this problem by calculating a modified IRR (MIRR), which can then be compared with the capital than get around of ), which can then be compared with the cost Think back to King Coal's strip-mining project. Its cash flows are as follows: Fi Cash Flows: Ct C2 C3 C. Cash flows -210 +125 +125 +175 +1754 $ millions The problem with the IRR rule arises because the cash flow in year 5 is negative. So let us try replac ing the last two cash flows with a single year-4 cash flow that has the same present value. If the cost of capital is 20%,then we can replace the cash flows in years 4 and 5 with a single cash flow in year 4 of 400 =-158 +175 - 400 +175-1.20 120 =-158 toz This figure is also negative. So we still have a problem. Therefore, we need to step back a furthen year and combine the last three cash flows into a single year-3 cash flow with the same present valae +175 + 175 +175 + 1.20 1 175 400 120-1202 = +43 This value is positive, so if we use it in place of the last three cash flows, we will have only cor change of sign. Now we can compute IRR using the modified cash-flow sequence: Year: 0 Cash flows, $ millions -210 +125 +125 +43 The modified IRR (MIRR) is the discount rate at which the net present value of these cast 125 125 1+MIRRMIRR++MIRR) -210+ 43 We solve to find that MIRR =22, or 22%,which is greater than the cost of capital of,2 modified IRR is greater than the cost of capital, then the project must have a positive N capital of 20% te NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts