Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How does asset turnover impact Walmart's Return on Assets? How does Profit Margin affect Nordstrom's Return on Equity? How does a company's business model influence

- How does asset turnover impact Walmart's Return on Assets?

- How does Profit Margin affect Nordstrom's Return on Equity?

- How does a company's business model influence what HR activities? For example, a consulting firm that strives to provide client-centered, quality service may invest in customer service training and bonuses for top service providers

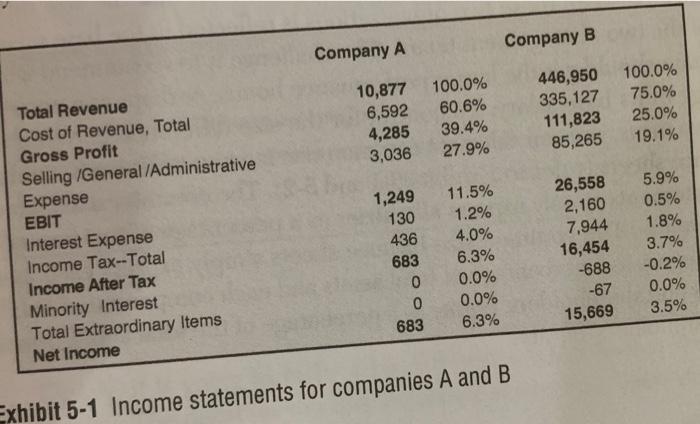

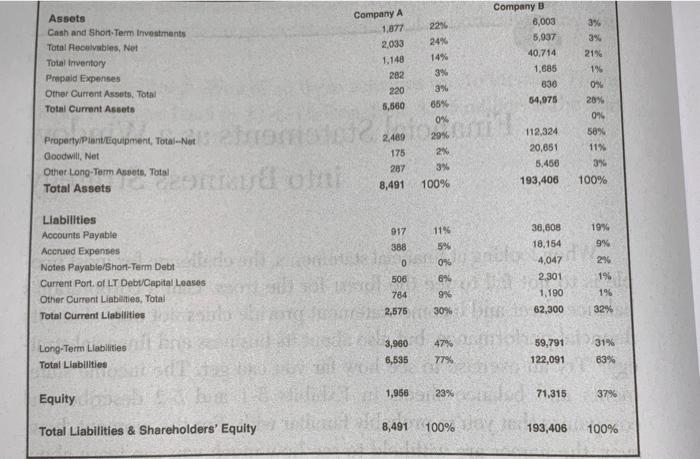

Company A - Walmart

COmaonny B Nordstrom

Company B Company A 10,877 6,592 4,285 3,036 100.0% 60.6% 39.4% 27.9% 446,950 335,127 111,823 85,265 100.0% 75.0% 25.0% 19.1% Total Revenue Cost of Revenue, Total Gross Profit Selling /General /Administrative Expense EBIT Interest Expense Income Tax--Total Income After Tax Minority Interest Total Extraordinary Items Net Income 1,249 130 436 683 0 0 683 11.5% 1.2% 4.0% 6.3% 0.0% 0.0% 6.3% 26,558 2,160 7,944 16,454 -688 -67 15,669 5.9% 0.5% 1.8% 3.7% -0.2% 0.0% 3.5% Exhibit 5-1 Income statements for companies A and B 2296 24% 14% Assets Cash and ShortTerm Investments Total Recalables, Net Total Inventory Prepaid Expenses Other Current Assets, Total Total Current Assets 3% 3% 21% Company B 6,003 5,937 40.714 1.685 836 54,975 Company A 1.877 2,033 1.148 282 220 5,560 3% 1% 0% 20% 0% 58% 11% 3% 100% Property PlantEquipment, Total-Net Goodwill, Net Other Long-Term Assets, Total Total Assets 3% 85% 0% 29% 2% 3% 100% 2.489 175 287 8,491 112,324 20,651 5,456 193,406 sen, Totale ou 917 388 Llabilities Accounts Payable Accrued Expenses Notes Payable/Short-Term Debt Current Port of LT Debt Capital Leases Other Current Liabilities. Total Total Current Liabilities 11% 5% 0% 6% 9% 30% 0 508 784 38,608 18.154 4,047 2.301 1,190 62,300 1994 9% 29 196 1% 2,876 SEN 32% Long-Term Liabilities Total Liabilities 3,960 6,535 47% 77% 59,791 122,091 31% 63% 1,956 23% 71,315 379 Equity Total Liabilities & Shareholders' Equity 8,491 100% 193,406 100%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started