Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how does it affect m1& m2? 1. Ted Mosby receives $125,000 after his certificate deposit (time deposit) with Goliath National Bank (GNB) matures. He also

how does it affect m1& m2?

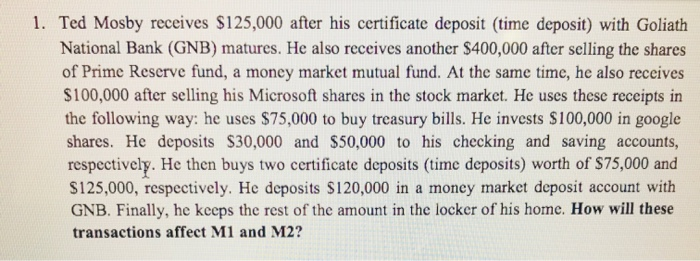

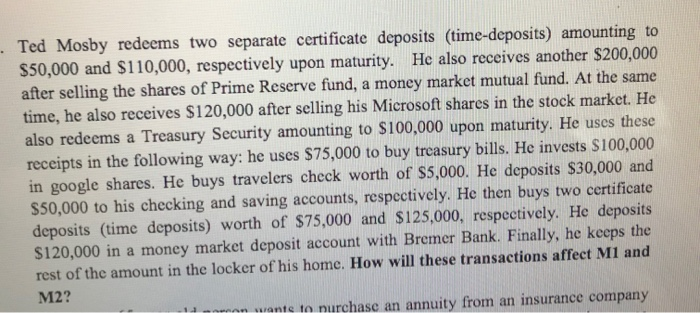

1. Ted Mosby receives $125,000 after his certificate deposit (time deposit) with Goliath National Bank (GNB) matures. He also receives another $400,000 after selling the shares of Prime Reserve fund, a money market mutual fund. At the same time, he also receives $100,000 after selling his Microsoft shares in the stock market. He uses these receipts in the following way: he uses $75,000 to buy treasury bills. He invests $100,000 in google shares. He deposits $30,000 and $50,000 to his checking and saving accounts, respectively. He then buys two certificate deposits (time deposits) worth of $75,000 and $125,000, respectively. He deposits $120,000 in a money market deposit account with GNB. Finally, he keeps the rest of the amount in the locker of his home. How will these transactions affect M1 and M2? Ted Mosby redeems two separate certificate deposits (time-deposits) amounting to $50,000 and $110,000, respectively upon maturity. He also receives another $200,000 after selling the shares of Prime Reserve fund, a money market mutual fund. At the same time, he also receives $120,000 after selling his Microsoft shares in the stock market. He also redeems a Treasury Security amounting to $100,000 upon maturity. He uses these receipts in the following way: he uses $75,000 to buy treasury bills. He invests $100.000 in google shares. He buys travelers check worth of $5,000. He deposits $30,000 and $50,000 to his checking and saving accounts, respectively. He then buys two certificate deposits (time deposits) worth of $75,000 and $125,000, respectively. He deposits $120,000 in a money market deposit account with Bremer Bank. Finally, he keeps the rest of the amount in the locker of his home. How will these transactions affect M1 and M2? an wante to nurchase an annuity from an insurance company Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started