Answered step by step

Verified Expert Solution

Question

1 Approved Answer

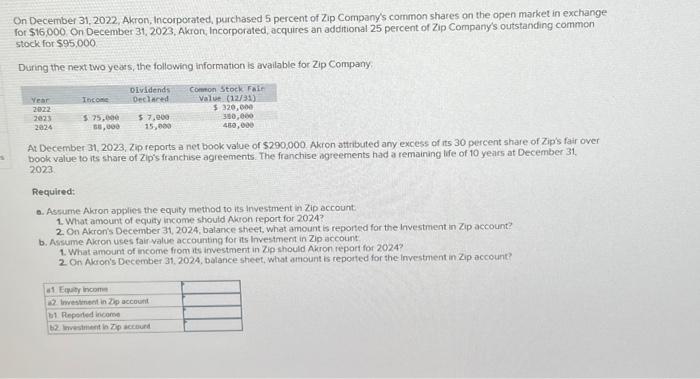

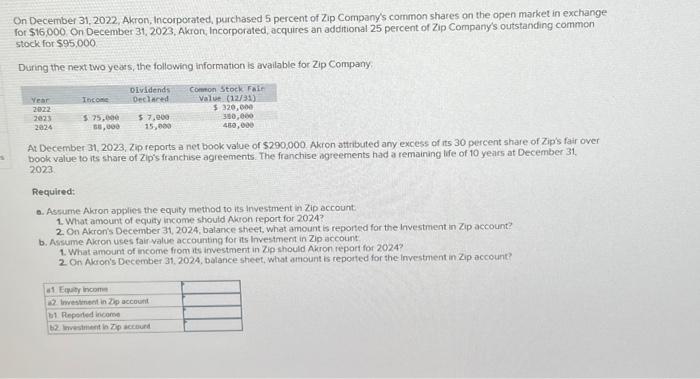

how i do this December 31, 2022, Akron, Incorporated, purchased 5 percent of Zip Company's common shares on the open market in exchange for $16,000

how i do this

December 31, 2022, Akron, Incorporated, purchased 5 percent of Zip Company's common shares on the open market in exchange for $16,000 On December 31, 2023, Akron, Incorporated, acquires an additional 25 percent of Zip Company's outstanding common stock for $95,000 During the next two years, the following information is available for Zip Company: At December 31,2023,Z p reports a net book value of $290,000 Akron attributed any excess of its 30 percent share of Zip's fair over book value to its share of Zip's franchise agreements. The franchise agreements had a remaining life of 10 yeirs at December 31 , 2023 Required: - Assume Akron applies the equity method to its investment in Zip account: 1. What amount of equity income should Avron teport for 2024 ? 2. On Akron's December 31,2024 , balance sheet, what amount is reponted for the investment in Zip account? b. Assume Akron uses fair value accounting for its investment in Zip account: 1. What amount of income from its investment in Zip should Akron report for 2024 ? 2 On Avon's December 31,2024 , balance sheet, what amount is reported for the investment in Zip account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started