Answered step by step

Verified Expert Solution

Question

1 Approved Answer

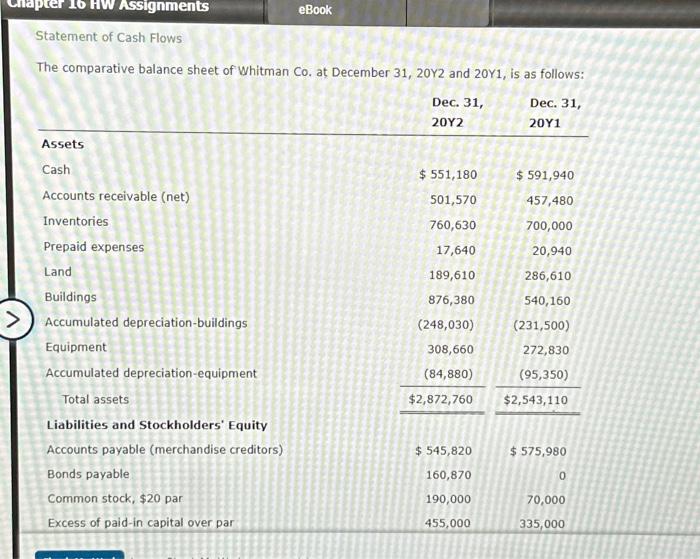

how is it not clear???? Statement of Cash Flows The comparative balance sheet of Whitman Co, at December 31,20Y2 and 20Y1, is as follows: The

how is it not clear????

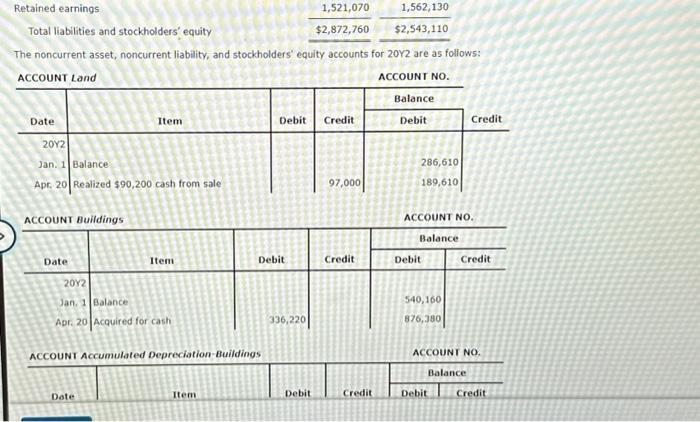

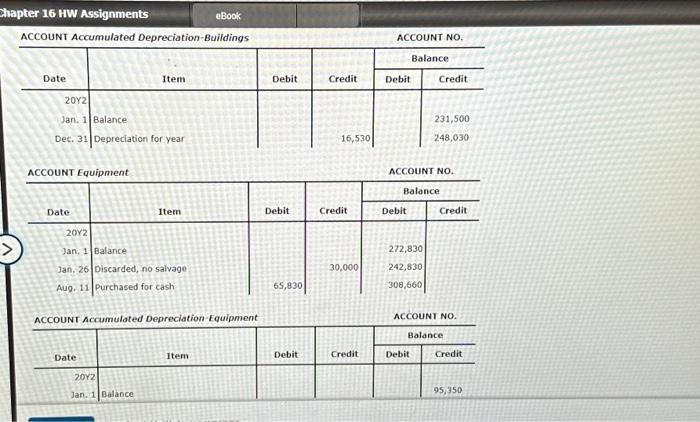

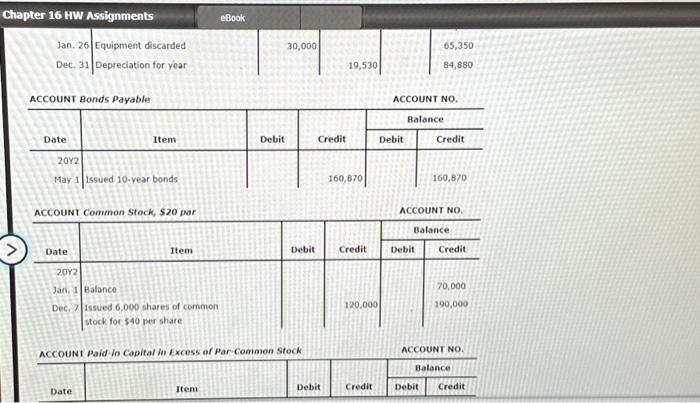

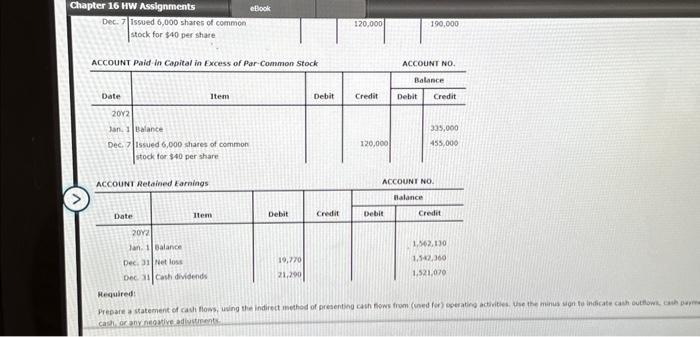

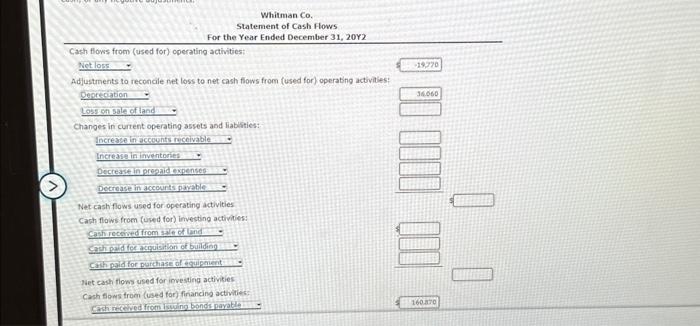

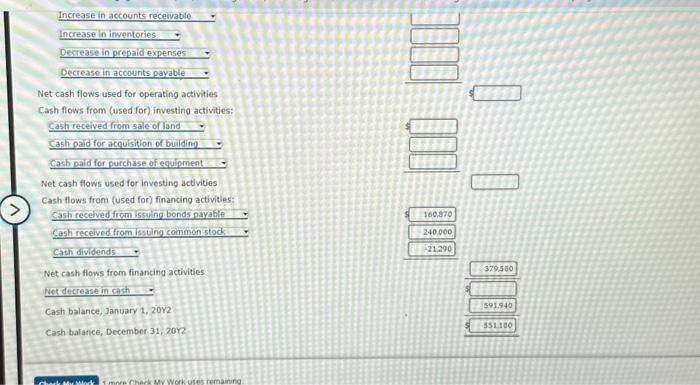

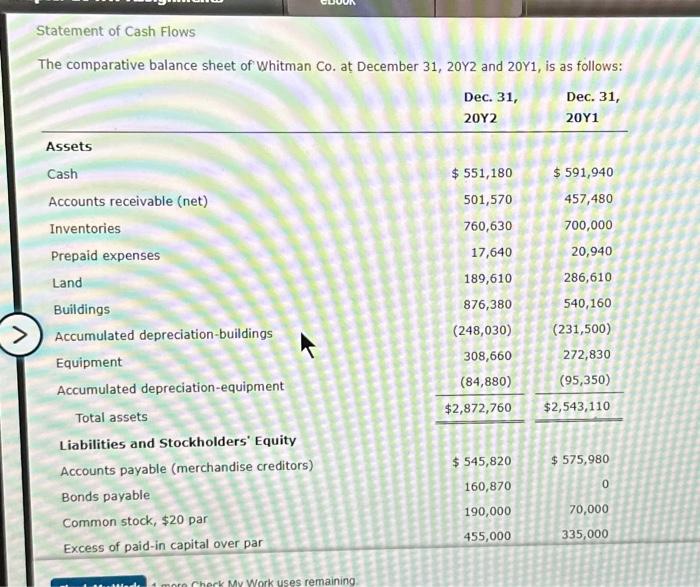

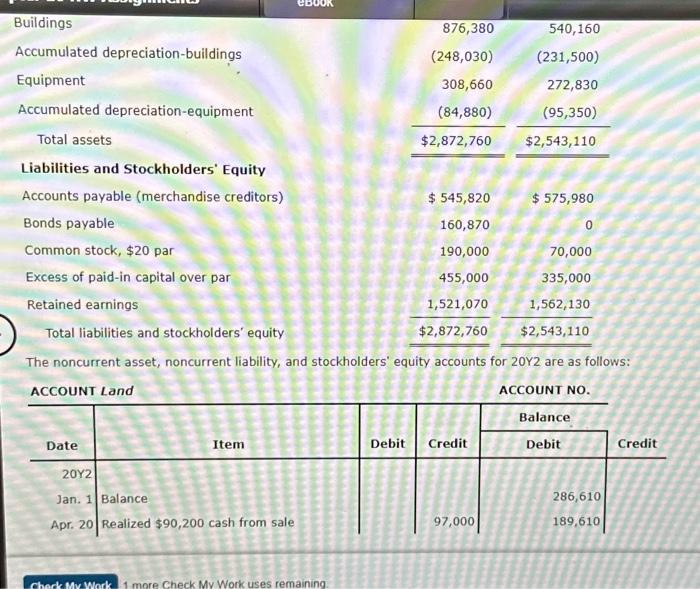

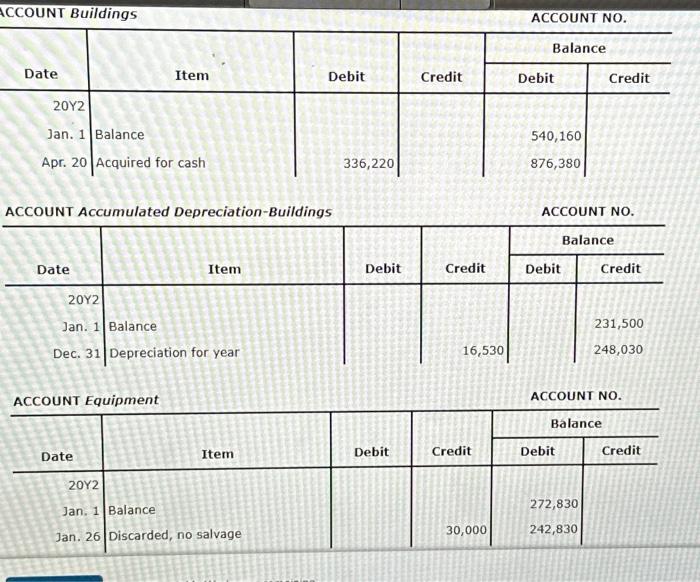

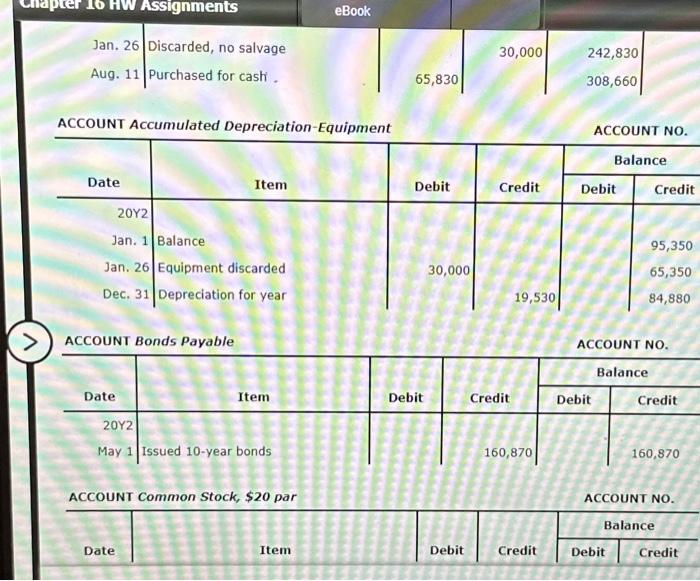

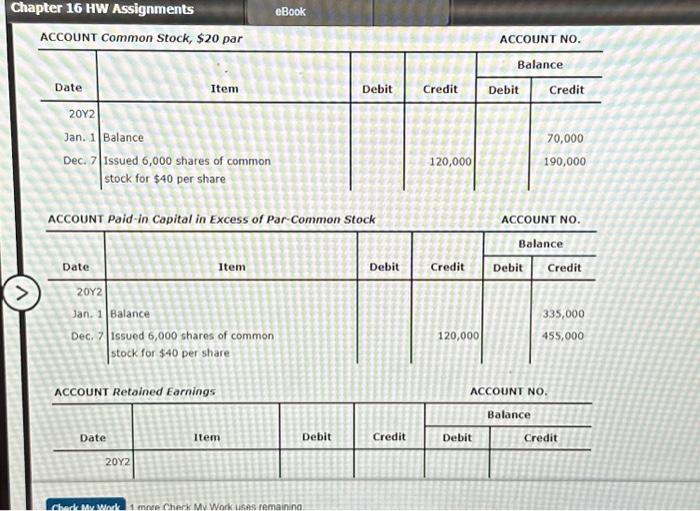

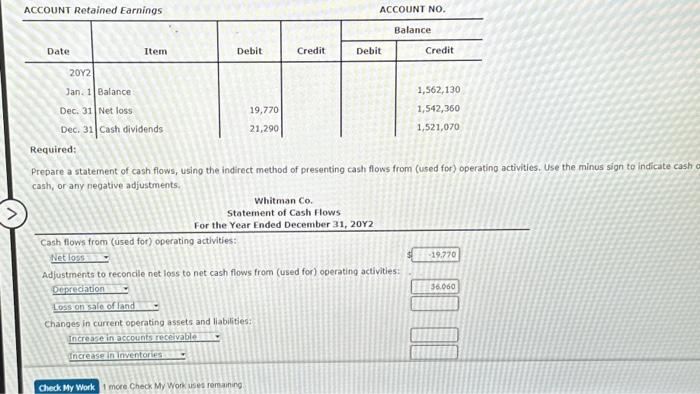

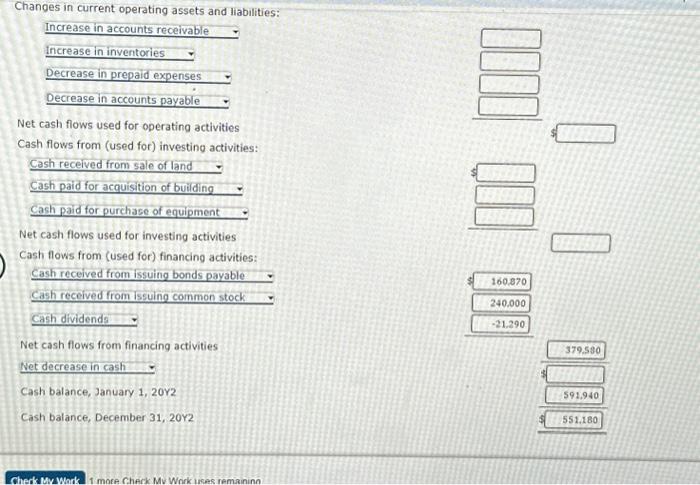

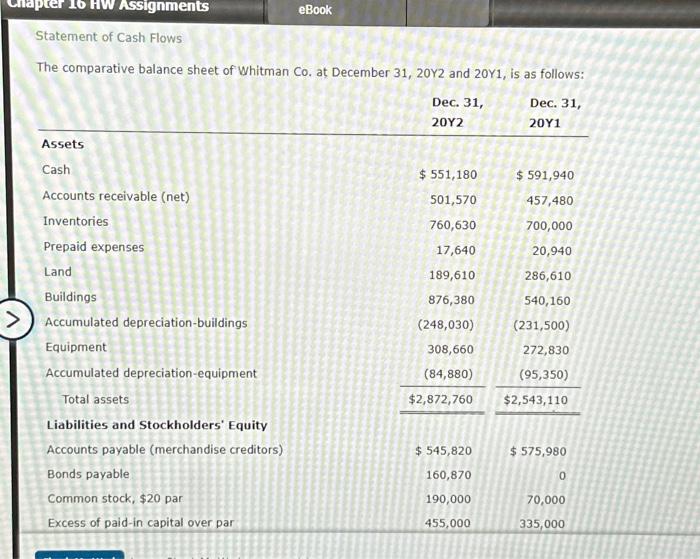

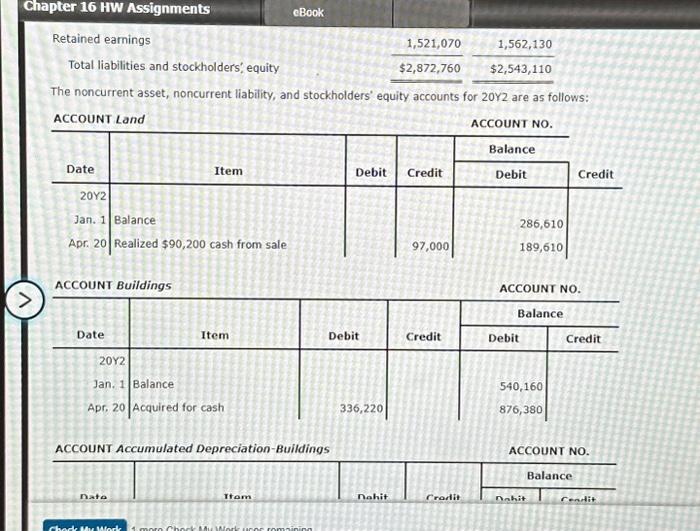

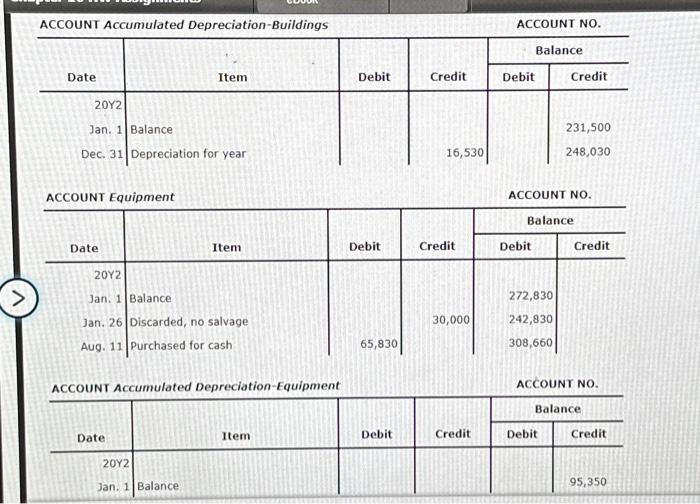

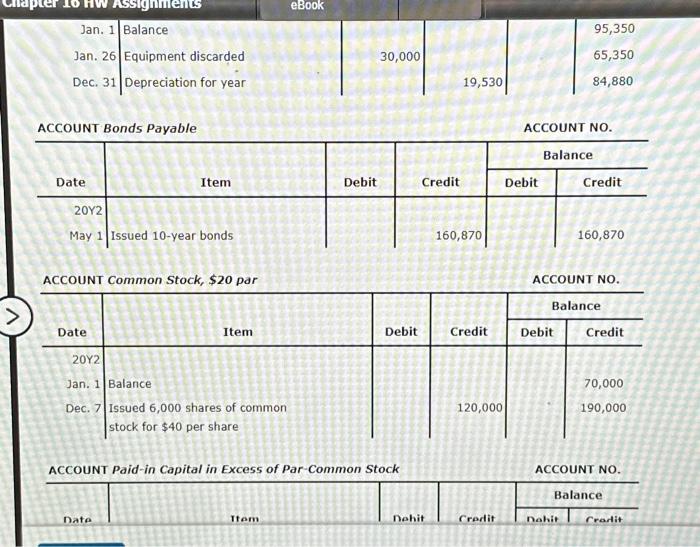

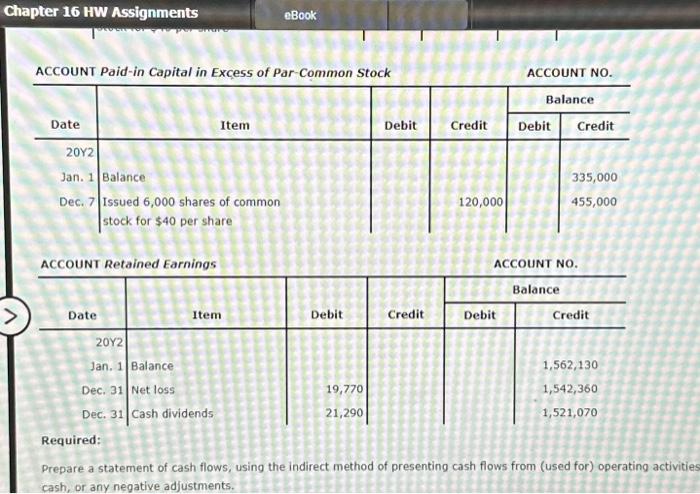

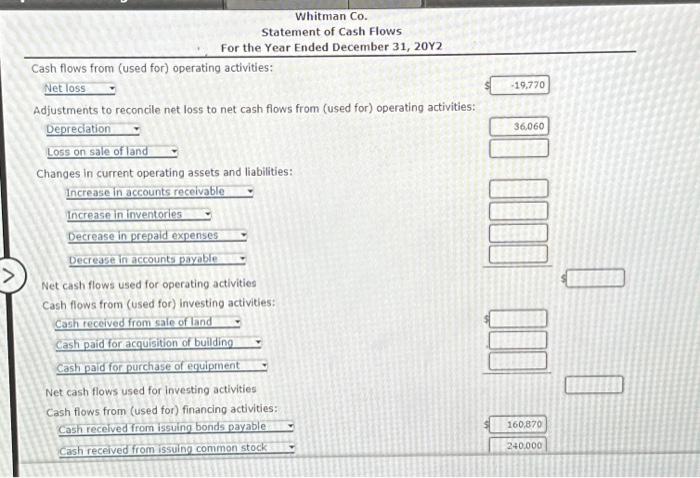

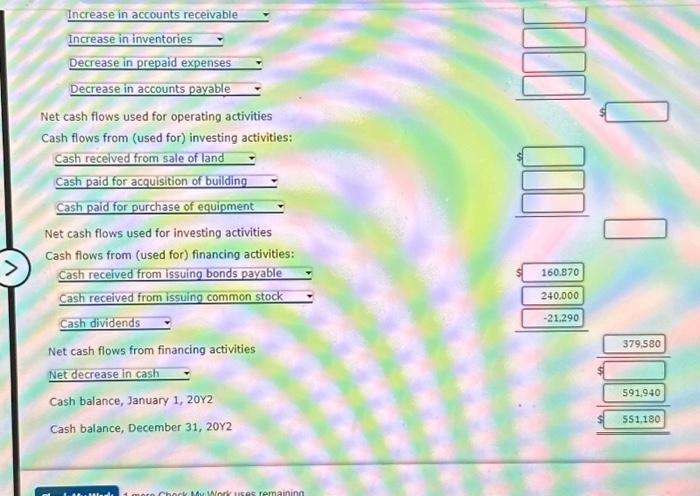

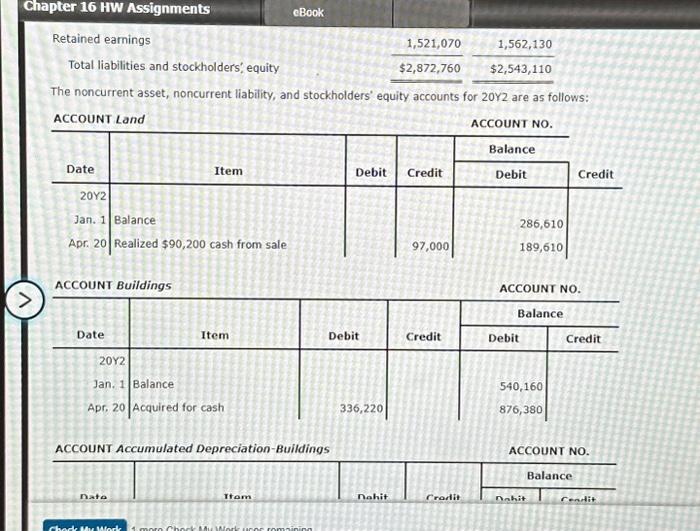

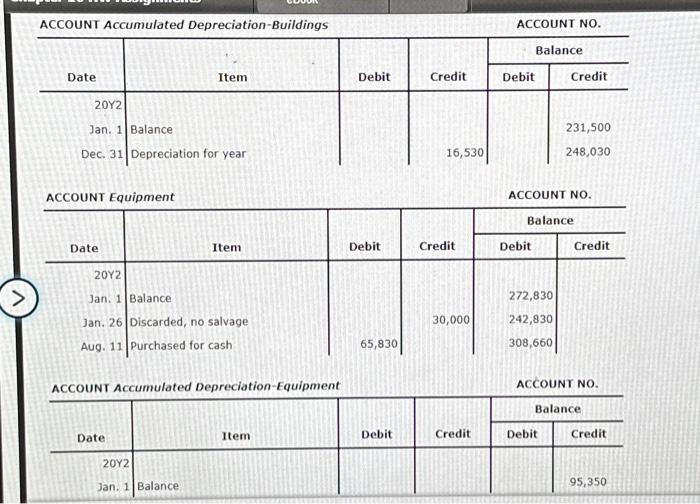

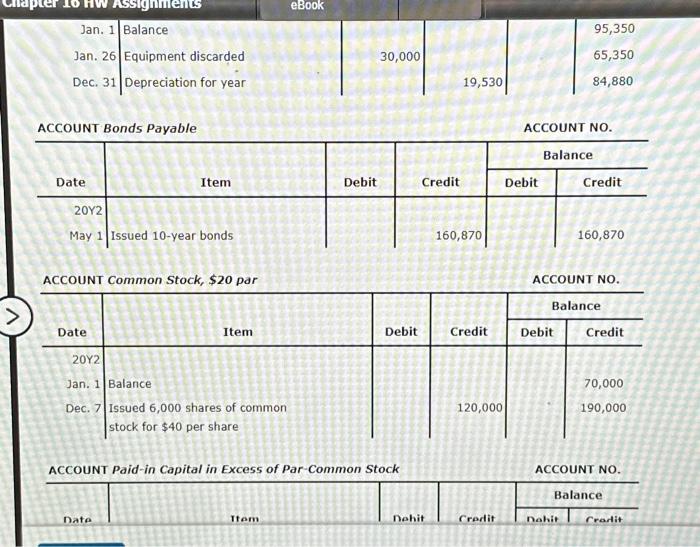

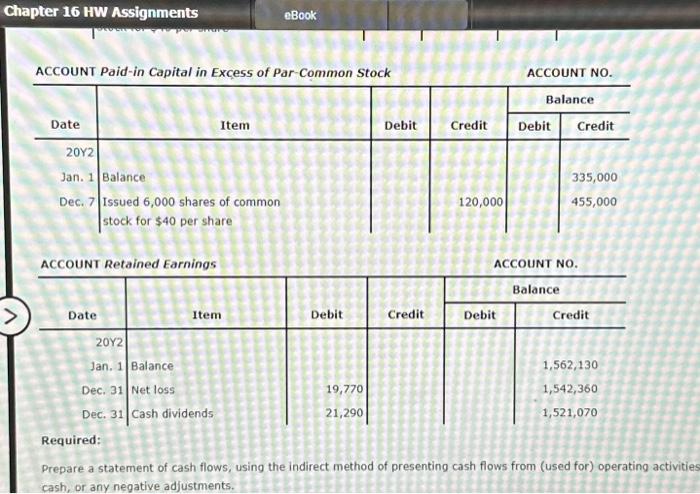

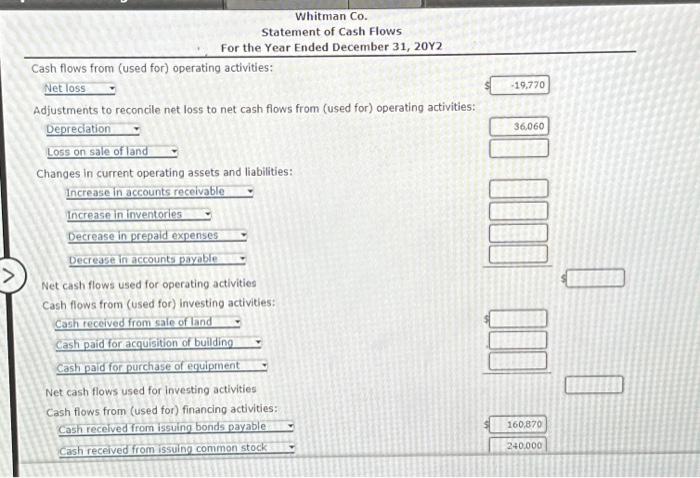

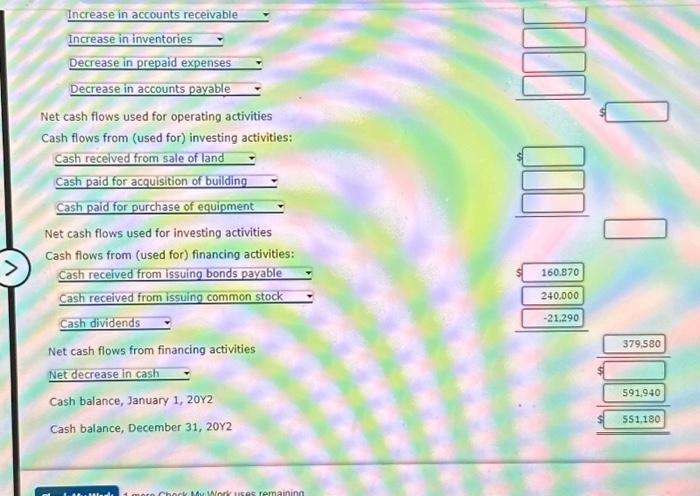

Statement of Cash Flows The comparative balance sheet of Whitman Co, at December 31,20Y2 and 20Y1, is as follows: The noncurrent asset, noncurrent liability, and stockholders' equity accounts for 20Y2 are as follows: ACCOUNT Accumulated Depreciation-Buildings ACCounT Paid -in Copital in Excess of Par-Common Stock ACCOUNT NO. Mequired: cast or any neoptive adiveterents Whitman Co. Statement of Cash Flows For the Year Ended December 31, 20Y2 Cach flows from (used for) operating activities: Net loss Adjustments to reconcile net loss to net cash fows from (used for) operabing activities: Depreciation Lossen sale of land Changes in curtent operating assets and liabisties: focrease in accounts receivable - Increase in inventories becreast in prepaid expenses Decrease in accourts pwahle- Net cash flows used for operating activities Cach flows from (used for) investing activities: cash received from wa diund Cath pid for purchase of ecquphent net cash flows used for iovesting activities Cash soms trom (used for) financing activities: Increase in accounts receivable Increase in imentories Decrease in prepaid expenses Decrease in accounts payable Net cash flows used for operating activities Cash flows from (used for) investing activities: Cash received from sale of land Cash pard for acquisition of building cash paid for purchase of equipment Net cash flows used for investing activities Cash flows from (used for) financing activities: cash received from issuing bonds payable Cash received from issuing common stock cash dividends Net cash flows from financing activities Net decrease in cash - Cash balance, January 1, 20 2 Cash balance, December 31,2012 The comparative balance sheet of Whitman Co. at December 31,20Y2 and 20Y1, is as follows: Buildings Accumulated depreciation-buildings (248,030) (231,500) Equipment 308,660 272,830 Accumulated depreciation-equipment Total assets $2,872,760(84,880)$2,543,110(95,350) Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $545,820$575,980 Bonds payable Common stock, \$20 par 160,870 0 Excess of paid-in capital over par 190,000 70,000 Retained earnings Total liabilities and stockholders' equity 455,000335,000 $2,872,7601,521,070$2,543,1101,562,130 The noncurrent asset, noncurrent liability, and stockholders' equity accounts for 20Y2 are as follows: ACCOUNT Land ACCOUNT NO. \begin{tabular}{r|l|l|l|l|r} \hline & & & & \multicolumn{2}{|c}{ Balance } \\ \cline { 5 - 6 } Date & Item & Debit & Credit & \multicolumn{1}{|c}{ Debit } & Credit \\ \hline 20 Y2 & & & & & \\ Jan. 1 & Balance & & & 286,610 & \\ Apr. 20 & Realized $90,200 cash from sale & & 97,000 & 189,610 & \end{tabular} ACCOUNT Accumulated Depreciation-Buildings ACCOUNT NO. ACCOUNT Equipment ACCOUNT NO. \begin{tabular}{r|r|r|r|r|r} \hline Date & & Item & & & \multicolumn{2}{|c}{ Balance } \\ \cline { 5 - 6 } & & Debit & Credit & \multicolumn{1}{|c}{ Debit } & \multicolumn{1}{c}{ Credit } \\ \hline 20Y2 & & & & & \\ Jan. 1 & Balance & & & 272,830 & \\ Jan. 26 & Discarded, no salvage & & 30,000 & 242,830 & \\ \hline \end{tabular} ACCOUNT Accumulated Depreciation-Equipment ACCOUNT NO. ACCOUNT Paid-in Capital in Excess of Par-Common Stock ACCOUNT Retained Earnings ACCOUNT NO. Required: Prepare a statement of cash flows, using the indirect method of presenting cash flows from (used for) operating activities. Use the minus sign to incicate cash o cash, or any negative adjustments. Whitman Co. Statement of Cash Flows For the Year Ended December 31, 20Y2 Cash flows from (used for) operating activities: Netlows Adjustments to reconcle net lass to net cash flows from (used for) operating activities: Deprectation Lass on sale of land Changes in current operating assets and liabilities: increase in accounts receivable Increase in inventories 1 more Check My Work uses remaining Changes in current operating assets and liabilities: Increase in accounts receivable Increase in inventories Decrease in prepaid expenses Decrease in accounts payable Net cash flows used for operating activities Cash flows from (used for) investing activities: Cash received from sale of land Cash paid for acquisition of building Cash paid for purchase of equipment Net cash flows used for investing activities Cash flows from (used for) financing activities: Cash received from issuing bonds payable cash received from Issuing common stock Cash dividende Net cash flows from financing activities Net decrease in cash Cash balance, January 1, 20r2 Cash balance, December 31,20y2 The comparative balance sheet of Whitman Co. at December 31,20Y2 and 20Y1, is as follows: ACCOUNT Buildings ACCOUNT NO. ACCOIINT NO. ACCOUNT NO. ACCOUNT Paid-in Capital in Excess of Par-Common Stock ACCOUNT NO. Required: Prepare a statement of cash flows, using the indirect method of presenting cash flows from (used for) operating activitie cash, or any negative adjustments. Whitman Co. Statement of Cash Flows For the Year Ended December 31, 20Y2 Cash flows from (used for) operating activities: Net loss Adjustments to reconcile net loss to net cash flows from (used for) operating activities: Depreciation Loss on sale of land Changes in current operating assets and liabilities: Increase in accounts recelvable Increase in inventories Decrease in prepald expenses Decrease in accounts payable Net cash flows used for operating activities Cash flows from (used for) investing activities: cash received from sale of land . Cash paid for acquisition of building Cash paid for purchase of equipment Net cash flows used for investing activities Cash flows from (used for) financing activities: Cash received from issuing bonds payable Cash received from issuing common stock 36,060 Increase in accounts receivable Increase in inventories Decrease in prepaid expenses Decrease in accounts payable Net cash flows used for operating activities Cash flows from (used for) investing activities: Cash recelved from sale of land Cash paid for acquisition of building Cash paid for purchase of equipment Net cash flows used for investing activities Cash flows from (used for) financing activities: Cash received from issuing bonds payable Cash received from issuing common stock Cash dividends Net cash flows from financing activities Net decrease in cash Cash balance, January 1, 20Y2 Cash balance, December 31,20Y2 379,580

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started