Answered step by step

Verified Expert Solution

Question

1 Approved Answer

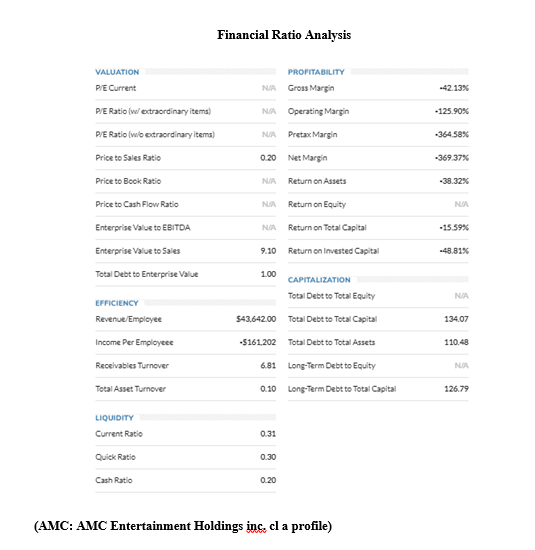

How liquid is the company? Is management generating a substantial profit on the companys assets? Financial Ratio Analysis PROFITABILITY Gross Margin NA -42.13% NA Operating

How liquid is the company? Is management generating a substantial profit on the companys assets?

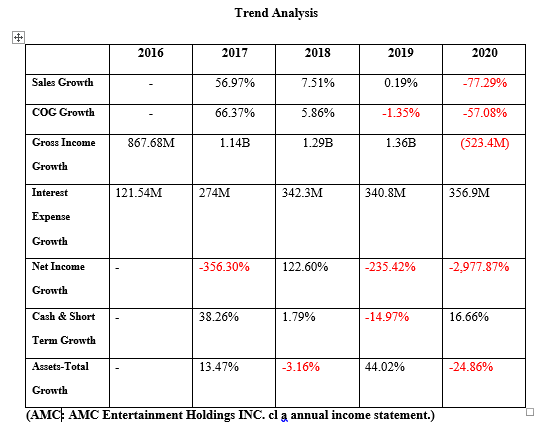

Financial Ratio Analysis PROFITABILITY Gross Margin NA -42.13% NA Operating Margin -125,90% NA Preta Margin -364.58% 0.20 Net Margin -369.37% VALUATION PE Current PE Ratio (w/ extraordinary items) PE Ratio (wo extraordinary items) Price to Sales Ratio Price to Book Ratio Price to Cash Flow Ratio Enterprise Value to EBITDA Enterprise Value to Sales Total Debt to Enterprise Valve NA Return on Assets -38.32% NA Return on Equity NA NA Return on Total Capital -15.59% 9.10 Return on invested Capital -48.81% 1.00 NA 134.07 EFFICIENCY Revenue/Employee Income Per Employee Receivables Turnover Total Asset Turnover CAPITALIZATION Total Debt to Total Equity $43,642.00 Total Debt to Total Capital -5161202 Total Debt to Total Assets 6.81 Long-Term Debt to Equity 0.10 Long-Term Debt to Total Capital 110.48 NUA 126.79 LIQUIDITY Current Ratio 0.31 Quick Ratio 0.30 Cash Ratio 0.20 (AMC: AMC Entertainment Holdings inc. cl a profile) Trend Analysis 2016 2017 2018 2019 2020 Sales Growth 56.97% 7.51% 0.19% -77.29% COG Growth 66.37% 5.86% -1.35% -57.08% Gross Income 867.68M 1.14B 1.29B 1.36B (523.4M) Growth Interest 121.54M 274M 342.3M 340.8M 356.9M Expense Growth Net Income -356.30% 122.60% -235.42% -2,977.87% Growth Cash & Short 38.26% 1.79% -14.97% 16.66% Term Growth Assets-Total 13.47% -3.16% 44.02% -24.86% Growth (AMC AMC Entertainment Holdings INC. cl a annual income statement.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started