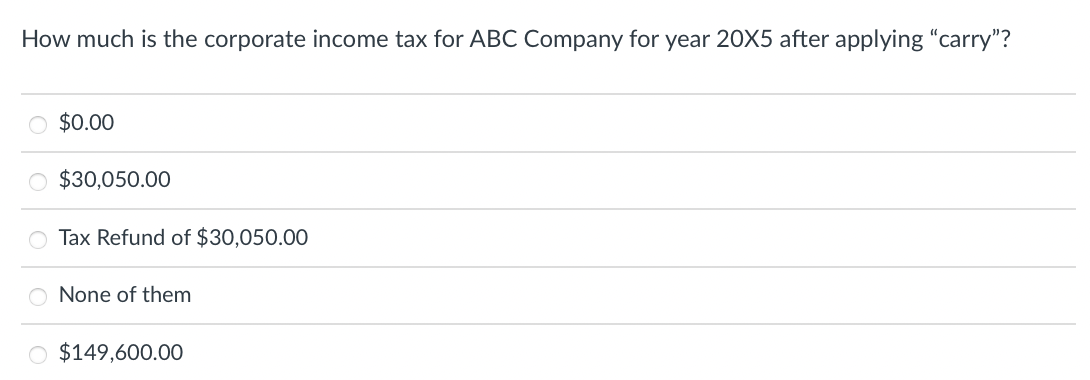

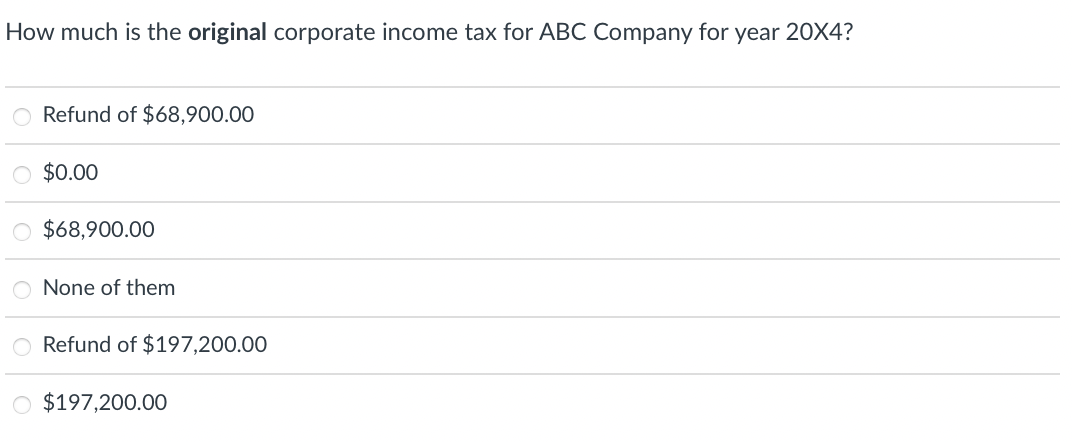

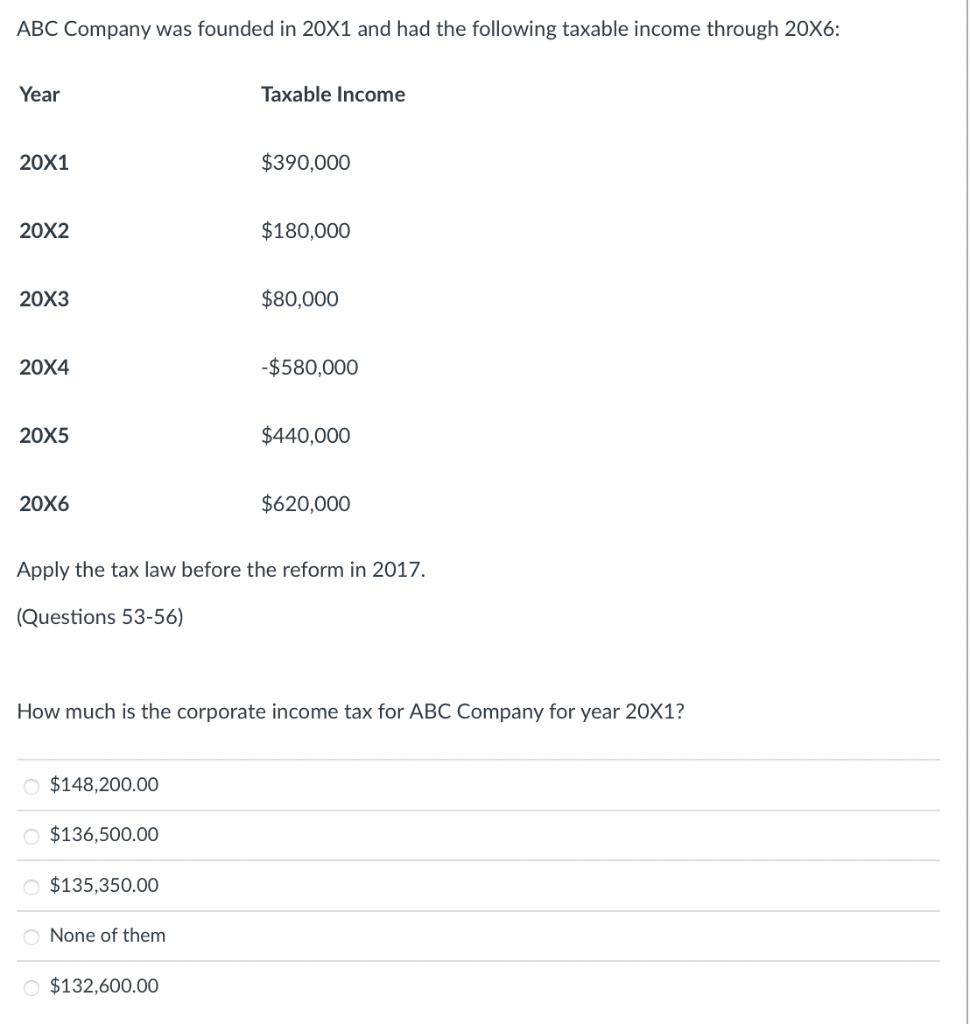

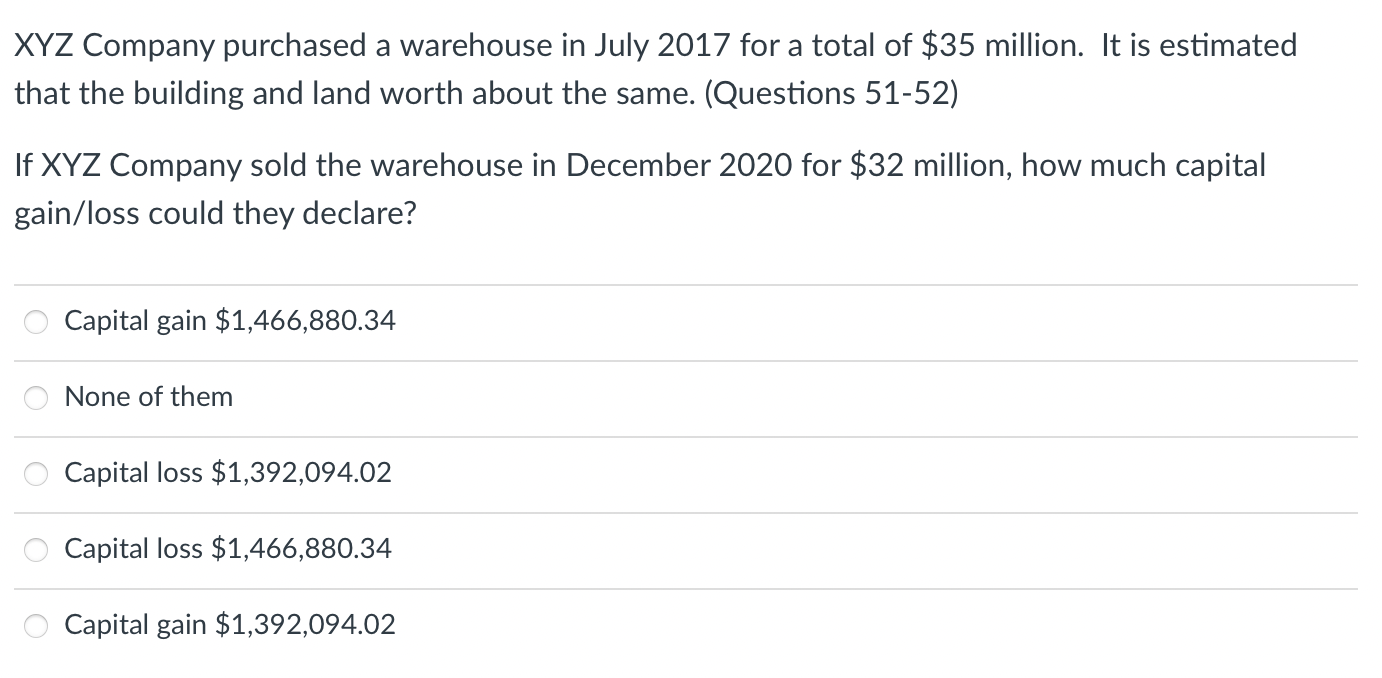

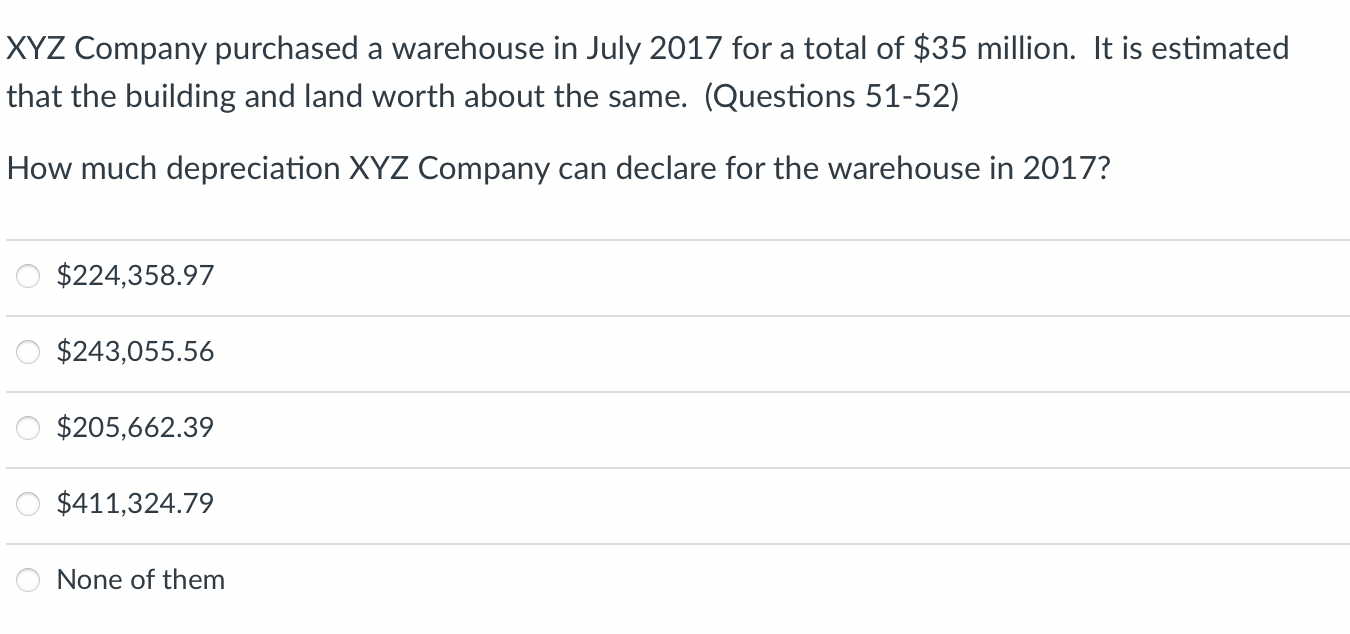

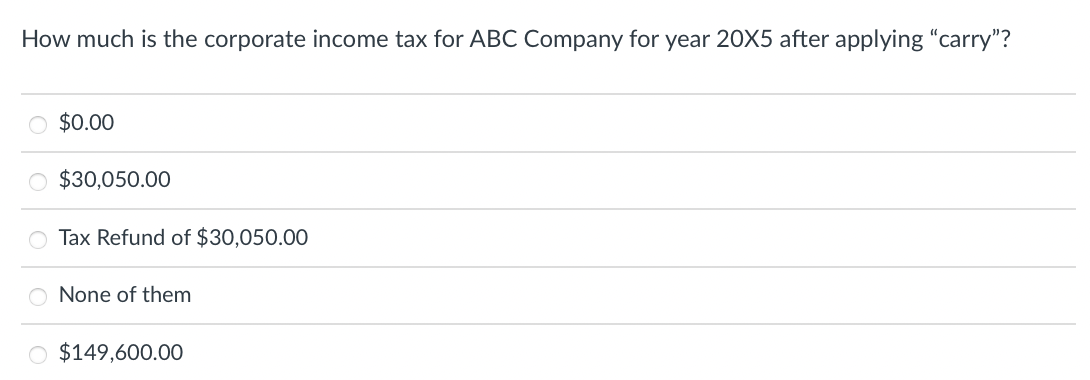

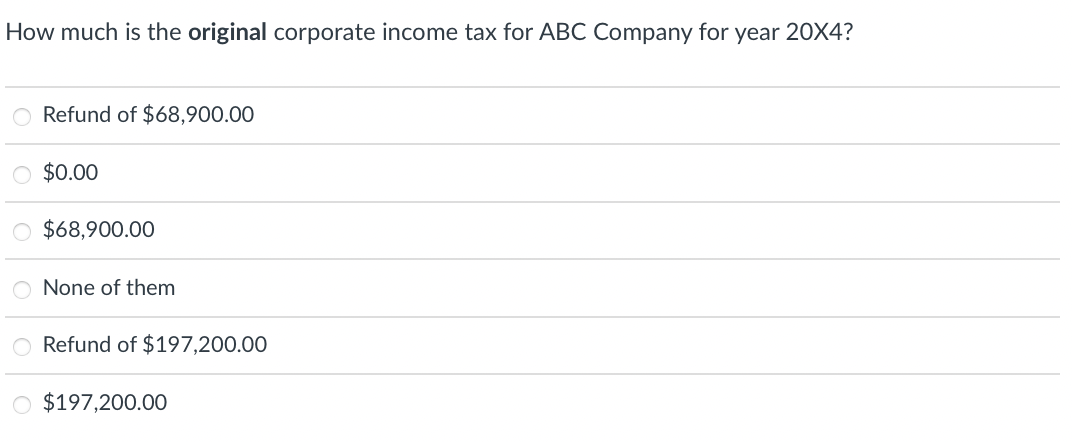

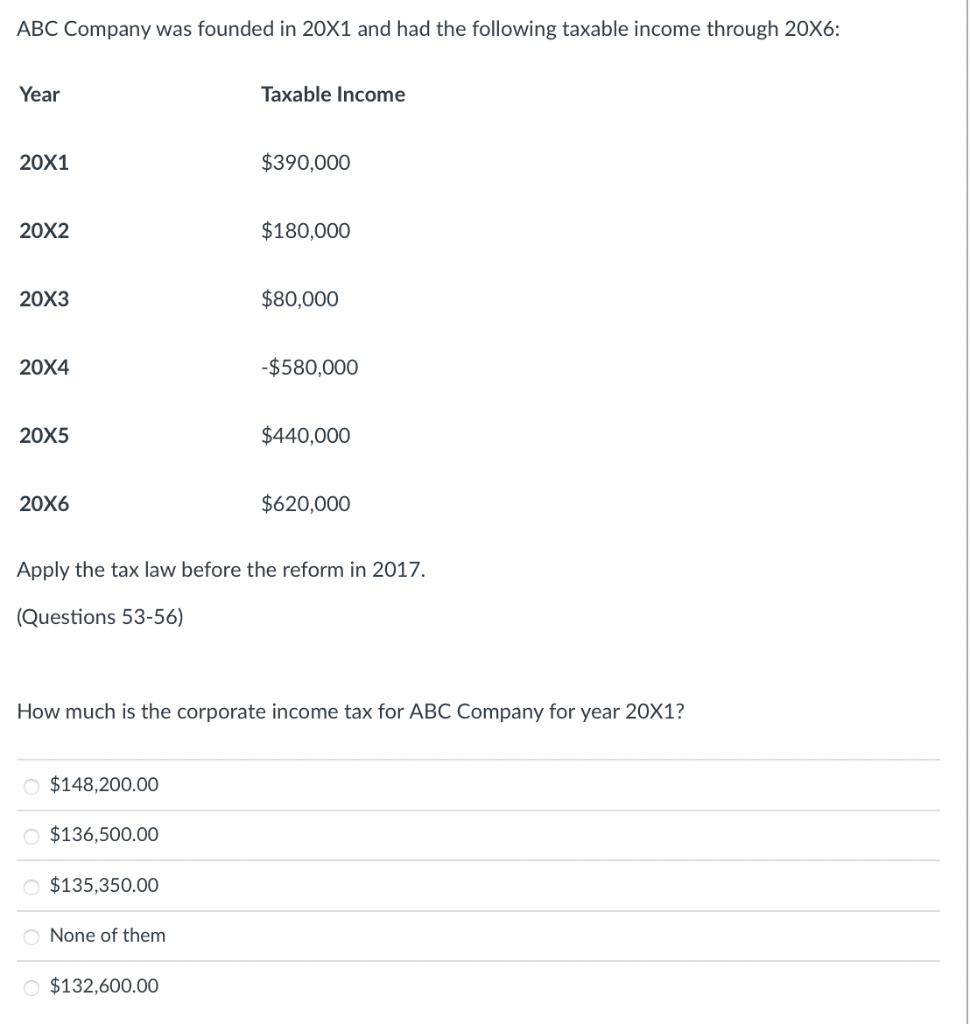

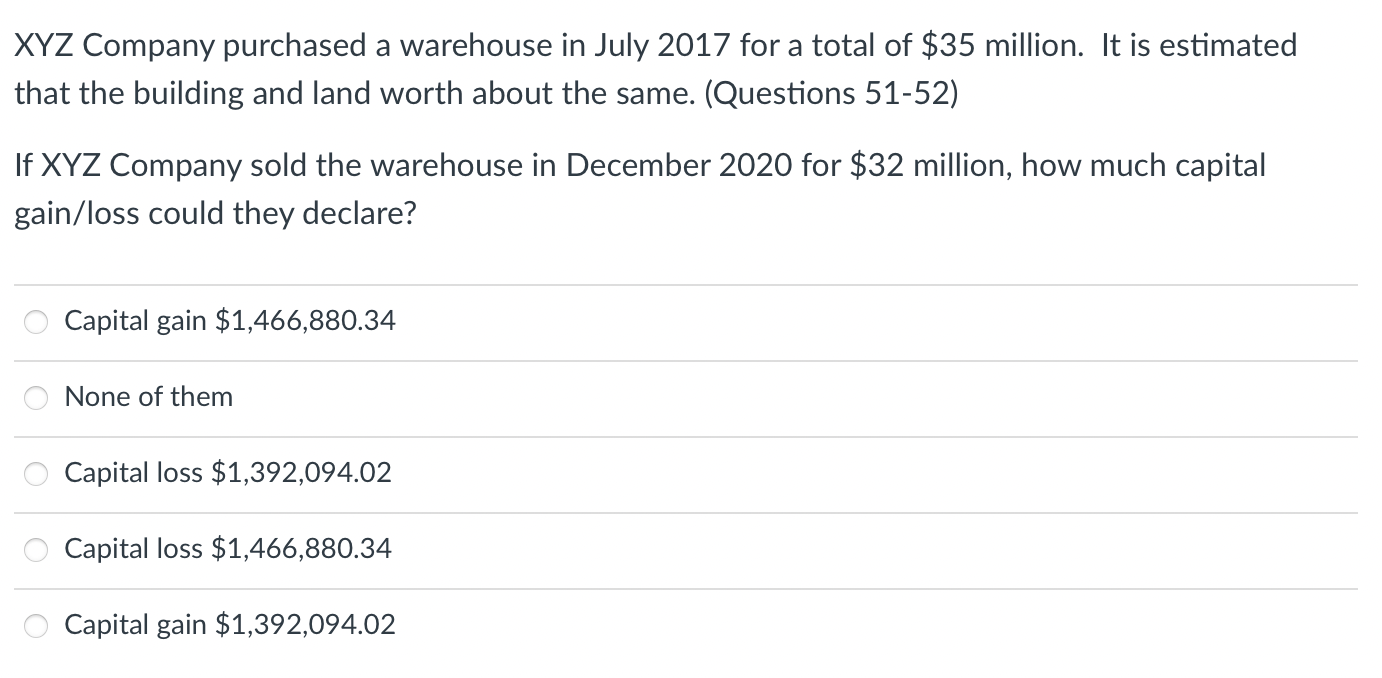

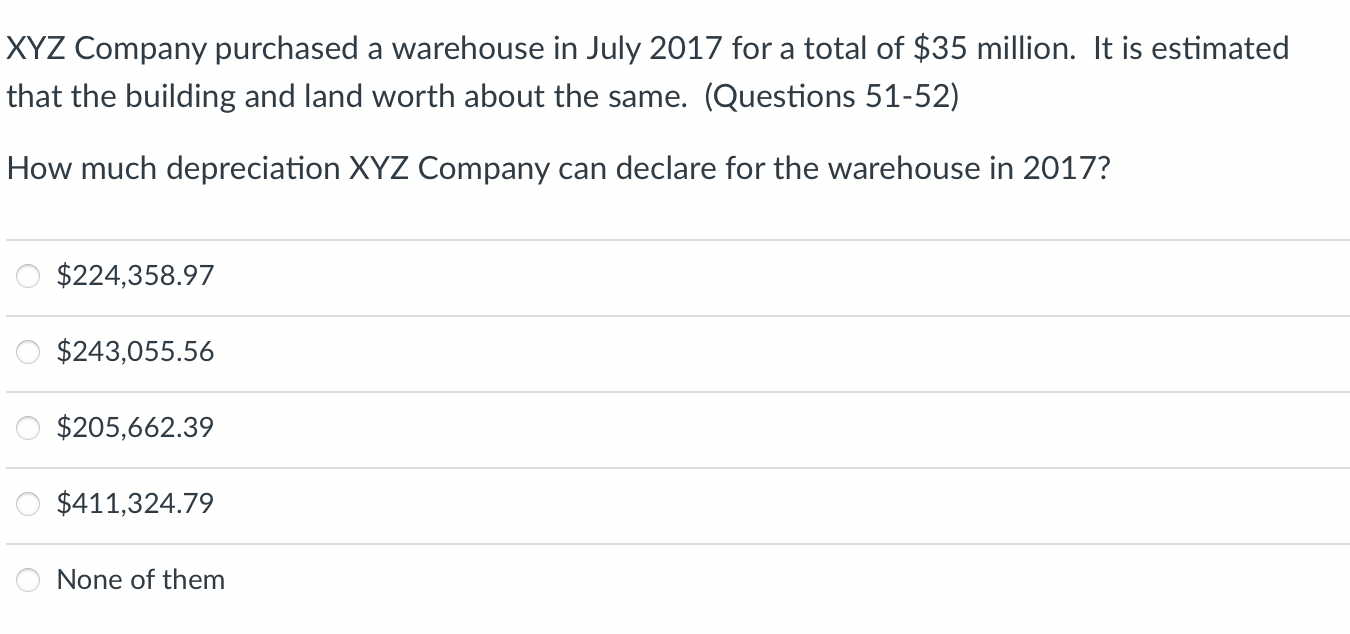

How much is the corporate income tax for ABC Company for year 205 after applying "carry"? $0.00 $30,050.00 Tax Refund of $30,050.00 None of them $149,600.00 How much is the original corporate income tax for ABC Company for year 204 ? Refund of $68,900.00 $0.00 $68,900.00 None of them Refund of $197,200.00 $197,200.00 ABC Company was founded in 201 and had the following taxable income through 206 : Apply the tax law before the reform in 2017. (Questions 53-56) How much is the corporate income tax for ABC Company for year 20X1? $148,200.00$136,500.00$135,350.00 None of them $132,600.00 XYZ Company purchased a warehouse in July 2017 for a total of $35 million. It is estimated that the building and land worth about the same. (Questions 51-52) If XYZ Company sold the warehouse in December 2020 for $32 million, how much capital gain/loss could they declare? Capital gain $1,466,880.34 None of them Capital loss $1,392,094.02 Capital loss $1,466,880.34 Capital gain $1,392,094.02 XYZ Company purchased a warehouse in July 2017 for a total of $35 million. It is estimated that the building and land worth about the same. (Questions 51-52) How much depreciation XYZ Company can declare for the warehouse in 2017? $224,358.97 $243,055.56 $205,662.39 $411,324.79 None of them How much is the corporate income tax for ABC Company for year 205 after applying "carry"? $0.00 $30,050.00 Tax Refund of $30,050.00 None of them $149,600.00 How much is the original corporate income tax for ABC Company for year 204 ? Refund of $68,900.00 $0.00 $68,900.00 None of them Refund of $197,200.00 $197,200.00 ABC Company was founded in 201 and had the following taxable income through 206 : Apply the tax law before the reform in 2017. (Questions 53-56) How much is the corporate income tax for ABC Company for year 20X1? $148,200.00$136,500.00$135,350.00 None of them $132,600.00 XYZ Company purchased a warehouse in July 2017 for a total of $35 million. It is estimated that the building and land worth about the same. (Questions 51-52) If XYZ Company sold the warehouse in December 2020 for $32 million, how much capital gain/loss could they declare? Capital gain $1,466,880.34 None of them Capital loss $1,392,094.02 Capital loss $1,466,880.34 Capital gain $1,392,094.02 XYZ Company purchased a warehouse in July 2017 for a total of $35 million. It is estimated that the building and land worth about the same. (Questions 51-52) How much depreciation XYZ Company can declare for the warehouse in 2017? $224,358.97 $243,055.56 $205,662.39 $411,324.79 None of them