Answered step by step

Verified Expert Solution

Question

1 Approved Answer

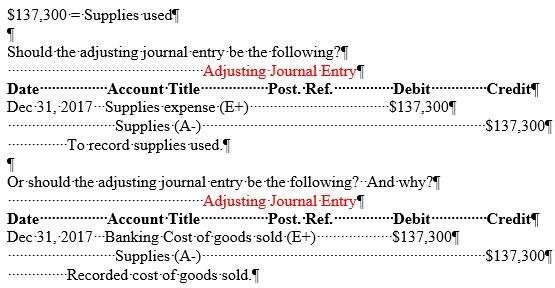

How should the adjusting journal entry be typed or written on an adjusting journal entry? Do you see the two different adjusting journal entries above?

How should the adjusting journal entry be typed or written on an adjusting journal entry? Do you see the two different adjusting journal entries above? I just want to know which is one considered the correct adjusting journal entry to use and why?

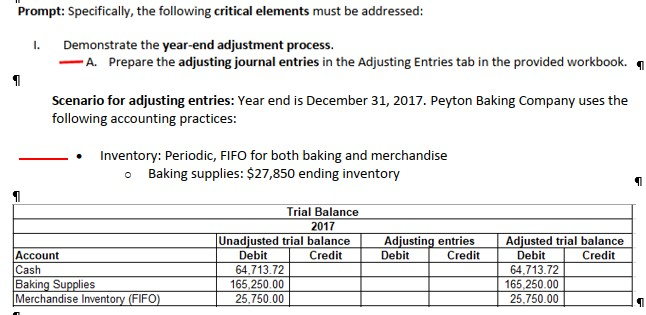

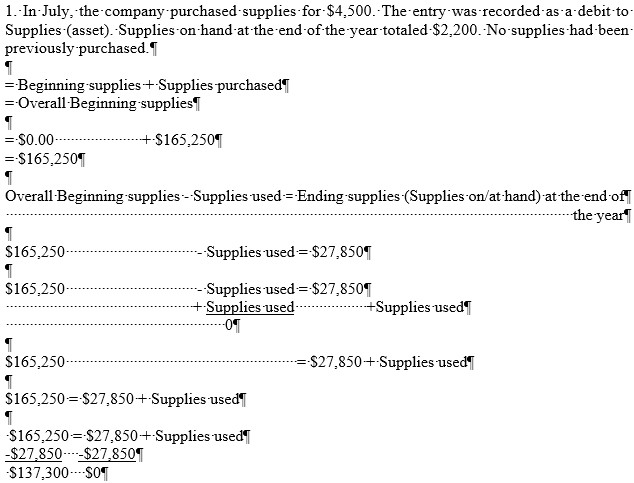

Prompt: Specifically, the following critical elements must be addressed: Demonstrate the year-end adjustment process. - A. Prepare the adjusting journal entries in the Adjusting Entries tab in the provided workbook. q I. Scenario for adjusting entries: Year end is December 31, 2017. Peyton Baking Company uses the following accounting practices: Inventory: Periodic, FIFO for both baking and merchandise Baking supplies: $27,850 ending inventory 11 Trial Balance 2017 Unadjusted trial balance Debit Credit 64.713.72 165,250.00 25.750.00 Adjusting entries Debit Credit Account Cash Baking Supplies Merchandise Inventory (FIFO) Adjusted trial balance Debit Credit 64,713.72 165 250.00 25.750.00 1 1.-In-July, the company purchased supplies-for-$4,500. The entry was recorded as a debit-to- Supplies (asset). Supplies on hand at the end of the year totaled $2,200. No-supplies had been previously purchased. I =Beginning supplies + Supplies purchased =-Overall Beginning supplies 1 1 = $0.00 +$165,2509 = $165,2501 1 Overall Beginning supplies--Supplies used-=-Ending supplies (Supplies on/at-hand) at the end off the year 1 $165,250 Supplies used=-$27,8501 1 $165,250 Supplies used=-$27,8509 + Supplies used +Supplies used --09 1 $165,250 --$27,850+ Supplies used 1 $165,250 = $27,850 +Supplies used 1 $165,250=-$27,850+ Supplies used -$27.850----$27,8509 $137,300---SOC $137,300 = Supplies used 1 --Credit Should the adjusting journal entry be the following? --Adjusting Journal-Entry Date Account Title" ...Post. Ref.: Dec 31, 2017 -- Supplies expense (E+) - Supplies -(A-) -To record-supplies used. -Debit --$137,3001 $137,3001 --Credit Or should the adjusting journal entry be the following?--And why? --Adjusting Journal Entry Date "Account Title" Post. Ref.: -Debit... Dec 31, 2017 - Banking Cost-of goods sold-(E+). $137,3001 ----Supplies (A-) -Recorded cost of goods sold. -$137,300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started