Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to calculate RPGT (malaysia inland)? Real Property Gain Tax (RPGT) act was introduced to provide the imposition, assessment and collection of a tax from

How to calculate RPGT (malaysia inland)?

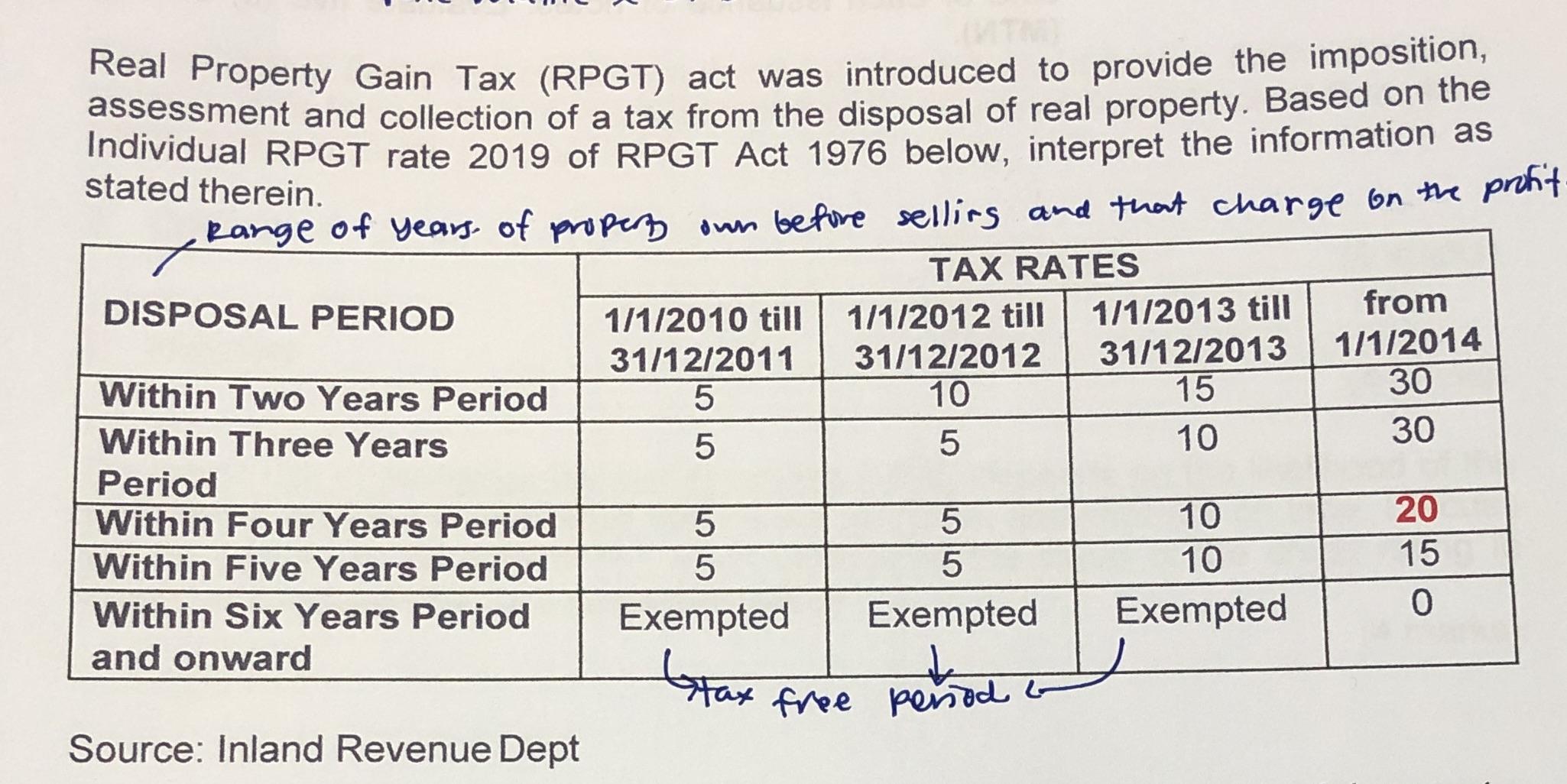

Real Property Gain Tax (RPGT) act was introduced to provide the imposition, assessment and collection of a tax from the disposal of real property. Based on the Individual RPGT rate 2019 of RPGT Act 1976 below, interpret the information as Range of years of property own before selling and that charge on the profit stated therein. TAX RATES DISPOSAL PERIOD Within Two Years Period Within Three Years Period Within Four Years Period Within Five Years Period Within Six Years Period and onward Source: Inland Revenue Dept 1/1/2010 till 31/12/2011 5 LO 5 5 5 Exempted 1/1/2012 till 31/12/2012 10 5 5 5 Exempted Extax free penod 1/1/2013 till 31/12/2013 15 10 10 10 Exempted from 1/1/2014 30 30 20 15 0

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To calculate RPGT in Malaysia you need to determine the chargeable gain and apply the appropriate tax rate based on the disposal period and the range ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started