How to complete in excel urgent

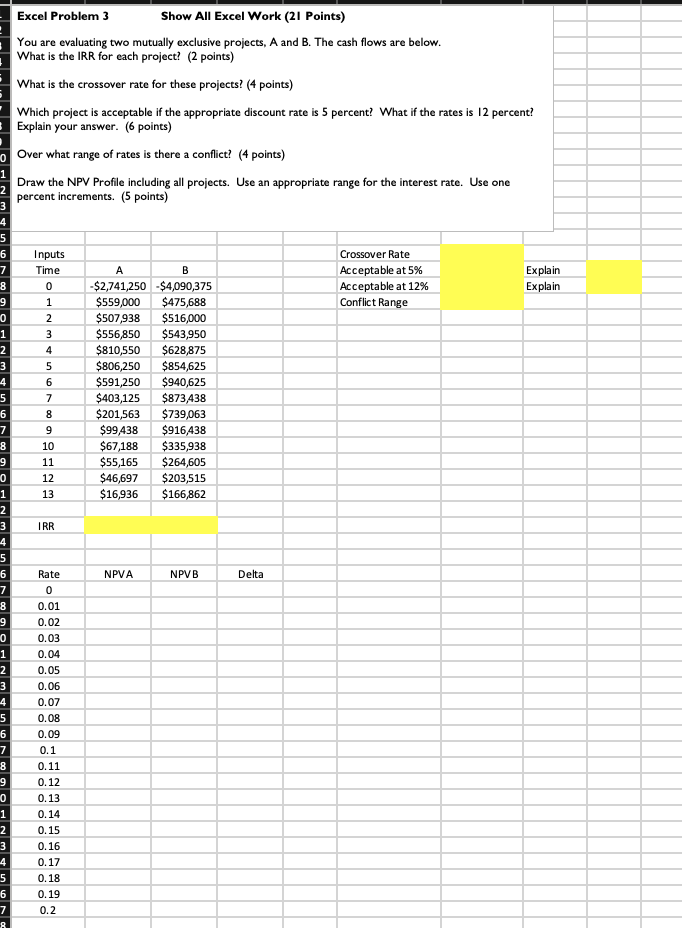

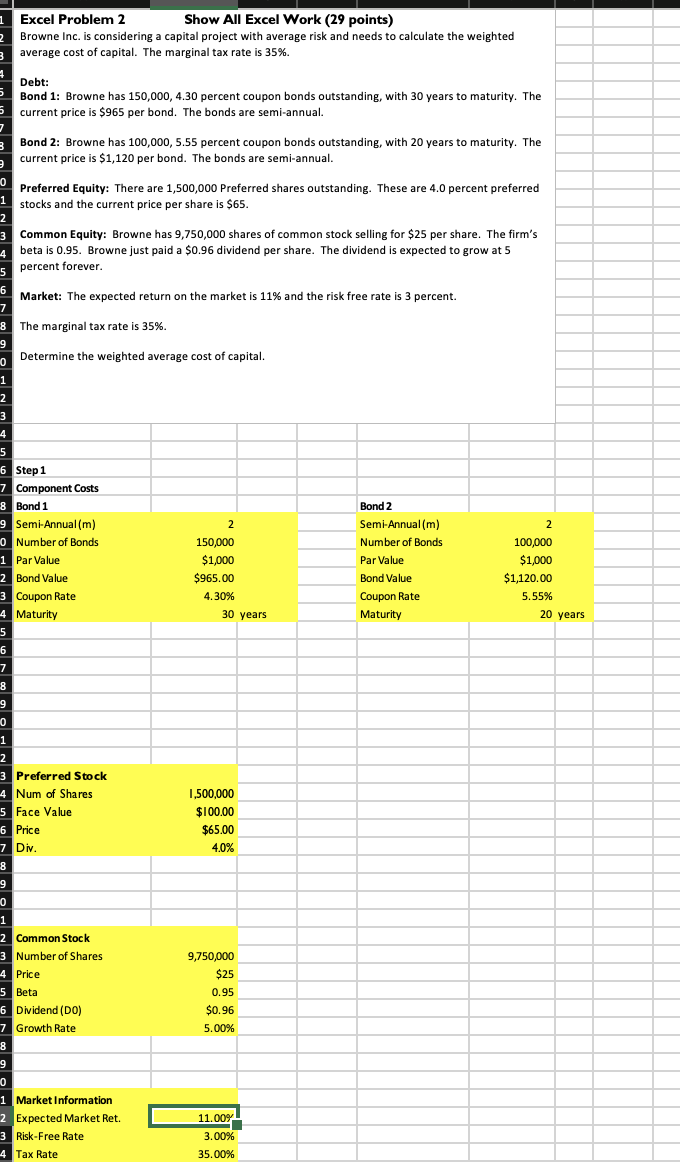

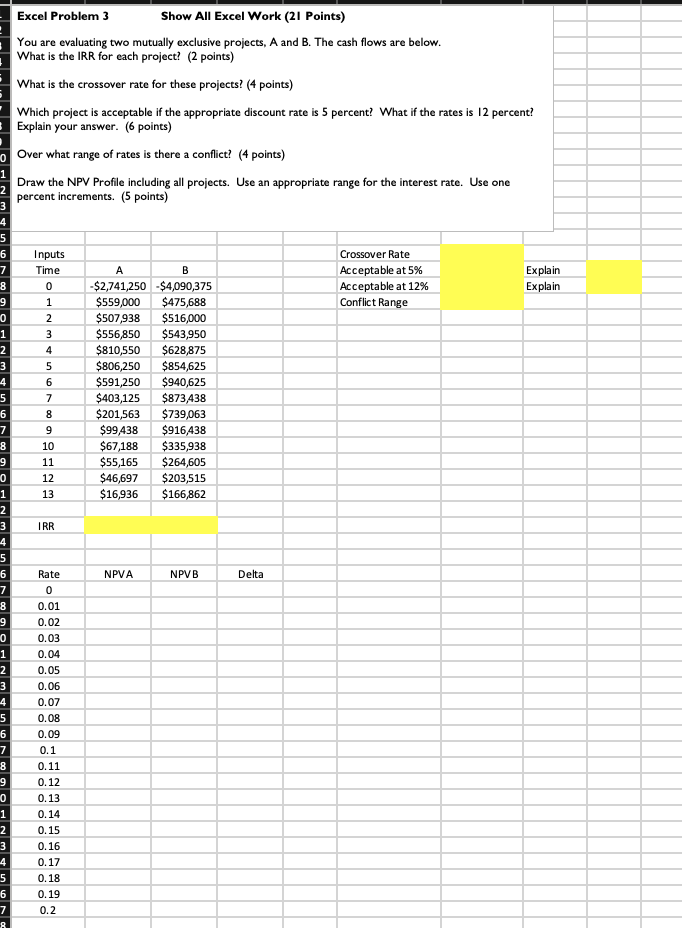

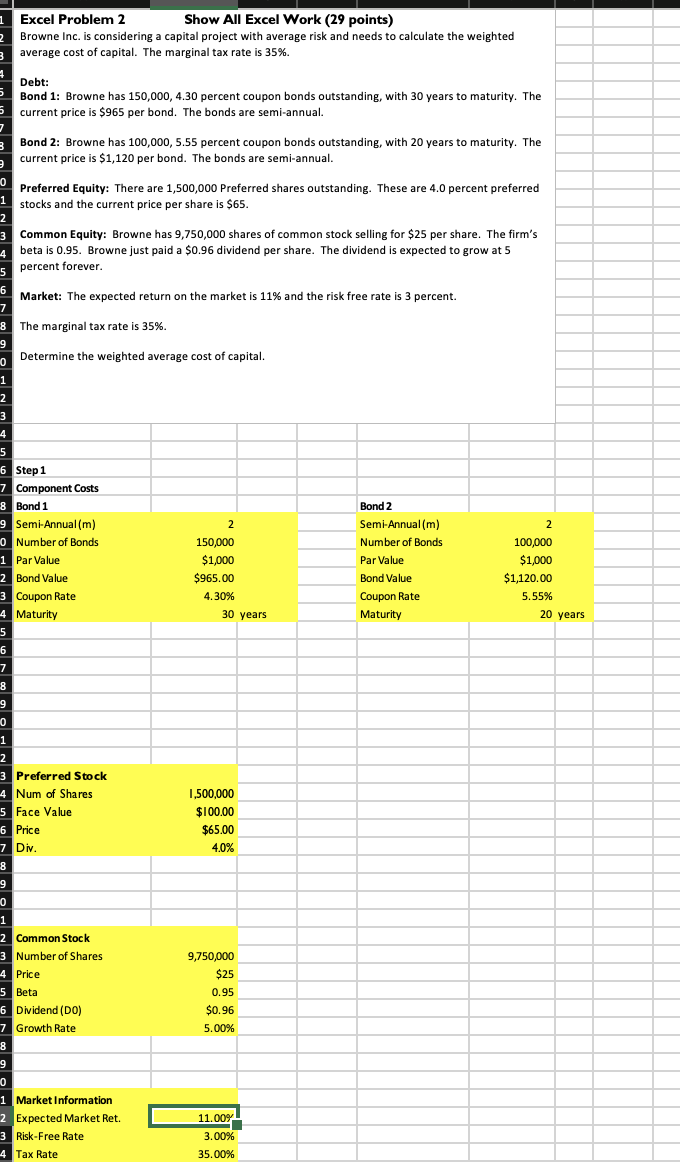

Excel Problem 3 Show All Excel Work (21 Points) You are evaluating two mutually exclusive projects, A and B. The cash flows are below. What is the IRR for each project? (2 points) What is the crossover rate for these projects? (4 points) Which project is acceptable if the appropriate discount rate is 5 percent? What if the rates is 12 percent? Explain your answer. (6 points) Over what range of rates is there a conflict? (4 points) Draw the NPV Profile including all projects. Use an appropriate range for the interest rate. Use one percent increments. (5 points) 3 Crossover Rate Acceptable at 5% Acceptable at 12% Conflict Range Explain Explain Inputs Time 0 1 2 3 4 5 6 7 8 9 10 11 12 13 A B -$2,741,250 $4,090,375 $559,000 $475,688 $507,938 $516,000 $556,850 $543,950 $810,550 $628,875 $806,250 $854,625 $591,250 $940,625 $403,125 $873,438 $201,563 $739,063 $99,438 $916,438 $67,188 $335,938 $55,165 $264,605 $46,697 $203,515 $16,936 $166,862 I RR 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 NPVA NPVB Delta Rate 0 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 0.09 0.1 0.11 0.12 0.13 0.14 0.15 0.16 0.17 0.18 0.19 0.2 4 5 6 7 8 1 Excel Problem 2 Show All Excel Work (29 points) Browne Inc. is considering a capital project with average risk and needs to calculate the weighted 3 average cost of capital. The marginal tax rate is 35%. 24 Debt: 5 Bond 1: Browne has 150,000, 4.30 percent coupon bonds outstanding, with 30 years to maturity. The current price is $965 per bond. The bonds are semi-annual. 7 Bond 2: Browne has 100,000, 5.55 percent coupon bonds outstanding, with 20 years to maturity. The current price is $1,120 per bond. The bonds are semi-annual. . 0 Preferred Equity: There are 1,500,000 Preferred shares outstanding. These are 4.0 percent preferred 1 stocks and the current price per share is $65. 2 3 Common Equity: Browne has 9,750,000 shares of common stock selling for $25 per share. The firm's 4 beta is 0.95. Browne just paid a $0.96 dividend per share. The dividend is expected to grow at 5 5 percent forever. 6 Market: The expected return on the market is 11% and the risk free rate is 3 percent. 7 8 The marginal tax rate is 35%. % 9 Determine the weighted average cost of capital. 0 1 2 3 2 2 150,000 $ $1,000 $965.00 4.30% 30 years Bond 2 Semi-Annual (m) Number of Bonds Par Value Bond Value Coupon Rate Maturity 2 100,000 $1,000 $1,120.00 5.55% 20 years 4 5 6 Step 1 7 Component Costs 7 8 Bond 1 9 Semi-Annual(m) 0 Number of Bonds 0 1 Par Value 2 Bond Value 3 Coupon Rate 4 Maturity 5 6 7 7 8 9 0 1 1 2 Preferred Stock 4 Num of Shares 5 Face Value 6 Price 7 Div. 8 9 0 0 1 2 Common Stock 3 Number of Shares 4 Price 5 Beta 6 Dividend (DO) 7 Growth Rate 8 9 9 0 1 Market Information 2 Expected Market Ret. . 3 Risk-Free Rate 4 Tax Rate 1,500,000 $100.00 $65.00 4.0% 9,750,000 $25 0.95 $0.96 5.00% 11.00% 3.00% 35.00%