Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lecture 2 - Power Point IMATIONS SLIDE SHOW REVIEW VIEW FOXIT PDF 22 tArt Chart Apps for Hyperlink Action Comment Office ations Apps Links Comments

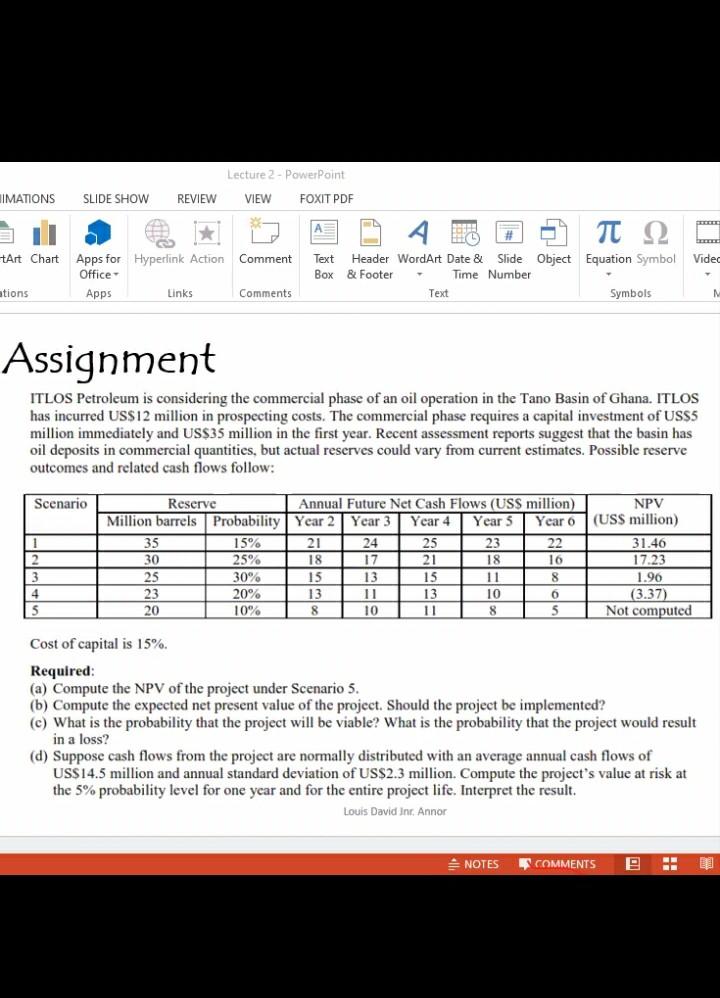

Lecture 2 - Power Point IMATIONS SLIDE SHOW REVIEW VIEW FOXIT PDF 22 tArt Chart Apps for Hyperlink Action Comment Office ations Apps Links Comments TT Text Header WordArt Date & Slide Object Equation Symbol Video Box & Footer Time Number Text Symbols M Assignment ITLOS Petroleum is considering the commercial phase of an oil operation in the Tano Basin of Ghana. ITLOS has incurred US$12 million in prospecting costs. The commercial phase requires a capital investment of US$5 million immediately and US$35 million in the first year. Recent assessment reports suggest that the basin has oil deposits in commercial quantities, but actual reserves could vary from current estimates. Possible reserve outcomes and related cash flows follow: Scenario Reserve Annual Future Net Cash Flows (USS million) NPV Million barrels Probability Year 2 Year 3 Year 4 Years Year (USS million) 1 35 15% 21 24 25 23 22 31.46 2 30 25% 18 17 21 18 16 17.23 3 25 30% 15 13 15 11 8 1.96 4 23 20% 13 11 13 10 0 (3.37) 5 20 10% 8 10 11 8 5 Not computed Cost of capital is 15%. Required: (a) Compute the NPV of the project under Scenario 5. (b) Compute the expected net present value of the project. Should the project be implemented? (c) What is the probability that the project will be viable? What is the probability that the project would result (d) Suppose cash flows from the project are normally distributed with an average annual cash flows of USS 14.5 million and annual standard deviation of US$2.3 million. Compute the project's value at risk at the 5% probability level for one year and for the entire project life. Interpret the result. Louis David Int. Annor in a loss? NOTES COMMENTS D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started