Question

Consider a European-style lookback put option. Assume the current share price is $20, the standard deviation of the return on the share (o) is

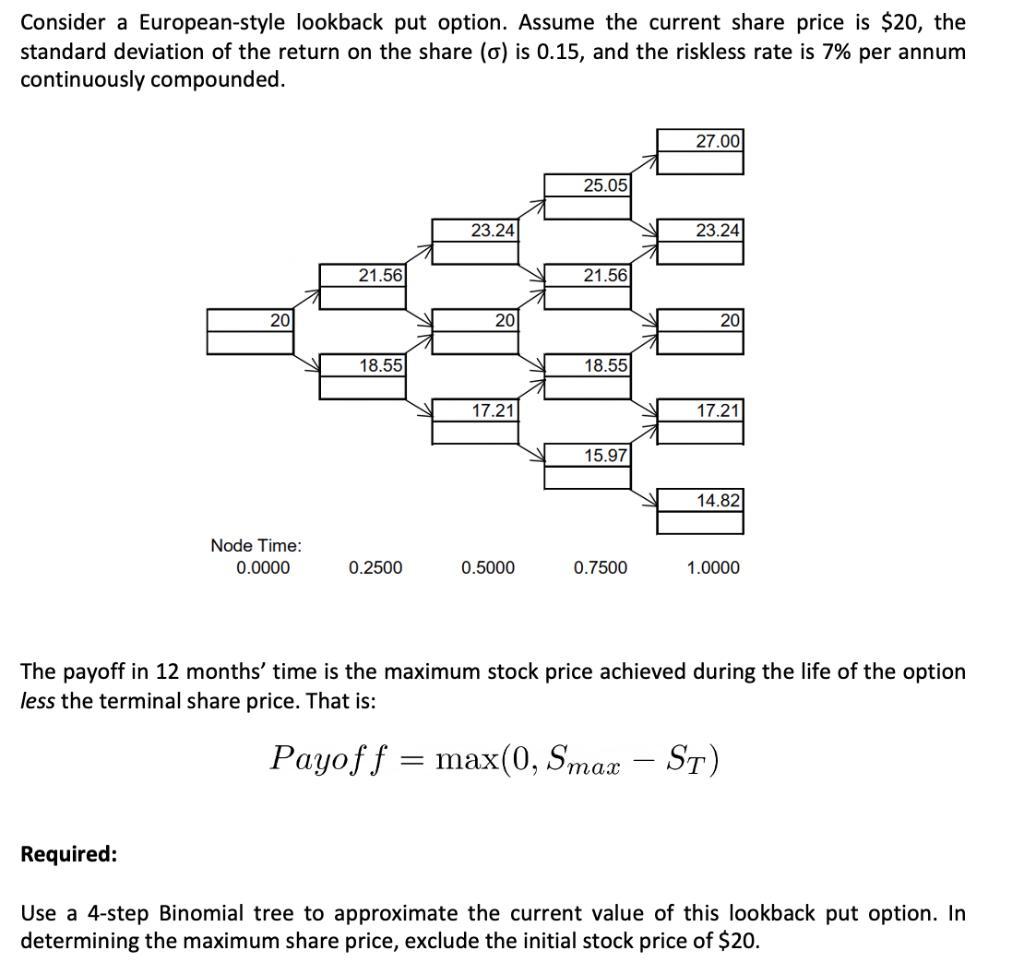

Consider a European-style lookback put option. Assume the current share price is $20, the standard deviation of the return on the share (o) is 0.15, and the riskless rate is 7% per annum continuously compounded. 20 Node Time: 0.0000 21.56 18.55 0.2500 23.24 20 17.21 0.5000 25.05 21.56 18.55 15.97 0.7500 27.00 23.24 20 17.21 14.82 1.0000 The payoff in 12 months' time is the maximum stock price achieved during the life of the option less the terminal share price. That is: Payoff = max(0, Smax - ST) Required: Use a 4-step Binomial tree to approximate the current value of this lookback put option. In determining the maximum share price, exclude the initial stock price of $20.

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Question S16513 K170 t102365 r00348 sigma00571 d1I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Smith and Roberson Business Law

Authors: Richard A. Mann, Barry S. Roberts

15th Edition

1285141903, 1285141903, 9781285141909, 978-0538473637

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App