* How to get accumulated depreciation of 49 if plant has not been impaired

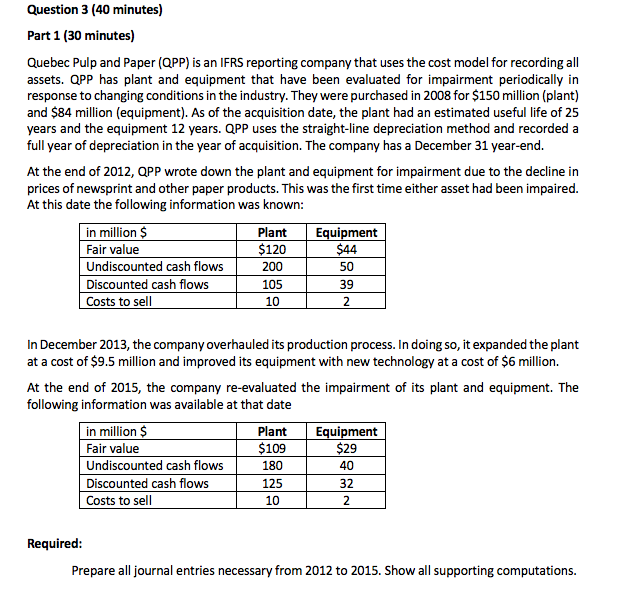

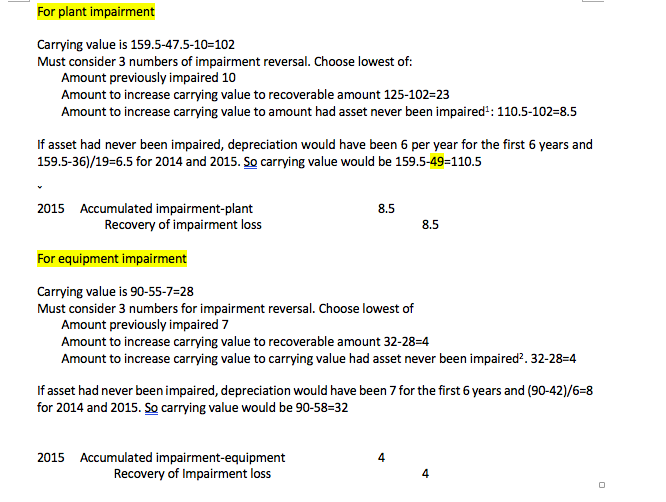

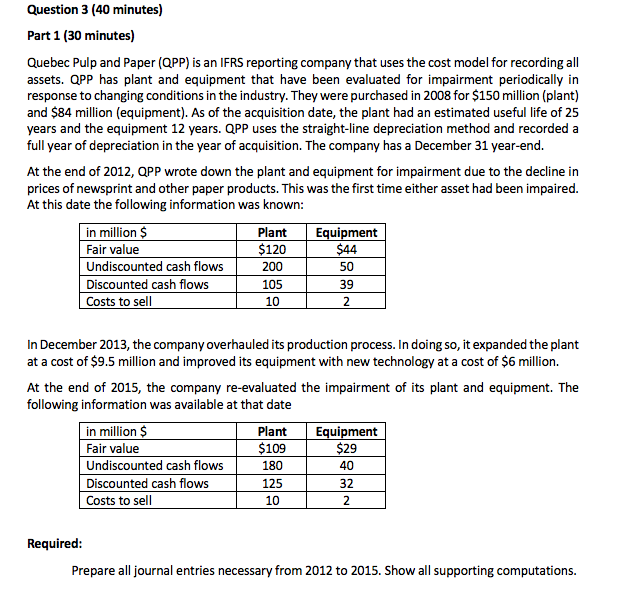

Question 3 (40 minutes) Part 1 (30 minutes) Quebec Pulp and Paper (QPP) is an IFRS reporting company that uses the cost model for recording all assets. QPP has plant and equipment that have been evaluated for impairment periodically in response to changing conditions in the industry. They were purchased in 2008 for $150 million (plant) and $84 million (equipment). As of the acquisition date, the plant had an estimated useful life of 25 years and the equipment 12 years. QPP uses the straight-line depreciation method and recorded a full year of depreciation in the year of acquisition. The company has a December 31 year-end. At the end of 2012, QPP wrote down the plant and equipment for impairment due to the decline in prices of newsprint and other paper products. This was the first time either asset had been impaired. At this date the following information was known: in million $ Fair value Undiscounted cash flows Discounted cash flows Costs to sell Plant $120 200 105 10 Equipment $44 50 39 1 2 In December 2013, the company overhauled its production process. In doing so, it expanded the plant at a cost of $9.5 million and improved its equipment with new technology at a cost of $6 million. At the end of 2015, the company re-evaluated the impairment of its plant and equipment. The following information was available at that date in million $ Fair value Undiscounted cash flows Discounted cash flows Costs to sell Plant $109 180 125 10 Equipment $29 40 32 2 Required: Prepare all journal entries necessary from 2012 to 2015. Show all supporting computations. For plant impairment Carrying value is 159.5-47.5-10=102 Must consider 3 numbers of impairment reversal. Choose lowest of: Amount previously impaired 10 Amount to increase carrying value to recoverable amount 125-102=23 Amount to increase carrying value to amount had asset never been impaired : 110.5-102=8.5 If asset had never been impaired, depreciation would have been 6 per year for the first 6 years and 159.5-36/19=6.5 for 2014 and 2015. So carrying value would be 159.5-49=110.5 2015 Accumulated impairment-plant Recovery of impairment loss 8.5 8.5 8.5 For equipment impairment Carrying value is 90-55-7=28 Must consider 3 numbers for impairment reversal. Choose lowest of Amount previously impaired 7 Amount to increase carrying value to recoverable amount 32-28=4 Amount to increase carrying value to carrying value had asset never been impaired?. 32-28=4 If asset had never been impaired, depreciation would have been 7 for the first 6 years and (90-42)/6=8 for 2014 and 2015. So carrying value would be 90-58=32 2015 Accumulated impairment-equipment Recovery of Impairment loss