Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to get the answers? 6. You own a private firm in the industrial sector. Your publicly traded competitors have, on average, levered betas of

How to get the answers?

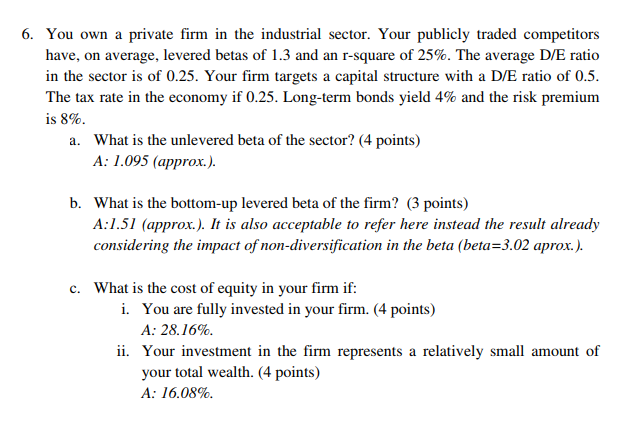

6. You own a private firm in the industrial sector. Your publicly traded competitors have, on average, levered betas of 1.3 and an r-square of 25%. The average D/E ratio in the sector is of 0.25. Your firm targets a capital structure with a D/E ratio of 0.5 The tax rate in the economy if 0.25. Long-term bonds yield 4% and the risk premium is 8%. What is the unlevered beta of the sector? (4 points) A: 1.095 (approx.). a. What is the bottom-up levered beta of the firm? (3 points) A:1.51 (approx.). It is also acceptable to refer here instead the result already considering the impact of non-diversification in the beta (beta=3.02 aprox b. c. What is the cost of equity in your firm if i. You are fully invested in your firm. (4 points) A: 28.16%. ii. Your investment in the fim represents a relatively small amount of your total wealth. (4 points) A: 16.08%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started