Answered step by step

Verified Expert Solution

Question

1 Approved Answer

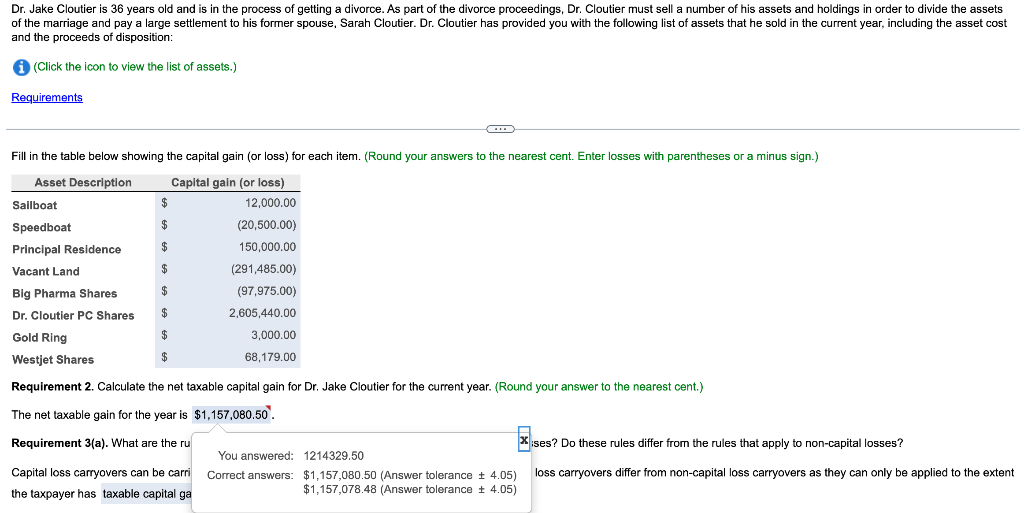

How to get the net taxable gain for the year? I need help with Requirement #2. Requirement #2: Calculate the net taxable capital gain for

How to get the net taxable gain for the year? I need help with Requirement #2.

Requirement #2: Calculate the net taxable capital gain for Dr. Jake for the current year.

The answer is $1,157,080.50, I just want to know how they got that answer.

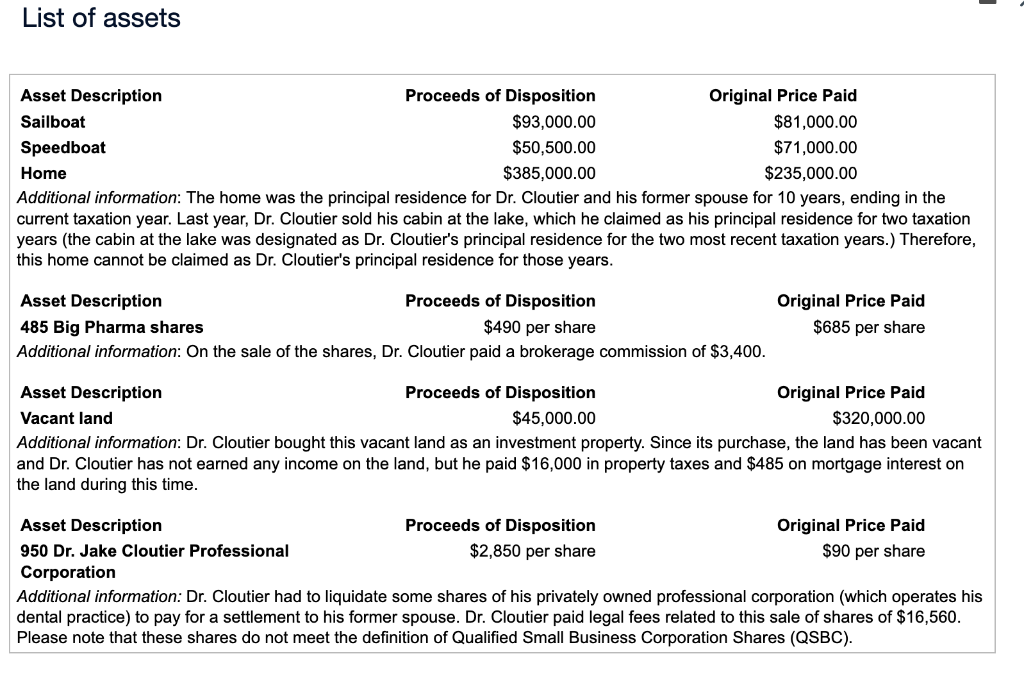

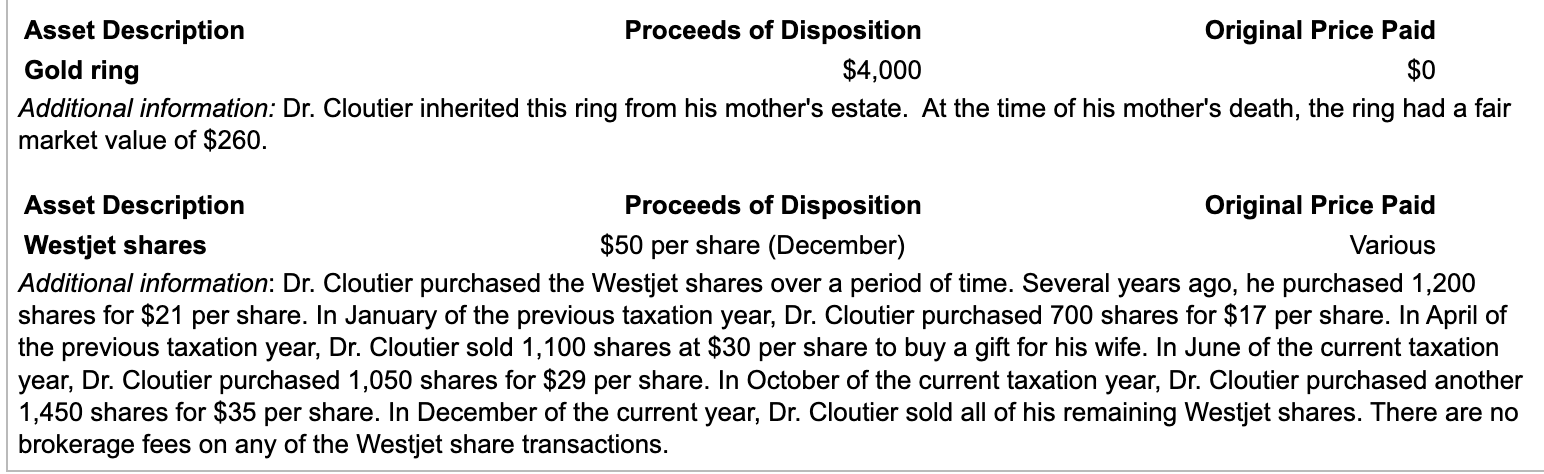

List of assets Additional information: The home was the principal residence for Dr. Cloutier and his former spouse for 10 years, ending in the current taxation year. Last year, Dr. Cloutier sold his cabin at the lake, which he claimed as his principal residence for two taxation years (the cabin at the lake was designated as Dr. Cloutier's principal residence for the two most recent taxation years.) Therefore, this home cannot be claimed as Dr. Cloutier's principal residence for those years. Additional information: Dr. Cloutier had to liquidate some shares of his privately owned professional corporation (which operates his dental practice) to pay for a settlement to his former spouse. Dr. Cloutier paid legal fees related to this sale of shares of $16,560. Please note that these shares do not meet the definition of Qualified Small Business Corporation Shares (QSBC). Asset Description Proceeds of Disposition Original Price Paid Gold ring $4,000 $0 Additional information: Dr. Cloutier inherited this ring from his mother's estate. At the time of his mother's death, the ring had a fair market value of $260. Asset Description Proceeds of Disposition Original Price Paid Westjet shares $50 per share (December) Various Additional information: Dr. Cloutier purchased the Westjet shares over a period of time. Several years ago, he purchased 1,200 shares for $21 per share. In January of the previous taxation year, Dr. Cloutier purchased 700 shares for $17 per share. In April of the previous taxation year, Dr. Cloutier sold 1,100 shares at $30 per share to buy a gift for his wife. In June of the current taxation year, Dr. Cloutier purchased 1,050 shares for $29 per share. In October of the current taxation year, Dr. Cloutier purchased another 1,450 shares for $35 per share. In December of the current year, Dr. Cloutier sold all of his remaining Westjet shares. There are no brokerage fees on any of the Westjet share transactions. Dr. Jake Cloutier is 36 years old and is in the process of getting a divorce. As part of the divorce proceedings, Dr. Cloutier must sell a number of his assets and holdings in order to divide the assets of the marriage and pay a large settlement to his former spouse, Sarah Cloutier. Dr. Cloutier has provided you with the following list of assets that he sold in the current year, including the asset cost and the proceeds of disposition: (Click the icon to view the list of assets.) Fill in the table below showing the capital gain (or loss) for each item. (Round your answers to the nearest cent. Enter losses with parentheses or a minus sign.) Requirement 2. Calculate the net taxable capital gain for Dr. Jake Cloutier for the current year. (Round your answer to the nearest cent.) The net taxable gain for the year is $1,157,080.50. Requirement 3(a). What are the ru ises? Do these rules differ from the rules that apply to non-capital losses? Capital loss carryovers can be carri loss carryovers differ from non-capital loss carryovers as they can only be applied to the extent the taxpayer hasStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started