Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how to plug NPR in to TI-83 calculator 17. Online Grocer.com hired you as a financial analyst. One of your first assignments is to evaluate

how to plug NPR in to TI-83 calculator

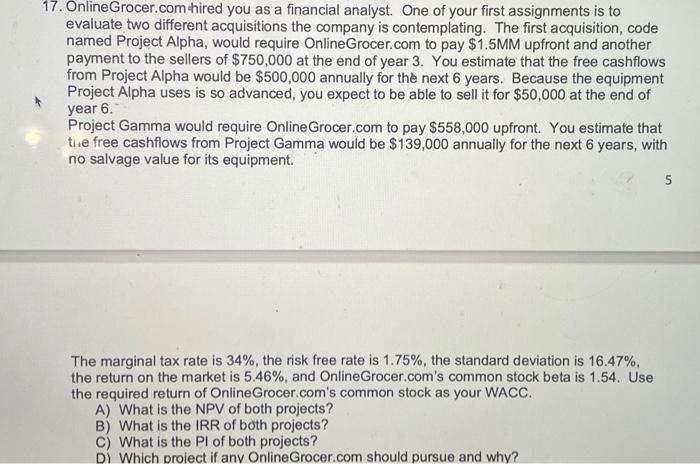

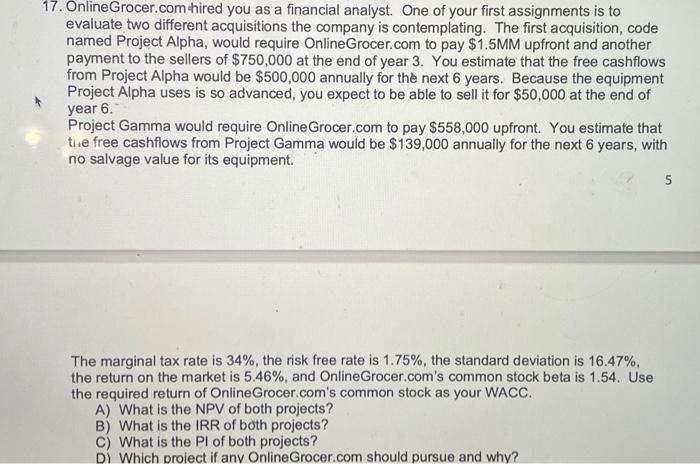

17. Online Grocer.com hired you as a financial analyst. One of your first assignments is to evaluate two different acquisitions the company is contemplating. The first acquisition, code named Project Alpha, would require Online Grocer.com to pay $1.5MM upfront and another payment to the sellers of $750,000 at the end of year 3. You estimate that the free cashflows from Project Alpha would be $500,000 annually for the next 6 years. Because the equipment Project Alpha uses is so advanced, you expect to be able to sell it for $50,000 at the end of year 6. Project Gamma would require Online Grocer.com to pay $558,000 upfront. You estimate that the free cashflows from Project Gamma would be $139,000 annually for the next 6 years, with no salvage value for its equipment. 5 The marginal tax rate is 34%, the risk free rate is 1.75%, the standard deviation is 16.47%, the return on the market is 5.46%, and Online Grocer.com's common stock beta is 1.54. Use the required return of Online Grocer.com's common stock as your WACC. A) What is the NPV of both projects? B) What is the IRR of both projects? C) What is the Pl of both projects? Di Which project if any Online Grocer.com should pursue and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started