Answered step by step

Verified Expert Solution

Question

1 Approved Answer

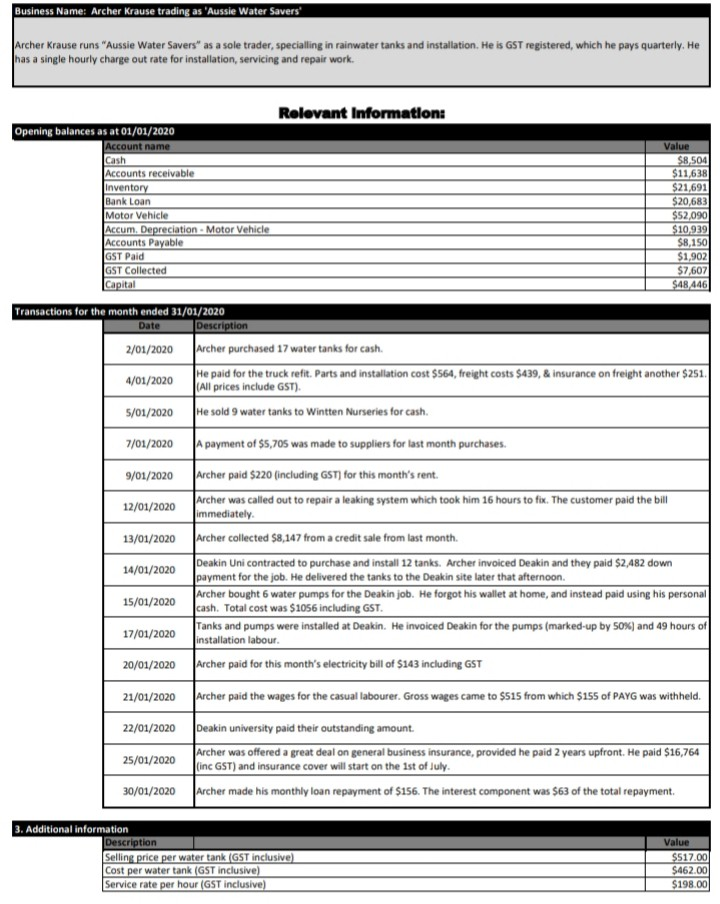

How to put the following information in to a: 1> General Journal 2> Ledger 3> Trial Balance this is an Accounting question Business Name: Archer

How to put the following information in to a: 1> General Journal 2> Ledger 3> Trial Balance this is an Accounting question

Business Name: Archer Krause trading as 'Aussie Water Savers Archer Krause runs "Aussie Water Savers" as a sole trader, specialling in rainwater tanks and installation. He is GST registered, which he pays quarterly. He has a single hourly charge out rate for installation, servicing and repair work. Rolovant Information: Opening balances as at 01/01/2020 Account name Cash Accounts receivable Inventory Bank Loan Motor Vehicle Accum. Depreciation - Motor Vehicle Accounts Payable GST Paid GST Collected Capital Value $8.504 $11.638 $21,691 $20,683 $52,0901 $10.939 $8,150 $1,902 $7,607 $48446 Transactions for the month ended 31/01/2020 Date Description 2/01/2020 Archer purchased 17 water tanks for cash. 4/01/2020 He paid for the truck refit. Parts and installation cost $564, freight costs $439, & insurance on freight another $251 (All prices include GST). 5/01/2020 He sold 9 water tanks to Wintten Nurseries for cash. 7/01/2020 A payment of $5,705 was made to suppliers for last month purchases. 9/01/2020 Archer paid $220 (including GST) for this month's rent. 12/01/2020 Archer was called out to repair a leaking system which took him 16 hours to fix. The customer paid the bill immediately 13/01/2020 Archer collected $8,147 from a credit sale from last month. 14/01/2020 15/01/2020 Deakin Uni contracted to purchase and install 12 tanks. Archer invoiced Deakin and they paid $2,482 down payment for the job. He delivered the tanks to the Deakin site later that afternoon. Archer bought 6 water pumps for the Deakin job. He forgot his wallet at home, and instead paid using his personal cash. Total cost was $1056 including GST. Tanks and pumps were installed at Deakin. He invoiced Deakin for the pumps (marked-up by 50%) and 49 hours of installation labour. 17/01/2020 20/01/2020 Archer paid for this month's electricity bill of $143 including GST 21/01/2020 Archer paid the wages for the casual labourer. Gross wages came to $515 from which $155 of PAYG was withheld. 22/01/2020 Deakin university paid their outstanding amount. 25/01/2020 Archer was offered a great deal on general business insurance, provided he paid 2 years upfront. He paid $16,764 (inc GST) and insurance cover will start on the 1st of July. 30/01/2020 Archer made his monthly loan repayment of $156. The interest component was $63 of the total repayment. 3. Additional information Description Selling price per water tank (GST inclusive) Cost per water tank (GST inclusive) Service rate per hour (GST inclusive) Value $517.00 $462.00 $198.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started