Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to put the following information in to a General Journal How to put the following information in to a General Journal Date Descripon 2/01/2020

How to put the following information in to a General Journal

How to put the following information in to a General Journal

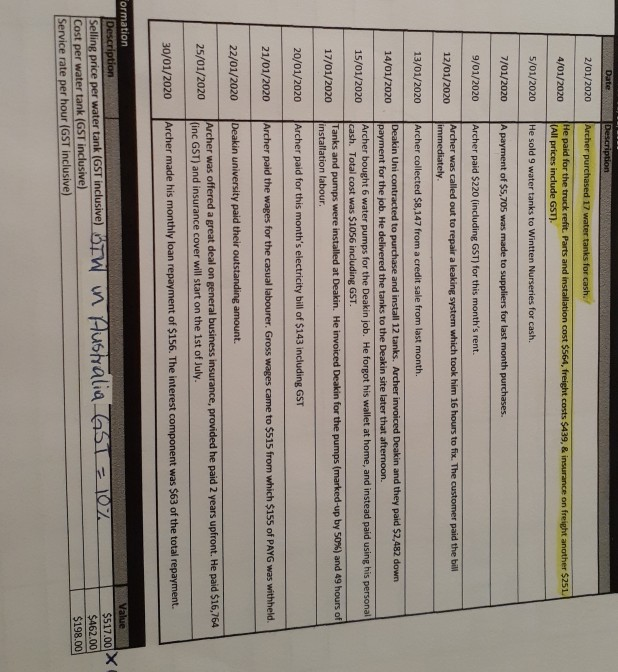

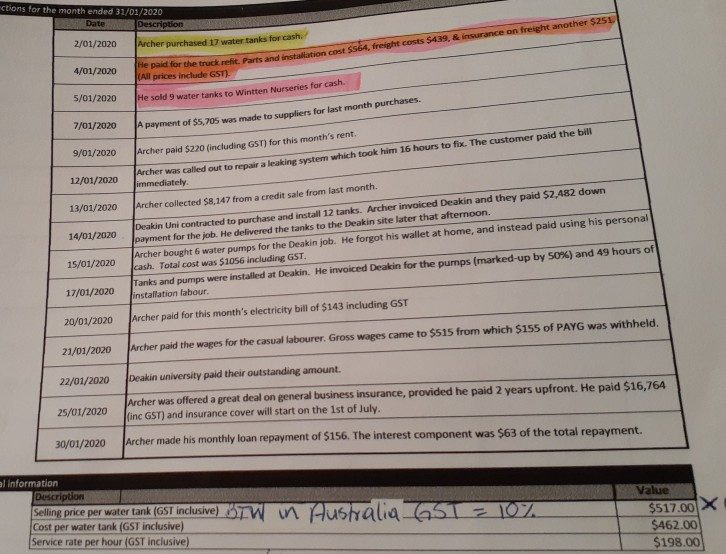

Date Descripon 2/01/2020 Archer purchased 17 water tanks for cash. He paid for the truck refit. Parts and installation cost $564, freight costs $439,& insurance on freight another 5251 (All prices include GST). 4/01/2020 5/01/2020 He sold 9 water tanks to Wintten Nurseries for cash. 7/01/2020 A payment of $5,705 was made to suppliers for last month purchases. 9/01/2020 Archer paid $220 (including GST) for this month's rent. Archer was called out to repair a leaking system which took him 16 hours to fix. The customer paid the bill immediately 12/01/2020 13/01/2020 Archer collected $8,147 from a credit sale from last month. 14/01/2020 15/01/2020 Deakin Uni contracted to purchase and install 12 tanks. Archer invoiced Deakin and they paid 52.482 down payment for the job. He delivered the tanks to the Deakin site later that afternoon Archer bought 6 water pumps for the Deakin job. He forgot his wallet at home, and instead paid using his personal cash. Total cost was $1056 including GST. Tanks and pumps were installed at Deakin. He invoiced Deakin for the pumps (marked up by 50%) and 49 hours of installation labour. 17/01/2020 20/01/2020 Archer paid for this month's electricity bill of $143 including GST 21/01/2020 Archer paid the wages for the casual labourer. Gross wages came to $515 from which $155 of PAYG was withheld. 22/01/2020 Deakin university paid their outstanding amount. Archer was offered a great deal on general business Insurance, provided he paid 2 years upfront. He paid $16,764 (inc GST) and insurance cover will start on the 1st of July. 25/01/2020 30/01/2020 Archer made his monthly loan repayment of $156. The interest component was $63 of the total repayment. Value $517.00 IW Australia GS1 = 10% ormation Description Selling price per water tank (GST inclusive) Cost per water tank (GST inclusive) Service rate per hour (GST inclusive) $462.00 $198.00 ctions for the month ended 31/01/2020 Date Description 2/01/2020 $564, freight costs $4.39, & insurance on freight another $25L 4/01/2020 Archer purchased 17 water tanks for cash. He paid for the truckreft. Parts and installation cos (All prices include GST). He sold 9 water tanks to Wintten Nurseries for cash. 5/01/2020 7/01/2020 A payment of $5,705 was made to suppliers for last month purchases. 9/01/2020 Archer paid $220 (including GST) for this month's rent. 12/01/2020 Archer was called out to repair a leaking system which took him 16 hours to fix. The customer paid the bill immediately 13/01/2020 14/01/2020 Archer collected $8,147 from a credit sale from last month. Deakin Uni contracted to purchase and install 12 tanks. Archer invoiced Deakin and they paid $2.482 down payment for the job. He delivered the tanks to the Deakin site later that afternoon. Archer bought 6 water pumps for the Deakin job. He forgot his wallet at home, and instead paid using his personal cash. Total cost was $1056 including GST Tanks and pumps were installed at Deakin. He invoiced Deakin for the pumps (marked-up by 50%) and 49 hours of installation labour. 15/01/2020 17/01/2020 JArcher paid for this month's electricity bill of $143 including GST 21/01/2020 Archer paid the wages for the casual labourer. Gross wages came to $515 from which $155 of PAYG was withheld. 22/01/2020 Deakin university paid their outstanding amount. 25/01/2020 Archer was offered a great deal on general business insurance, provided he paid 2 years upfront. He paid $16,764 finc GST) and insurance cover will start on the 1st of July. 30/01/2020 Archer made his monthly loan repayment of $156. The interest component was $63 of the total repayment. al information Description Selling price per water tank (GST inclusive) Cost per water tank (GST inclusive) Service rate per hour (GST inclusive) W m Aushalig GST - TOZ Value $517.00 $462.00 $198.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started