102) Xiaolin Company was established in X1, and its inventory valuation method adopts the first-in-first-out method, but sells sugar with bottled money 1. Method, at the beginning of X4, Xiaolin Company believes that peer-to-peer exploration and weighted average method evaluation are used to increase the comparability of financial and thermal energy tables. The inventory valuation method has also been changed to the average method without standard.

year

XI

X3

$65,000

70,000 85,000

$96.000

120.000 158.000

X4

150,000

Assuming that the number of outstanding ordinary shares of Kobayashi Corporation is 80,000 shares: the income tax rate is 20%.

trial

(a) Entries for changes in accounting policies. 16%) (b) If the after-tax business profit and repair profit reported by Xiaolin Company in X3 are both $100,000; and the operating profit after X4 is $200,000, based on the above information, compile the comparative comprehensive profit of Xiaolin Company in X3 and X4 (this future earnings per share). (6%)

MacBook Air

888

F4

FS

F6

F7

FB

$

4

%

5

6

&

7

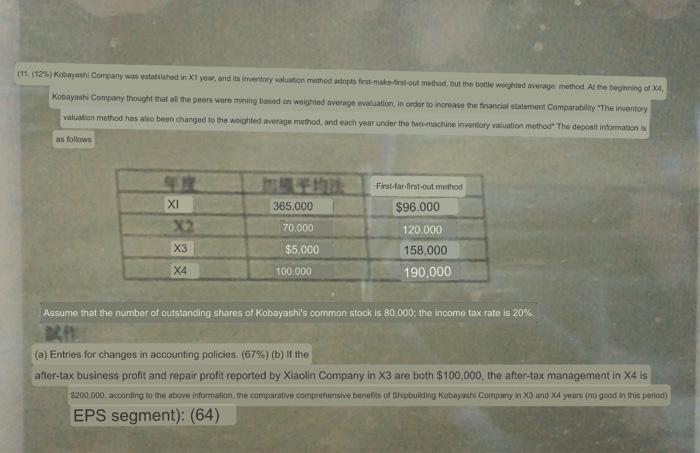

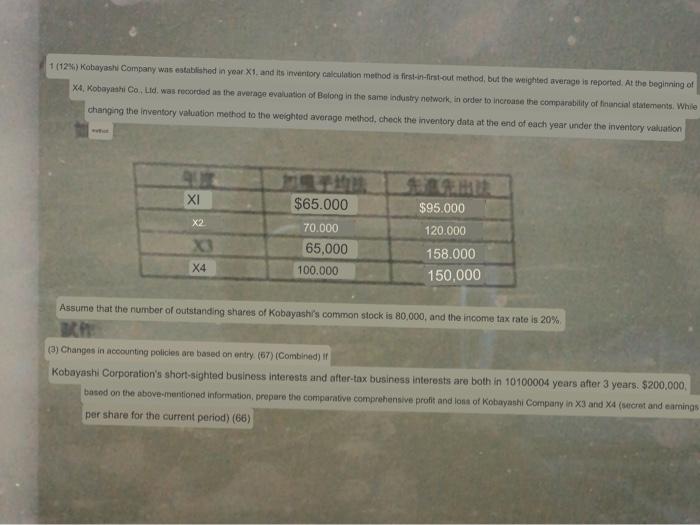

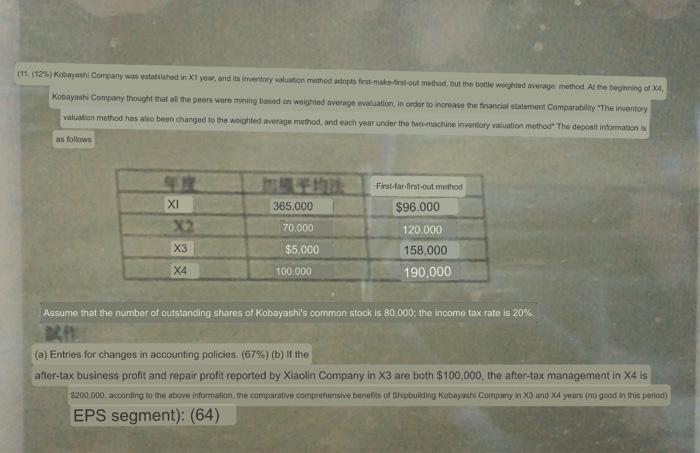

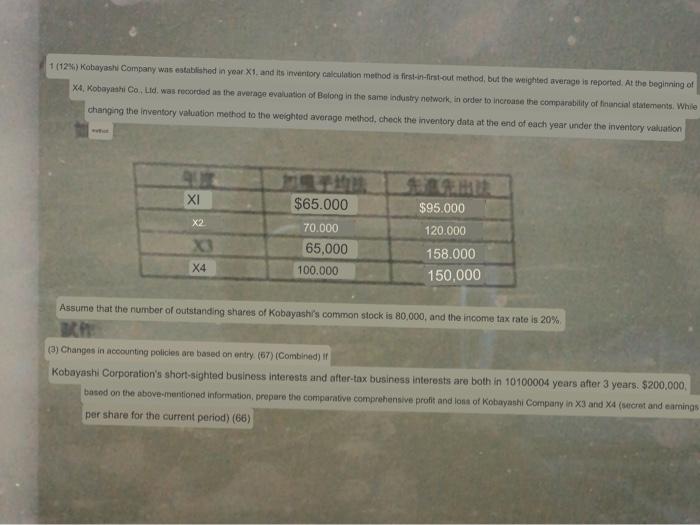

(11 (12%) Kobayashi Company was established in X1 year, and its inventory valuation method adopts first-make-first-out method, but the bottle weighted average method. At the beginning of X4, Kobayashi Company thought that all the peers were mining based on weighted average evaluation, in order to increase the financial statement Comparability "The inventory valuation method has also been changed to the weighted average method, and each year under the two-machine inventory valuation method" The deposit information is as follows XI X2 X3 X4 365.000 70.000 $5,000 100.000 First-far-first-out method $96.000 120.000 158,000 190,000 Assume that the number of outstanding shares of Kobayashi's common stock is 80,000; the income tax rate is 20%. (a) Entries for changes in accounting policies. (67%) (b) If the after-tax business profit and repair profit reported by Xiaolin Company in X3 are both $100,000, the after-tax management in X4 is $200,000, according to the above information, the comparative comprehensive benefits of Shipbuilding Kobayashi Company in X3 and X4 years (no good in this period) EPS segment): (64) 1 (12%) Kobayashi Company was established in year X1. and its inventory calculation method is first-in-first-out method, but the weighted average is reported. At the beginning of X4, Kobayashi Co., Ltd. was recorded as the average evaluation of Belong in the same industry network, in order to increase the comparability of financial statements. While changing the inventory valuation method to the weighted average method, check the inventory data at the end of each year under the inventory valuation etic XI X4 $65.000 70.000 65,000 100.000 $95.000 120.000 158.000 150,000 Assume that the number of outstanding shares of Kobayashi's common stock is 80,000, and the income tax rate is 20% (3) Changes in accounting policies are based on entry. (67) (Combined) If Kobayashi Corporation's short-sighted business interests and after-tax business interests are both in 10100004 years after 3 years. $200,000, based on the above-mentioned information, prepare the comparative comprehensive profit and loss of Kobayashi Company in X3 and X4 (secret and earnings per share for the current period) (66) (11 (12%) Kobayashi Company was established in X1 year, and its inventory valuation method adopts first-make-first-out method, but the bottle weighted average method. At the beginning of X4, Kobayashi Company thought that all the peers were mining based on weighted average evaluation, in order to increase the financial statement Comparability "The inventory valuation method has also been changed to the weighted average method, and each year under the two-machine inventory valuation method" The deposit information is as follows XI X2 X3 X4 365.000 70.000 $5,000 100.000 First-far-first-out method $96.000 120.000 158,000 190,000 Assume that the number of outstanding shares of Kobayashi's common stock is 80,000; the income tax rate is 20%. (a) Entries for changes in accounting policies. (67%) (b) If the after-tax business profit and repair profit reported by Xiaolin Company in X3 are both $100,000, the after-tax management in X4 is $200,000, according to the above information, the comparative comprehensive benefits of Shipbuilding Kobayashi Company in X3 and X4 years (no good in this period) EPS segment): (64) 1 (12%) Kobayashi Company was established in year X1. and its inventory calculation method is first-in-first-out method, but the weighted average is reported. At the beginning of X4, Kobayashi Co., Ltd. was recorded as the average evaluation of Belong in the same industry network, in order to increase the comparability of financial statements. While changing the inventory valuation method to the weighted average method, check the inventory data at the end of each year under the inventory valuation etic XI X4 $65.000 70.000 65,000 100.000 $95.000 120.000 158.000 150,000 Assume that the number of outstanding shares of Kobayashi's common stock is 80,000, and the income tax rate is 20% (3) Changes in accounting policies are based on entry. (67) (Combined) If Kobayashi Corporation's short-sighted business interests and after-tax business interests are both in 10100004 years after 3 years. $200,000, based on the above-mentioned information, prepare the comparative comprehensive profit and loss of Kobayashi Company in X3 and X4 (secret and earnings per share for the current period) (66)