Kokomo Corporation is making a $96,400 investment in equipment with a 5-year life. The company uses the straight-line method of depreciation and has a tax rate of 20 percent. The companys required rate of return is 10 percent.

What is the present value of the tax savings related to depreciation of the equipment? (Round present value factor calculations to 4 decimal places, e.g. 1.2151 and final answer to 0 decimal place, e.g. 125. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

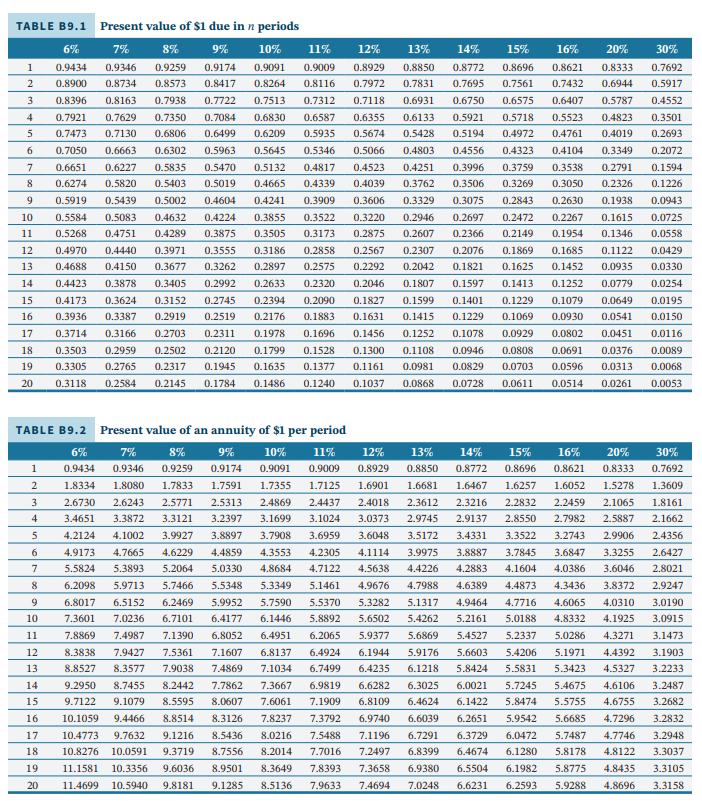

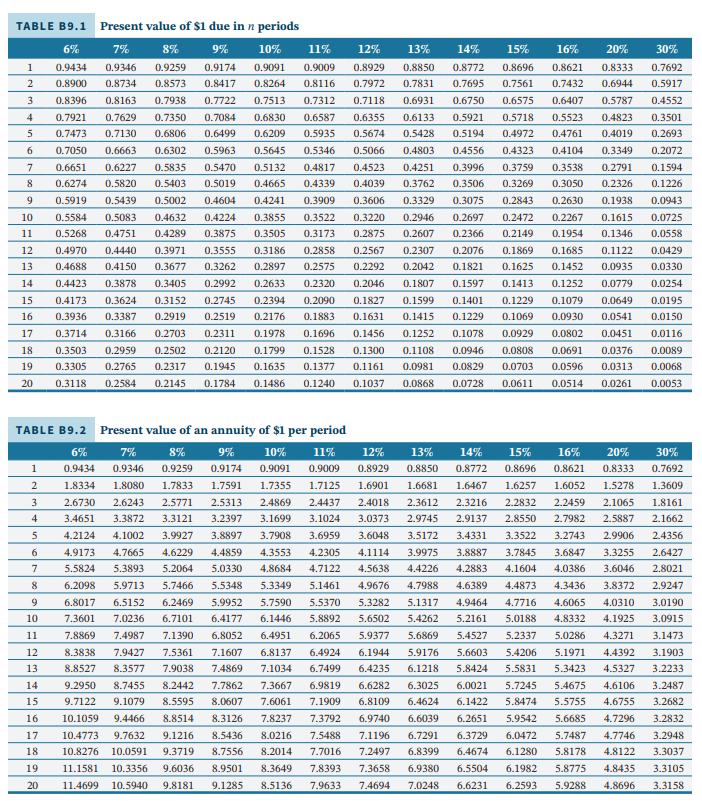

12% 13% 15% 20% 30% 14% 0.8772 0.7695 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.4251 0.3762 16% 0.8621 0.7432 0.6407 0.5523 0.4761 0.4104 0.3538 un + 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 0.2149 0.7692 0.5917 0.4552 0.3501 0.2693 0.2072 TABLE B9.1 Present value of $1 due in n periods 6% 7% 8% 9% 10% 11% 1 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 2 0.8900 0.8734 0.8573 0.8417 0.8264 0.8116 3 0.8396 0.8163 0.7938 0.7722 0.7513 0.7312 4 0.7921 0.7629 0.7350 0.7084 0.6830 0.6587 5 0.7473 0.7130 0.6806 0.6499 0.6209 0.5935 6 0.7050 0.6663 0.6302 0.5963 0.5645 0.5346 7 0.6651 0.6227 0.5835 0.5470 0.5132 0.4817 8 0.6274 0.5820 0.5403 0.5019 0.4665 0.4339 9 0.5919 0.5439 0.5002 0.4604 0.4241 0.3909 10 0.5584 0.5083 0.4632 0.4224 0.3855 0.3522 11 0.5268 0.4751 0.4289 0.3875 0.3505 0.3173 12 0.4970 0.4440 0.3971 0.3555 0.3186 0.2858 13 0.4688 0.4150 0.3677 0.3262 0.2897 0.2575 14 0.4423 0.3878 0.3405 0.2992 0.2633 0.2320 15 0.4173 0.3624 0.3152 0.2745 0.2394 0.2090 16 0.3936 0.3387 0.2919 0.2519 0.2176 0.1883 17 0.3714 0.3166 0.2703 0.2311 0.1978 0.1696 18 0.3503 0.2959 0.2502 0.2120 0.1799 0.1528 19 0.3305 0.2765 0.2317 0.1945 0.1635 0.1377 20 0.3118 0.2584 0.2145 0.1784 0.1486 0.1240 0.8333 0.6944 0.5787 0.4823 0.4019 0.3349 0.2791 0.2326 0.1938 0.1615 0.1346 0.3050 IS 0.6750 0.5921 0.5194 0.4556 0.3996 0.3506 0.3075 0.2697 0.2366 0.2076 0.1821 0.1597 0.1401 0.1229 0.1078 0.0946 0.0829 0.4523 0.4039 0.3606 0.3220 0.2875 0.2567 0.2292 0.2046 0.3329 0.2946 0.2607 0.2630 0.2267 0.1954 0.1685 0.1452 0.1252 0.1079 0.0930 0.0802 0.0691 0.0596 0.0514 0.2307 0.2042 0.1807 0.1599 0.1415 0.1252 0.1108 0.0981 0.0868 bola 0.1869 0.1625 0.1413 0.1229 0.1069 0.0929 0.0808 0.0703 0.0611 0.1827 0.1631 0.1456 0.1300 0.1161 0.1037 0.1594 0.1226 0.0943 0.0725 0.0558 0.0429 0.0330 0.0254 0.0195 0.0150 0.0116 0.1122 0.0935 0.0779 0.0649 0.0541 0.0451 0.0376 0.0313 0.0261 0.0089 0.0068 0.0053 0.0728 7% 9% 20% 0.8333 1.5278 TABLE B9.2 Present value of an annuity of $1 per period 6% 8% 10% 11% 1 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 2 1.8334 1.8080 1.7833 1.7591 1.7355 1.7125 3 2.6730 2.6243 2.5771 2.5313 2.4869 2.4437 4 3.4651 3.3872 3.3121 3.2397 3.1699 3.1024 5 4.2124 4.1002 3.9927 3.8897 3.7908 3.6959 6 4.9173 4.7665 4.6229 4.4859 4.3553 4.2305 7 5.5824 5.3893 5.2064 5.0330 4.8684 4.7122 8 6.2098 5.9713 5.7466 5.5348 5.3349 5.1461 9 6.8017 6.5152 6.2469 5.9952 5.7590 5.5370 10 7.3601 7.0236 6.7101 6.4177 6.1446 5.8892 11 7.8869 7.4987 7.1390 6.8052 6.4951 6.2065 12 8.3838 7.9427 7.5361 7.1607 6.8137 6.4924 13 8.8527 8.3577 7.9038 7.4869 7.1034 6.7499 14 9.2950 8.7455 8.2442 7.7862 7.3667 6.9819 15 9.7122 9.1079 8.5595 8.0607 7.6061 7.1909 16 10.1059 9.4466 8.8514 8.3126 7.8237 7.3792 17 10.4773 9.7632 9.1216 8.5436 8.0216 7.5488 18 10.8276 10.0591 9.3719 8.7556 8.2014 7.7016 19 11.1581 10.3356 9.6036 8.9501 8.3649 7.8393 20 11.4699 10.5940 9.8181 9.1285 8.5136 7.9633 12% 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 5.9377 6.1944 6.4235 6.6282 6.8109 30% 0.7692 1.3609 1.8161 2.1662 2.4356 2.6427 2.8021 2.9247 13% 0.8850 1.6681 2.3612 2.9745 3.5172 3.9975 4.4226 4.7988 5.1317 5.4262 5.6869 5.9176 6.1218 6.3025 6.4624 6.6039 6.7291 6.8399 14% 0.8772 1.6467 2.3216 2.9137 3.4331 3.8887 4.2883 4.6389 4.9464 5.2161 5.4527 5.6603 5.8424 6.0021 6.1422 6.2651 6.3729 6.4674 6.5504 6.6231 15% 0.8696 1.6257 2.2832 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 5.0188 5.2337 5.4206 5.5831 5.7245 5.8474 5.9542 6.0472 6.1280 6.1982 6.2593 16% 0.8621 1.6052 2.2459 2.7982 3.2743 3.6847 4.0386 4.3436 4.6065 4.8332 3.0190 3.0915 5.0286 5.1971 5.3423 5.4675 5.5755 5.6685 5.7487 5.8178 5.8775 5.9288 2.1065 2.5887 2.9906 3.3255 3.6046 3.8372 4.0310 4.1925 4.3271 4.4392 4.5327 4.6106 4.6755 4.7296 4.7746 4.8122 4.8435 4.8696 3.1473 3.1903 3.2233 3.2487 3.2682 3.2832 3.2948 3.3037 3.3105 3.3158 6.9740 7.1196 7.2497 7.3658 7.4694 6.9380 7.0248