Question

Carter Recycling Ltd started operating on 1 April 2020. Profit and loss information follows: Carter Recycling Ltds plant, at a cost of $600,000, is depreciated

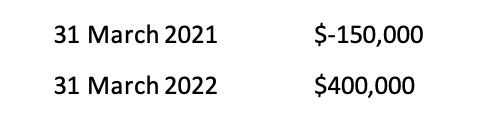

Carter Recycling Ltd started operating on 1 April 2020. Profit and loss information follows:

Carter Recycling Ltds plant, at a cost of $600,000, is depreciated using the straight-line method over a period of six years to a nil residual value. For tax purposes the plant is depreciated at a rate of 20% using the straight-line method. The tax rate is 28%.

Tasks

i. Prepare a journal entry to account for income tax for the financial reporting period ending 31 March 2022, assuming that Carter Recycling Ltd recognised the whole of the tax loss at 31 March 2021 as a deferred tax asset.

ii. Prepare a journal entry to account for income tax for the financial reporting period ending 31 March 2022, assuming that Carter Recycling Ltd recognised the tax loss only to the extent of the taxable temporary differences at 31 March 2021.

31 March 2021 $150,000 31 March 2022 $400,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started