Answered step by step

Verified Expert Solution

Question

1 Approved Answer

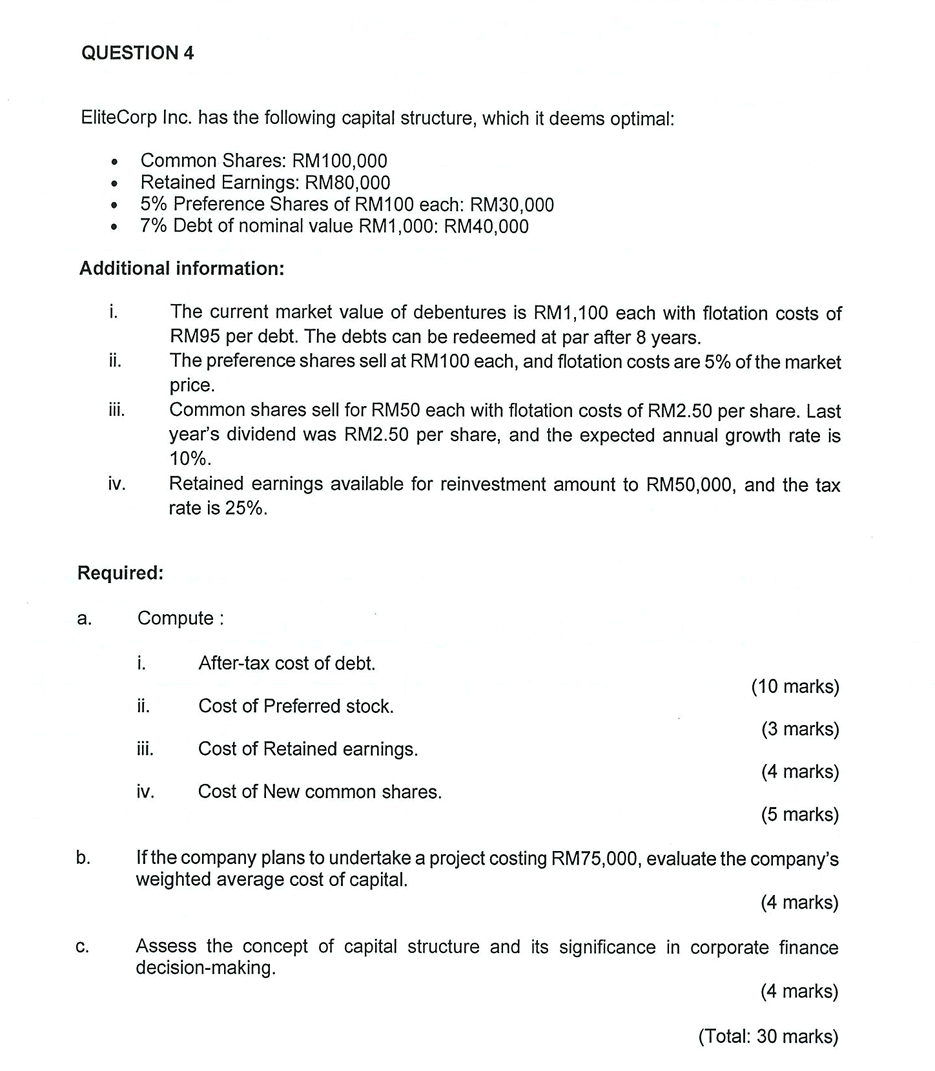

How to solve according to the malaysian finance atandaestandards QUESTION 4 EliteCorp Inc. has the following capital structure, which it deems optimal: Common Shares: RM

How to solve according to the malaysian finance atandaestandards

QUESTION

EliteCorp Inc. has the following capital structure, which it deems optimal:

Common Shares: RM

Retained Earnings: RM

Preference Shares of RM each: RM

Debt of nominal value RM: RM

Additional information:

i The current market value of debentures is RM each with flotation costs of

RM per debt. The debts can be redeemed at par after years.

ii The preference shares sell at RM each, and flotation costs are of the market

price.

iii. Common shares sell for RM each with flotation costs of RM per share. Last

year's dividend was RM per share, and the expected annual growth rate is

iv Retained earnings available for reinvestment amount to RM and the tax

rate is

Required:

a Compute :

i Aftertax cost of debt.

ii Cost of Preferred stock.

marks

iii. Cost of Retained earnings.

marks

marks

iv Cost of New common shares.

marks

b If the company plans to undertake a project costing RM evaluate the company's

weighted average cost of capital.

marks

c Assess the concept of capital structure and its significance in corporate finance

decisionmaking.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started