Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to solve Relaxation of credit standards. Lewis Enterprises currently makes sales only in cash, but it is considering offering credit to customers to increase

How to solve

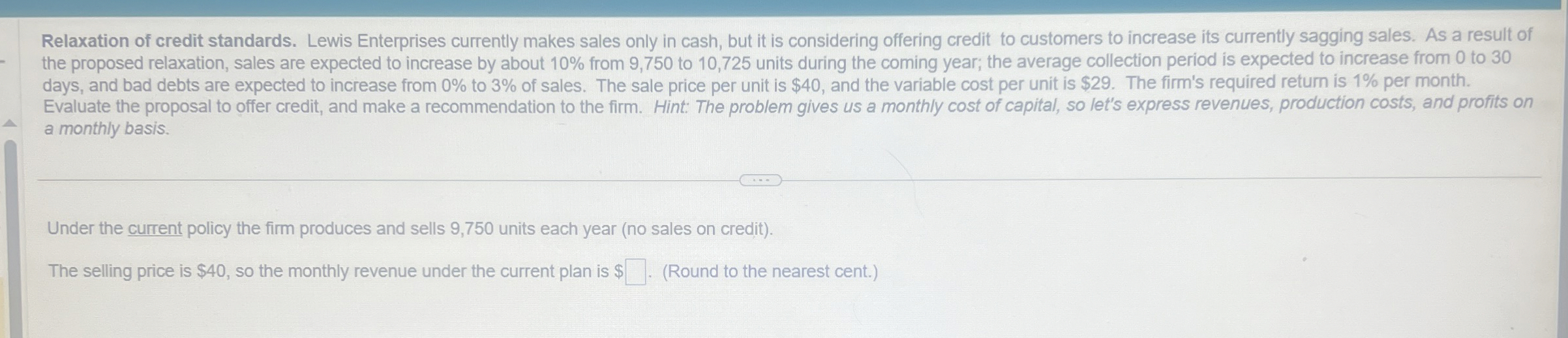

Relaxation of credit standards. Lewis Enterprises currently makes sales only in cash, but it is considering offering credit to customers to increase its currently sagging sales. As a result of the proposed relaxation, sales are expected to increase by about from to units during the coming year; the average collection period is expected to increase from to days, and bad debts are expected to increase from to of sales. The sale price per unit is $ and the variable cost per unit is $ The firm's required return is per month. Evaluate the proposal to offer credit, and make a recommendation to the firm. Hint: The problem gives us a monthly cost of capital, so let's express revenues, production costs, and profits on a monthly basis.

Under the current policy the firm produces and sells units each year no sales on credit

The selling price is $ so the monthly revenue under the current plan is $ Round to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started