Answered step by step

Verified Expert Solution

Question

1 Approved Answer

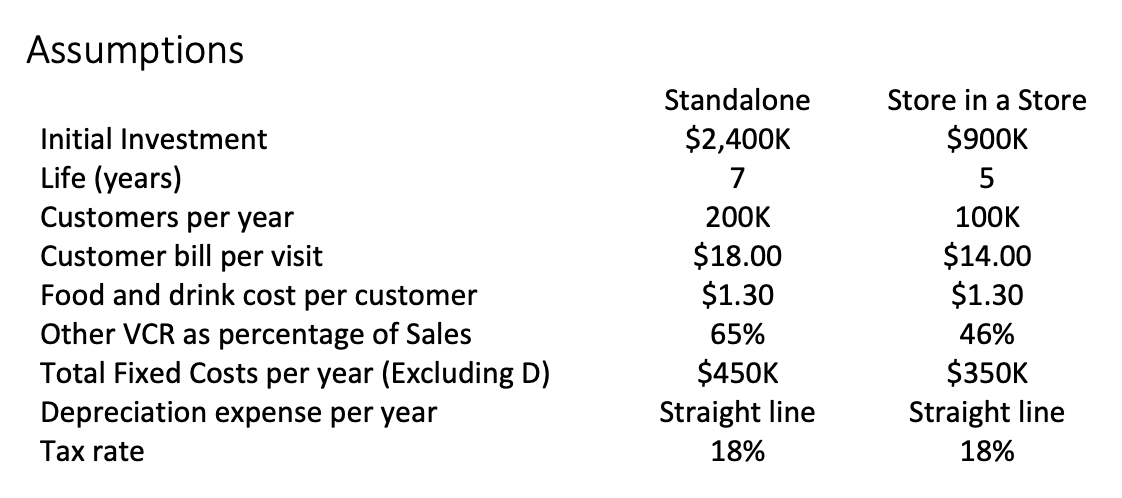

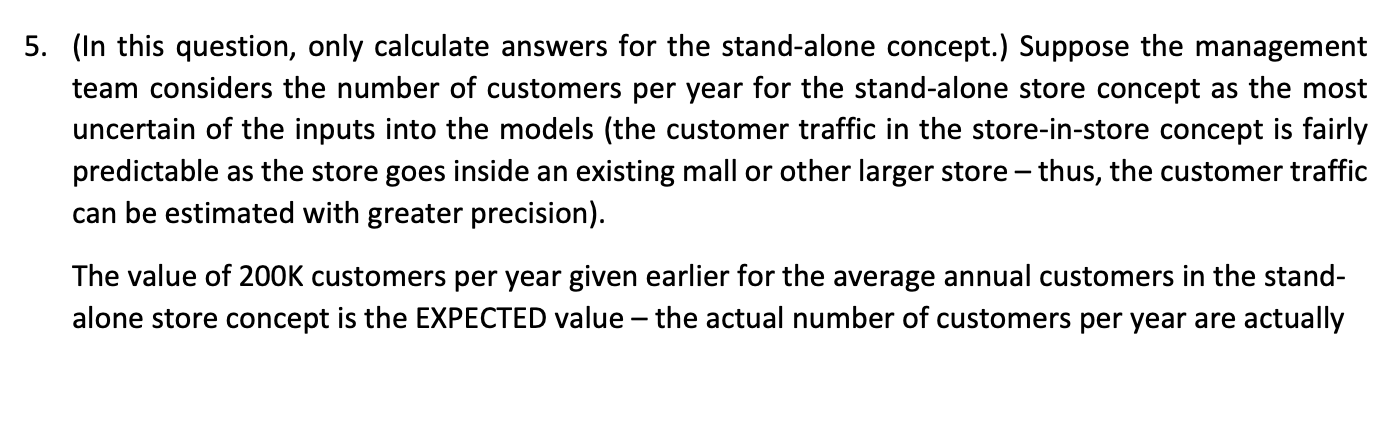

How to solve this using excel? Assumptions InitialInvestmentLife(years)CustomersperyearCustomerbillpervisitFoodanddrinkcostpercustomerOtherVCRaspercentageofSalesTotalFixedCostsperyear(ExcludingD)DepreciationexpenseperyearTaxrateStandalone$2,400K7200K$18.00$1.3065%$450KStraightline18%StoreinaStore$900K5100K$14.00$1.3046%$350KStraightline18% 5. (In this question, only calculate answers for the stand-alone concept.) Suppose the management team considers the

How to solve this using excel?

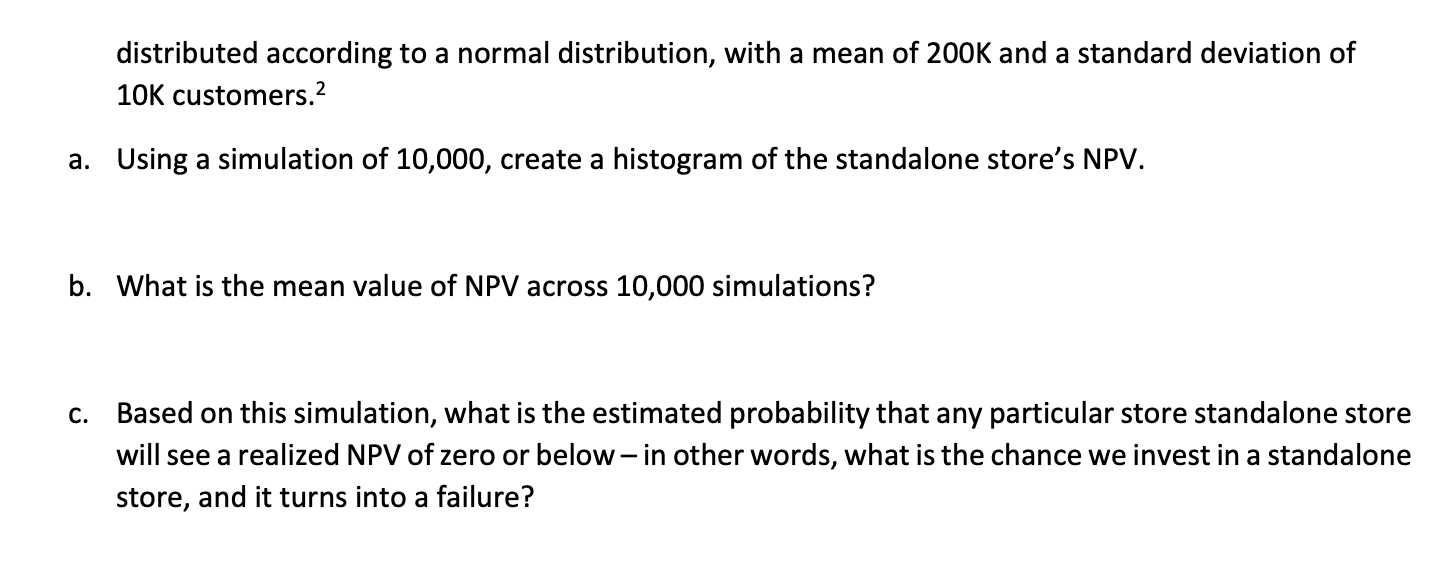

Assumptions InitialInvestmentLife(years)CustomersperyearCustomerbillpervisitFoodanddrinkcostpercustomerOtherVCRaspercentageofSalesTotalFixedCostsperyear(ExcludingD)DepreciationexpenseperyearTaxrateStandalone$2,400K7200K$18.00$1.3065%$450KStraightline18%StoreinaStore$900K5100K$14.00$1.3046%$350KStraightline18% 5. (In this question, only calculate answers for the stand-alone concept.) Suppose the management team considers the number of customers per year for the stand-alone store concept as the most uncertain of the inputs into the models (the customer traffic in the store-in-store concept is fairly predictable as the store goes inside an existing mall or other larger store - thus, the customer traffic can be estimated with greater precision). The value of 200K customers per year given earlier for the average annual customers in the standalone store concept is the EXPECTED value - the actual number of customers per year are actually distributed according to a normal distribution, with a mean of 200K and a standard deviation of 10K customers. 2 a. Using a simulation of 10,000, create a histogram of the standalone store's NPV. b. What is the mean value of NPV across 10,000 simulations? c. Based on this simulation, what is the estimated probability that any particular store standalone store will see a realized NPV of zero or below - in other words, what is the chance we invest in a standalone store, and it turns into a failureStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started