Answered step by step

Verified Expert Solution

Question

1 Approved Answer

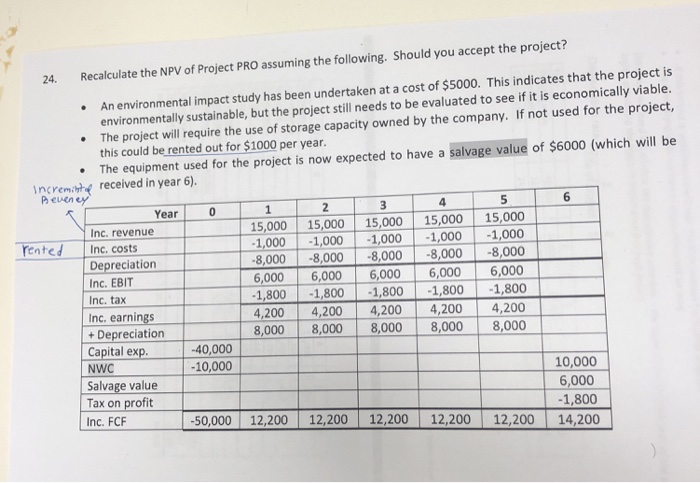

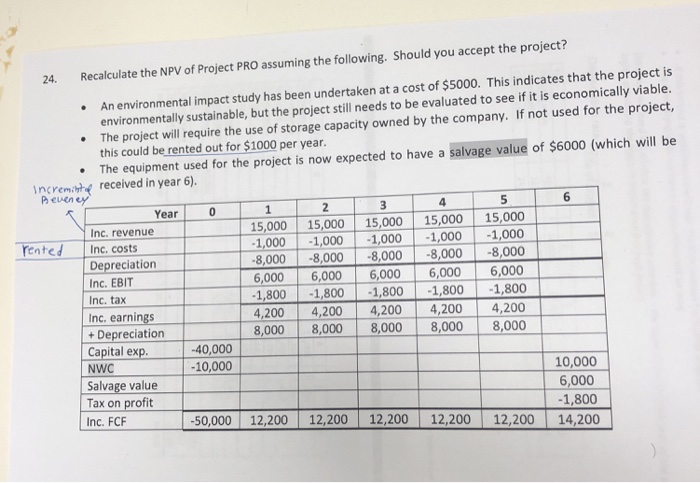

how we get the revenue the 15000? where is came from ?(Inc. revenue 15,000 in the first line)? also, How we find the Depreciation? Recalculate

how we get the revenue the 15000? where is came from ?(Inc. revenue 15,000 in the first line)?

also, How we find the Depreciation?

Recalculate the NPV of Project PRO assuming the following. Should you accept the project? 24 An environmental impact study has been undertaken at a cost of $5000. This indicates that the project is environmentally sustai nable, but the project still needs to be evaluated to see if it is economically viable. The project will require the use of storage capacity owned by the company. If not used for the project, this could be rented out for $1000 per year. The equipment used for the project is now expected to have a salvage value of $6000 (which will be Incremihe received in year 6) Peuen ey 6 4 3 1 2 0 Year 15,000 -1,000 -8,000 6,000 -1,800 4,200 8,000 15,000 -1,000 -8,000 6,000 -1,800 15,000 -1,000 15,000 -1,000 8,000 6,000 1,800 4,200 8,000 15,000 -1,000 8,000 Inc. revenue Tented Inc. costs Depreciation -8,000 6,000 1,800 6,000 -1,800 Inc. EBIT Inc. tax Inc. earnings +Depreciation Capital exp. 4,200 8,000 4,200 8,000 4,200 8,000 -40,000 -10,000 NWC 10,000 Salvage value Tax on profit 6,000 -1,800 Inc. FCF -50,000 12,200 12,200 12,200 12,200 12,200 14,200 Recalculate the NPV of Project PRO assuming the following. Should you accept the project? 24 An environmental impact study has been undertaken at a cost of $5000. This indicates that the project is environmentally sustai nable, but the project still needs to be evaluated to see if it is economically viable. The project will require the use of storage capacity owned by the company. If not used for the project, this could be rented out for $1000 per year. The equipment used for the project is now expected to have a salvage value of $6000 (which will be Incremihe received in year 6) Peuen ey 6 4 3 1 2 0 Year 15,000 -1,000 -8,000 6,000 -1,800 4,200 8,000 15,000 -1,000 -8,000 6,000 -1,800 15,000 -1,000 15,000 -1,000 8,000 6,000 1,800 4,200 8,000 15,000 -1,000 8,000 Inc. revenue Tented Inc. costs Depreciation -8,000 6,000 1,800 6,000 -1,800 Inc. EBIT Inc. tax Inc. earnings +Depreciation Capital exp. 4,200 8,000 4,200 8,000 4,200 8,000 -40,000 -10,000 NWC 10,000 Salvage value Tax on profit 6,000 -1,800 Inc. FCF -50,000 12,200 12,200 12,200 12,200 12,200 14,200 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started