Answered step by step

Verified Expert Solution

Question

1 Approved Answer

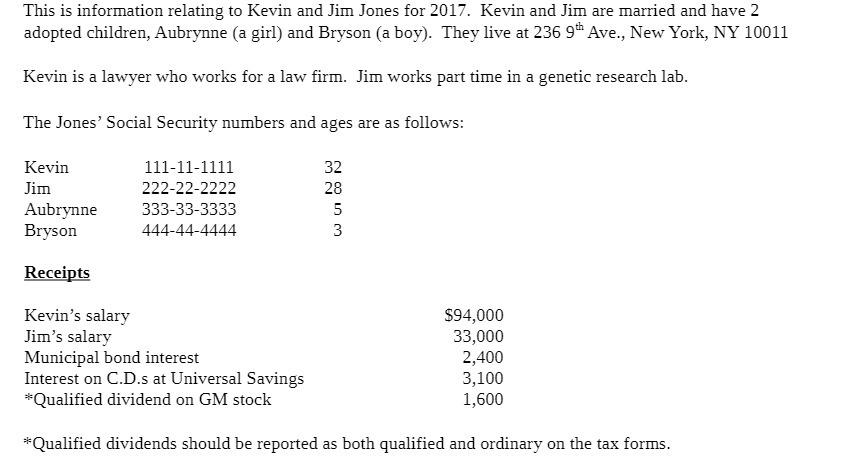

How would information appear on a 1040 married couple filing jointly? This is information relating to Kevin and Jim Jones for 2017. Kevin and Jim

How would information appear on a 1040 married couple filing jointly?

This is information relating to Kevin and Jim Jones for 2017. Kevin and Jim are married and have 2 adopted children, Aubrynne (a girl) and Bryson (a boy). They live at 236 9th Ave., New York, NY 10011 Kevin is a lawyer who works for a law firm. Jim works part time in a genetic research lab. The Jones' Social Security numbers and ages are as follows: Kevin Jim Aubrynne Bryson Receipts Kevin's salary Jim's salary 111-11-1111 222-22-2222 333-33-3333 444-44-4444 32 28 5 3 $94,000 33,000 2,400 3,100 1,600 Municipal bond interest Interest on C.D.s at Universal Savings *Qualified dividend on GM stock *Qualified dividends should be reported as both qualified and ordinary on the tax forms.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To accurately complete a 1040 form for Kevin and Jim Jones for 2017 ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started