Answered step by step

Verified Expert Solution

Question

1 Approved Answer

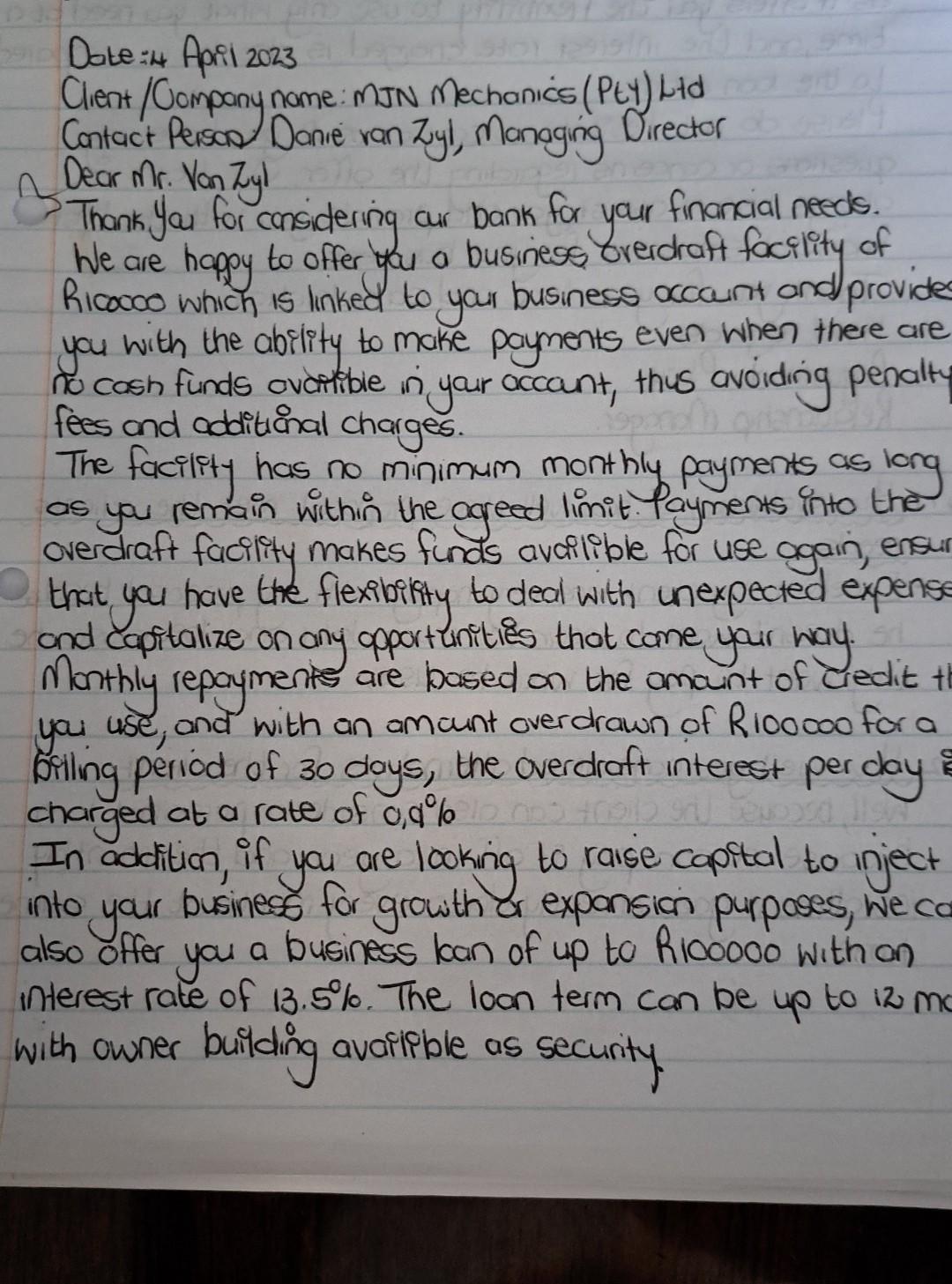

How you ensured that your client would take you seriously and the flow of your presentation; Date : 4 Apiil 2023 Client/Company name: MJN mechanics

How you ensured that your client would take you seriously and the flow of your presentation;

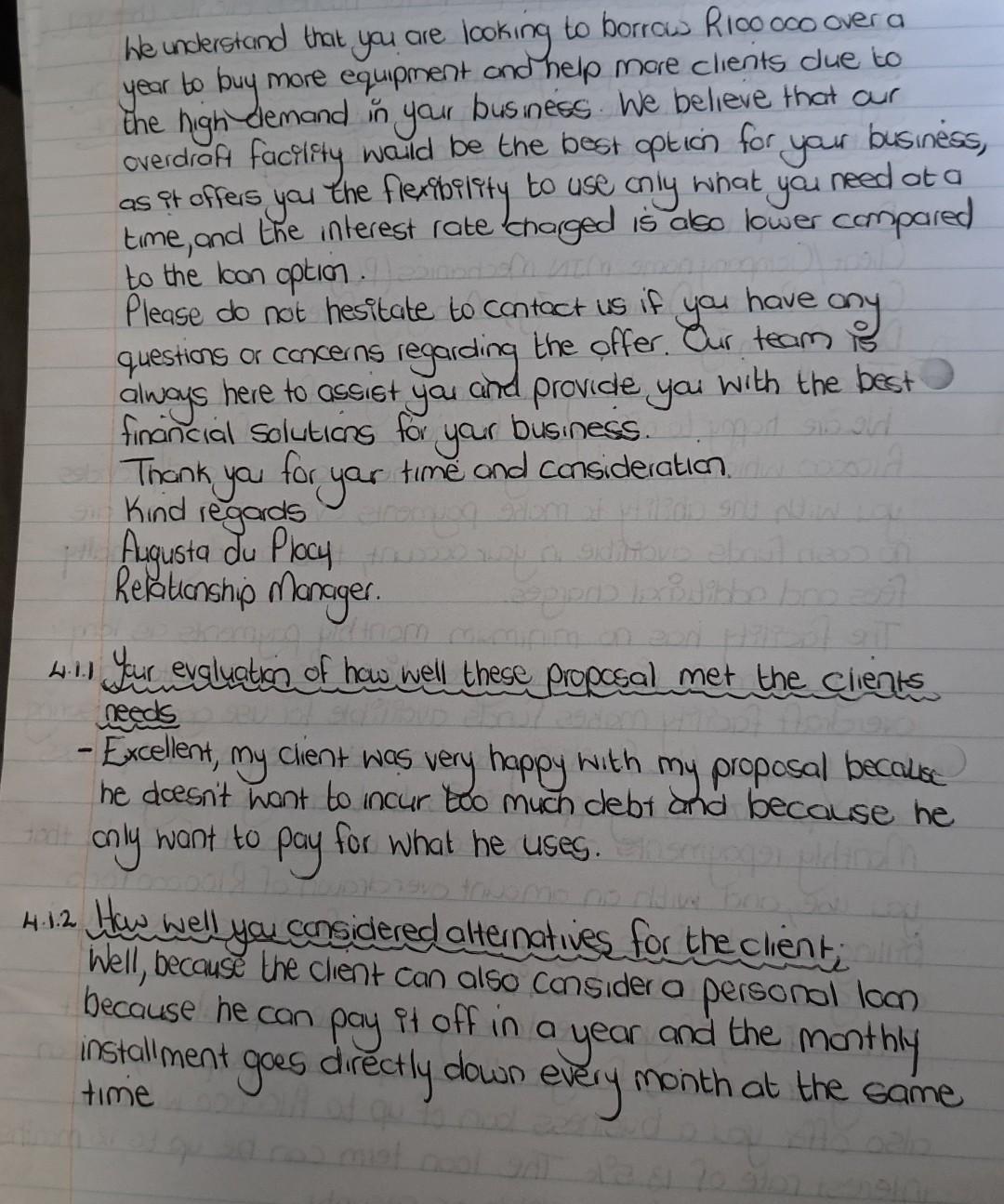

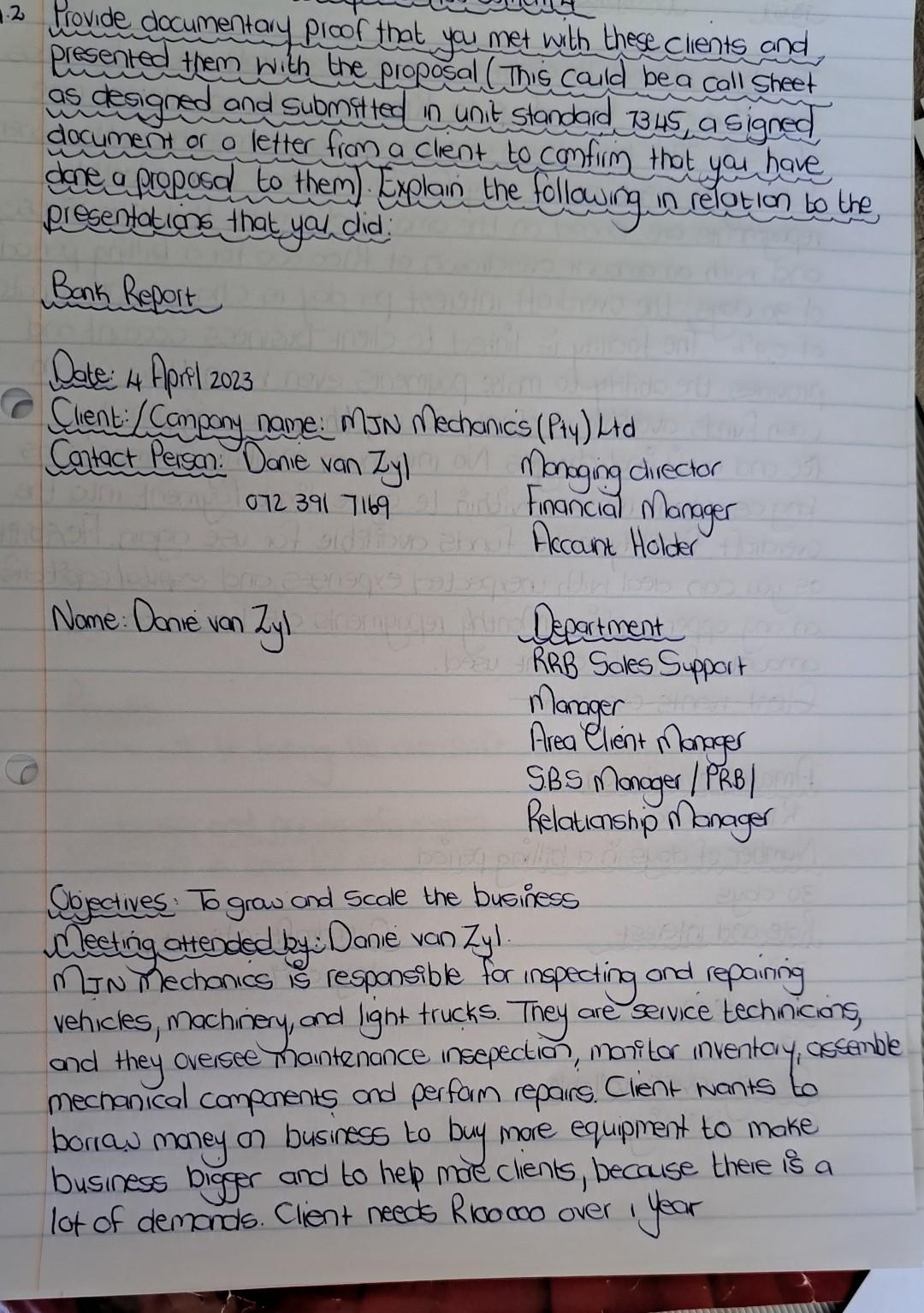

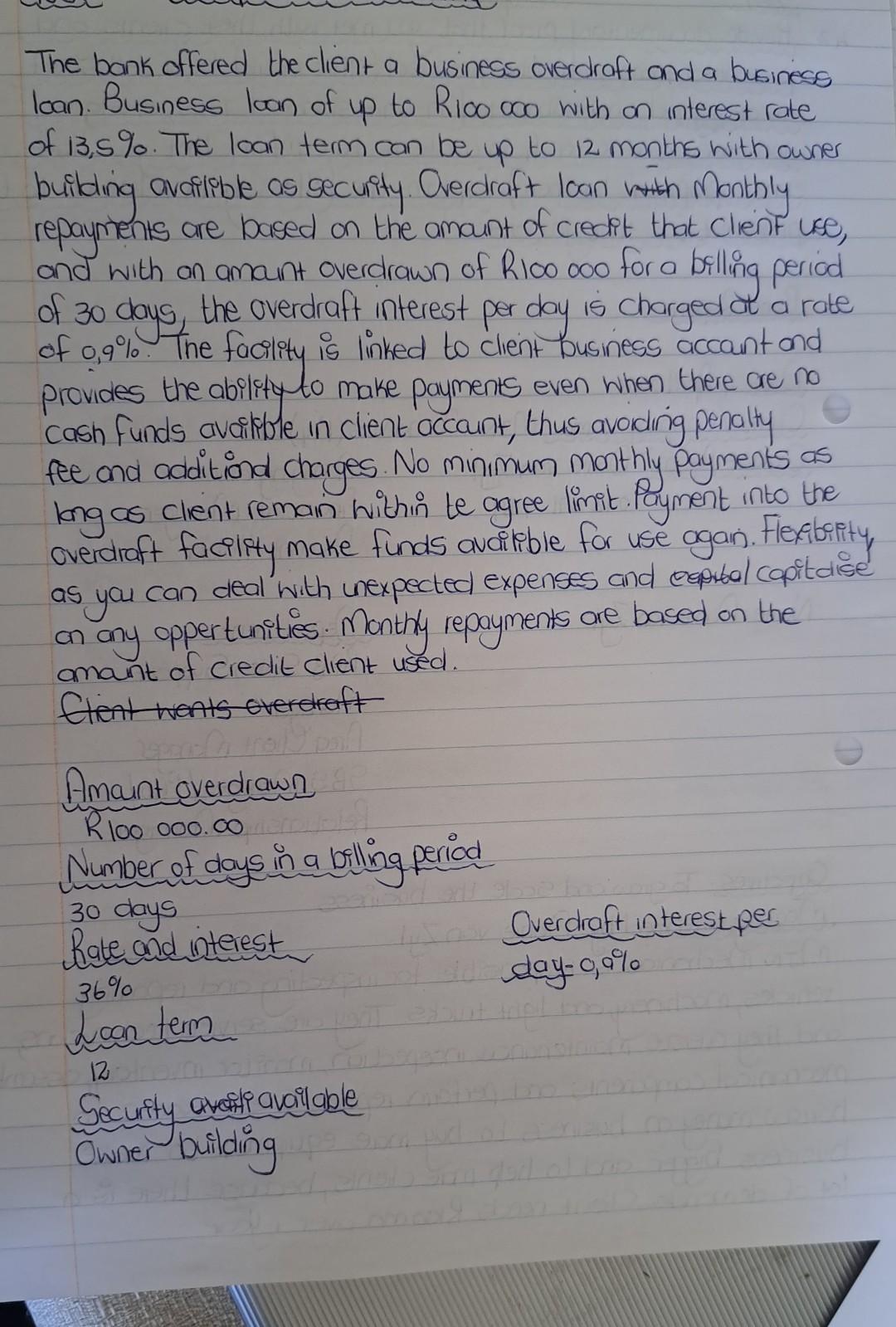

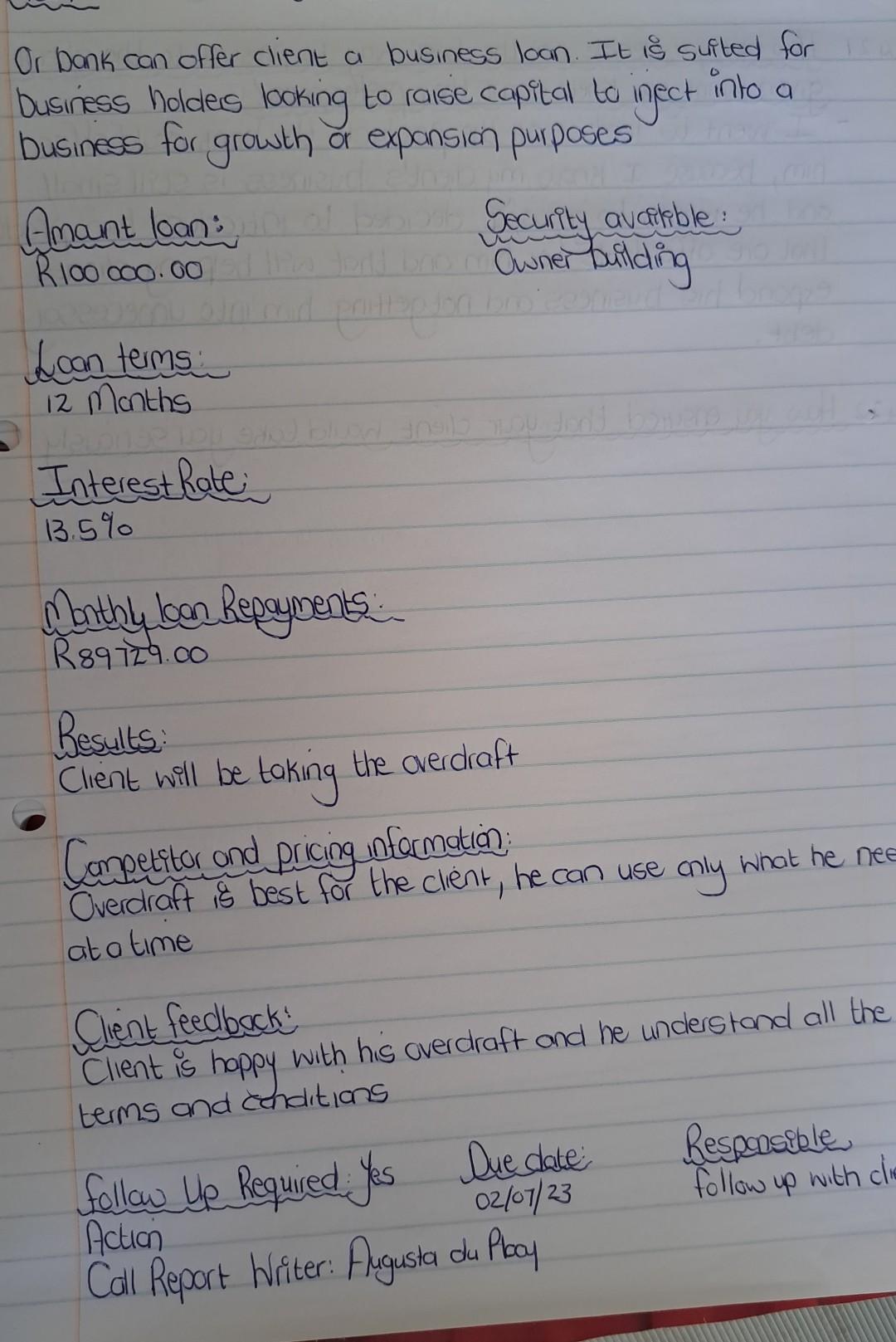

Date : 4 Apiil 2023 Client/Company name: MJN mechanics (Pty) Lid Contact Persas Danie van Zyl, Managing Director Dear mr. Van Zyl Thank Yar for considering aur bank for your financial needs. We are happy to offer you a business orerdraft facility of Ricocoo which is linked to your business occaint and) provide you with the ability to make payments even when there are no cash funds ovdritible in your accaunt, thus avoiding penalty fees and additianal charges. The facility has no minimum monthly payments as long as you remain within the agreed limit. Payments into the overdraft facility makes funds availible for use again, ensur that you have the flexibility to deal with unexpected expense and capitalize on any opportunities that come your way. manthly repaymentis are based on the amaint of credit t you use, and with an amaunt overdrawn of R100000 for a billing period of 30 days, the overdraft interest per day charged at a rate of 0,q% In addition, if you are looking to raise capital to inject into your business for growith ar expansion purpases, we co also offer you a business loan of up to R100000 with on interest rate of 13.5%. The loan term can be up to 12ma with owner building avariible as security. He understand that you are looking to borrow R 100000 over a year to buy more equipment and help more clients due to the high demand in your business. We believe that our overdraf facility waild be the best option for your business, as it offers yoi the flexibility to use only what you need at a time, and the interest rate charged is also lower compared to the loon option. Please do not hesitate to contact us if you have any questions or concerns regarding the offer. Our team is always here to assist you and provide yoi with the best financial solutions for your business. Thank you for yar time and consideration. Kind regards Augusta du Plocy Redationship manager. W.1. Yur evgluation of how well these proposal met the clients needs - Excellent, my cient was very happy with my proposal becalse he doesn't hant to incur too much debt and because he only want to pay for what he uses. 4.1.2 Hew well you considered alternatives for the client; Well, because the client can also consider a personal loan because he can pay it off in a year and the monthly installment gaes directly down every month at the same Mrovide documentary proof that you met with these clients and presented them with the proposal (This caild bea call sheet as designed and submitted in unit standard 7345 , a signed document or a letter from a client to comfirm that yau have done a proposd to them). Explain the following in relation to the presentations that you did: Bank Report Date: 4 April 2023 Client: /Company name: MJN Mechanics (Pty) Ltd Cantact Person: Danie van Zy I Managing director 0723917169 Financial Manager Name: Danie van Zyl Department Alanager Area Client monager S.BS monager / PRB | Relatianship nanager Objectives: To graw and scale the business Meeting attended by: Danie van Zyl. MIN Mechanics is responsible for inspecting and repairing vehicles, machinery, and light trucks. They are service techinicions, and they oversee Maintenance insepection, manitor inventary, assemble mechanical components and perfarm repars. Client wants to boriau maney on business to buy more equipment to make business bigger and to hep mare clients, because there is a lot of demands. Client needs Rloocoo over y Year The bank offered the client a business overdraft and a business loan. Business loan of up to R100 000 with on interest rate of 13,5%. The loan term can be up to 12 months with owner building availible as security. Overdraft loan with monthly repayments are based on the amount of credit that client lise, and with on amaint overdrawn of R100 000 for a billing period of 30 days, the overdraft interest per day is charged at a rate of 0,9%. The facility is linked to client business accant and cash funds avaikble in client account, thus avoiding penalty flee and additiond charges. No minimum monthly payments as lang as client remain within te agree limit. Payment into the overdraft facility make funds availible for use agan. Flexibility, as you can deal with inexpected expenses and eepital copitdise on any oppertunities. Monthy repayments are based on the amant of credit client used. Amaint overdrawn Number of days in a billing period 30 days Rate and interest 36% Loan term Security atefili available Owner building Or bank can offer client a business loan. It is suited for business holders looking to raise capital to infect into a business for growth or expansion purposes fmaint loan: Security availible: R100 000.00 Owner building Loan terms: 12 months Interestrate: 13.5% Monthly loan Repayments: R89729.00 Results: Client will be taking the overdraft Competitor and pricing information: Overdraft is best for the client, he can use only what he nee at a time Client is happy with his overdraft and he understand all the Glient feedback: terms and cenditions follow Ue Required: Yes Due date: Respensiple, 02/07/23 follow up with di Coll Report Writer: Augusta du Pboy ActionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started