Answered step by step

Verified Expert Solution

Question

1 Approved Answer

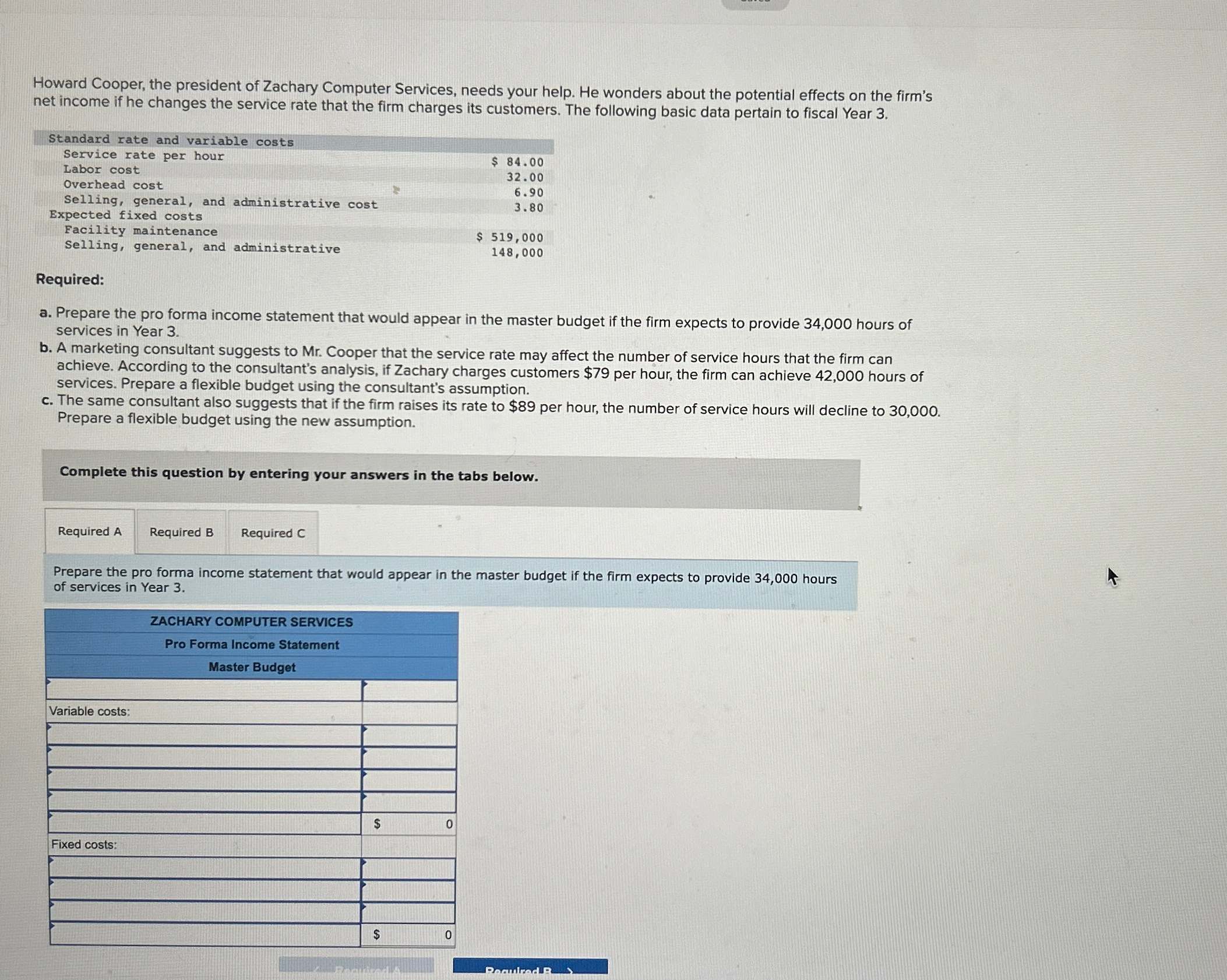

Howard Cooper, the president of Zachary Computer Services, needs your help. He wonders about the potential effects on the firm's net income if he changes

Howard Cooper, the president of Zachary Computer Services, needs your help. He wonders about the potential effects on the firm's net income if he changes the service rate that the firm charges its customers. The following basic data pertain to fiscal Year

Standard rate and variable costs

Service rate per hour

Labor cost

Overhead cost

Selling, general, and administrative cost

Expected fixed costs

Facility maintenance

Selling, general, and administrative

$

Required:

a Prepare the pro forma income statement that would appear in the master budget if the firm expects to provide hours of services in Year

b A marketing consultant suggests to Mr Cooper that the service rate may affect the number of service hours that the firm can achieve. According to the consultant's analysis, if Zachary charges customers $ per hour, the firm can achieve hours of services. Prepare a flexible budget using the consultant's assumption.

c The same consultant also suggests that if the firm raises its rate to $ per hour, the number of service hours will decline to Prepare a flexible budget using the new assumption.

Complete this question by entering your answers in the tabs below.

Required

Required B

Prepare the pro forma income statement that would appear in the master budget if the firm expects to provide hours of services in Year

tabletableZACHARY COMPUTER SERVICESPro Forma Income StatementMaster BudgetVariable costs:,Fixed costs:,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started