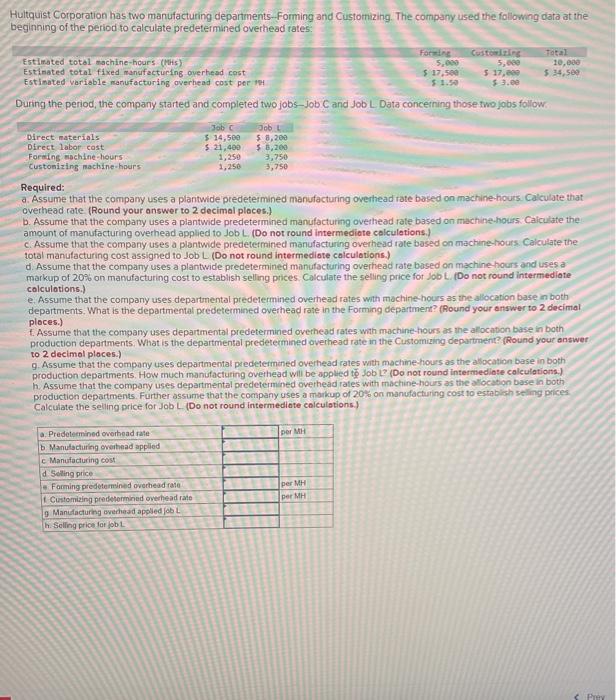

Hultquist Corporation has two manufacturing departments. Forming and Customizing. The company used the followng dara at the beginning of the period to calculate predetermined overhead rates: During the period, the company started and completed two jobs - Job C and Job L. Data concerning those two jobs follow. Required: a. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. Calculate that ovethead rate. (Round your answer to 2 decimal places.) b. Assume that the company uses a plantwide predetermined manufacturing ovethead rate based on machine-hours. Calculate the amount of manufacturing overhead applied to Job L. (Do not round intermediate calculetions.) c. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machinehours. Calculate the total manufacturing cost assigned to Job L (Do not round intermediate calculotions.) d. Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine hours and uses a markup of 20% on manufacturing cost to establish seling prices. Calculate the selling price for Job L.. (Do not round intermediate colculations.) e. Assume that the company uses departmental prederermined overhead rates with machine-hours as the allocation base in both departments. What is the departmental predetermined ovethead rate in the Forming departmert? (Round your answer to 2 decimal ploces.) f. Assume that the company uses departmental predetermined overhead rates with machine-hours as me allocation base in both production departments. What is the departmental prederermined overhead rate in the Customizing department? (Round your answer to 2 decimal ploces.) 9. Assume that the company uses departmental predetermened overhead rates with machine hours as the allocation base in both production departments. How much manufacturing ovethead will be appled t lob l? (Do not round intermediote calculetions.) h. Assume that the company uses departmental predetemined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a makup of 20% on manufacturing cost to estabich seling Pices Calculate the seling price for Jab L. (Do not round intermediote colculations.)