hurry up please

thank you so much!!

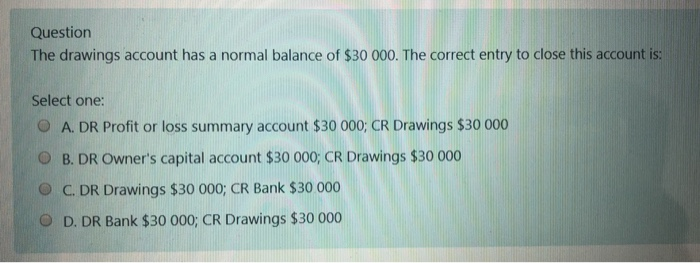

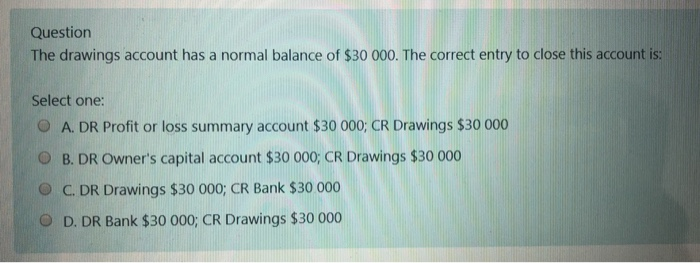

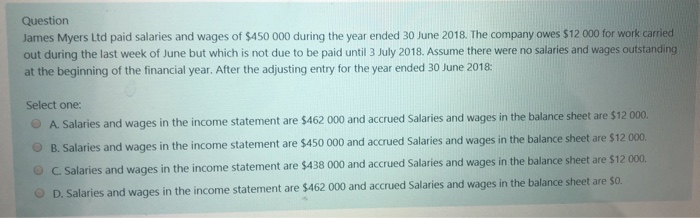

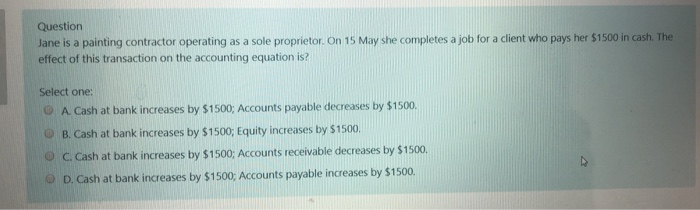

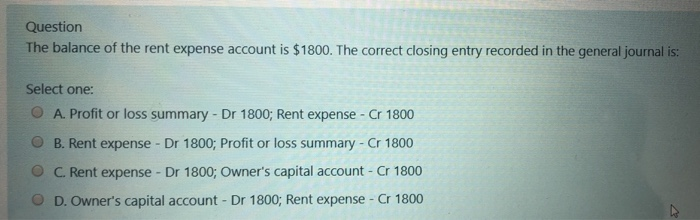

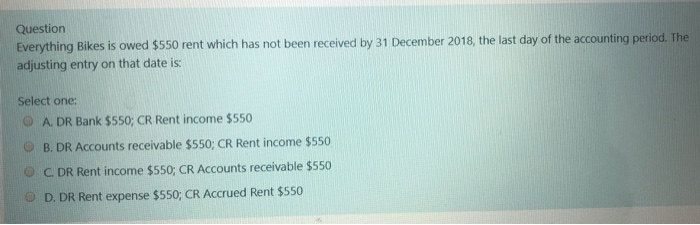

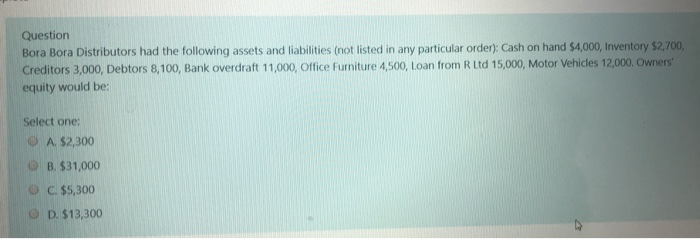

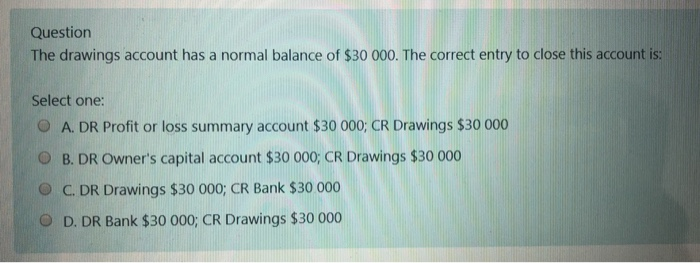

Question The drawings account has a normal balance of $30 000. The correct entry to close this account is: Select one: O A. DR Profit or loss summary account $30 000; CR Drawings $30 000 O B. DR Owner's capital account $30 000; CR Drawings $30 000 OC. DR Drawings $30 000; CR Bank $30 000 O D. DR Bank $30 000; CR Drawings $30 000 Question James Myers Ltd paid salaries and wages of $450 000 during the year ended 30 June 2018. The company owes $12 000 for work carried out during the last week of June but which is not due to be paid until 3 July 2018. Assume there were no salaries and wages outstanding at the beginning of the financial year. After the adjusting entry for the year ended 30 June 2018: Select one: A. Salaries and wages in the income statement are $462 000 and accrued Salaries and wages in the balance sheet are $12 000 O B. Salaries and wages in the income statement are $450 000 and accrued Salaries and wages in the balance sheet are $12 000 C. Salaries and wages in the income statement are $438 000 and accrued Salaries and wages in the balance sheet are $12.000. D. Salaries and wages in the income statement are $462 000 and accrued Salaries and wages in the balance sheet are 50 O Question On 1 May 2018, Dress in Style received a $2000 advance payment from a customer for the design and making of a formal gown. The gown is expected to be completed by the end of August 2018. By 30 June 2018, approximately half of the dress is complete. The correct adjusting entry to be recorded at 30 June 2018 is: Select one: O A. DR Dress-making expenses $1000; CR Uneared income $1000 B. DR Unearned income $1000; CR Bank $1000 OC. DR Unearned income $1000; CR Dress making income $1000 OD. DR Income earned $1000, CR Dress-making income $1000 Question Jane is a painting contractor operating as a sole proprietor. On 15 May she completes a job for a client who pays her $1500 in cash. The effect of this transaction on the accounting equation is? Select one: O A. Cash at bank increases by $1500; Accounts payable decreases by $1500. O B. Cash at bank increases by $1500; Equity increases by $1500. O C. Cash at bank increases by $1500; Accounts receivable decreases by $1500. D. Cash at bank increases by $1500; Accounts payable increases by $1500. Question The balance of the rent expense account is $1800. The correct closing entry recorded in the general journal is: Select one: O A. Profit or loss summary - Dr 1800; Rent expense - Cr 1800 O B. Rent expense - Dr 1800; Profit or loss summary - Cr 1800 O C. Rent expense - Dr 1800; Owner's capital account - Cr 1800 O D. Owner's capital account - Dr 1800; Rent expense - Cr 1800 Question Everything Bikes is owed $550 rent which has not been received by 31 December 2018, the last day of the accounting period. The adjusting entry on that date is: Select one: O A. DR Bank $550; CR Rent income $550 B. DR Accounts receivable $550; CR Rent income $550 OC. DR Rent income $550; CR Accounts receivable $550 OD. DR Rent expense $550; CR Accrued Rent $550 Question Bora Bora Distributors had the following assets and liabilities (not listed in any particular order): Cash on hand $4,000, Inventory $2,700, Creditors 3,000, Debtors 8, 100, Bank overdraft 11,000, Office Furniture 4,500, Loan from R Ltd 15,000, Motor Vehicles 12,000. Owners equity would be Select one: O A $2,300 B. $31,000 C. $5,300 D. $13,300