Answered step by step

Verified Expert Solution

Question

1 Approved Answer

husky Enterprises recently sold an issue of 11 year maturity bonds. The bonds were sold at a deep discount price of $475 each. After flotation

husky Enterprises recently sold an issue of 11 year maturity bonds. The bonds were sold at a deep discount price of $475 each. After flotation cost, husky received $455.12 each. The bonds have a $1000 maturity value and pay $40 interest at the end of each year. Compute the after-tax cost of debt for these bonds if huskies marginal rate is 40%.

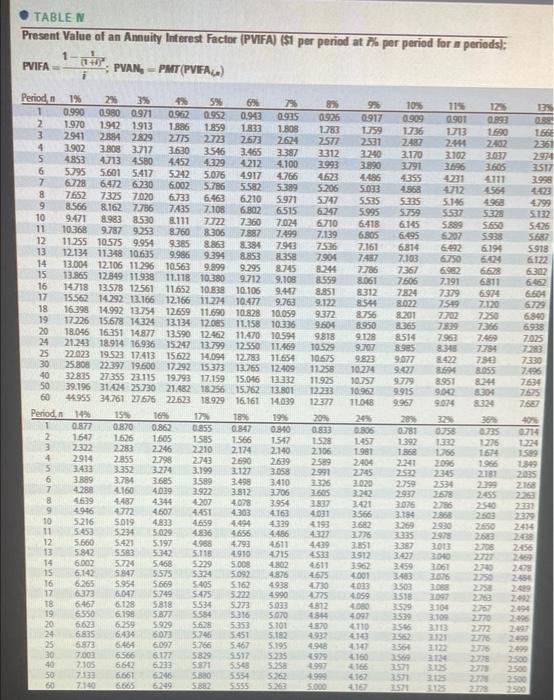

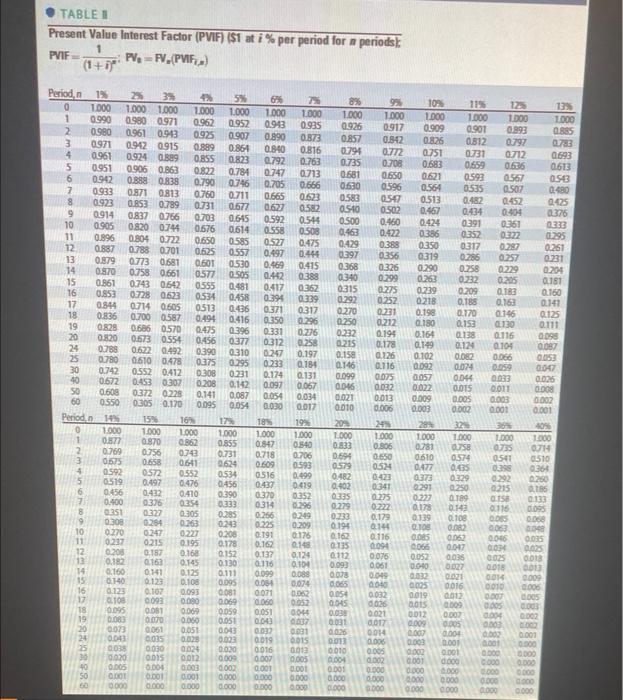

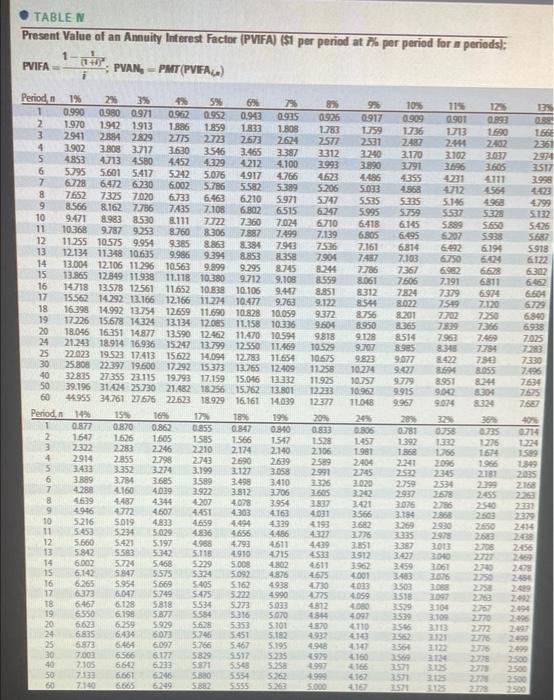

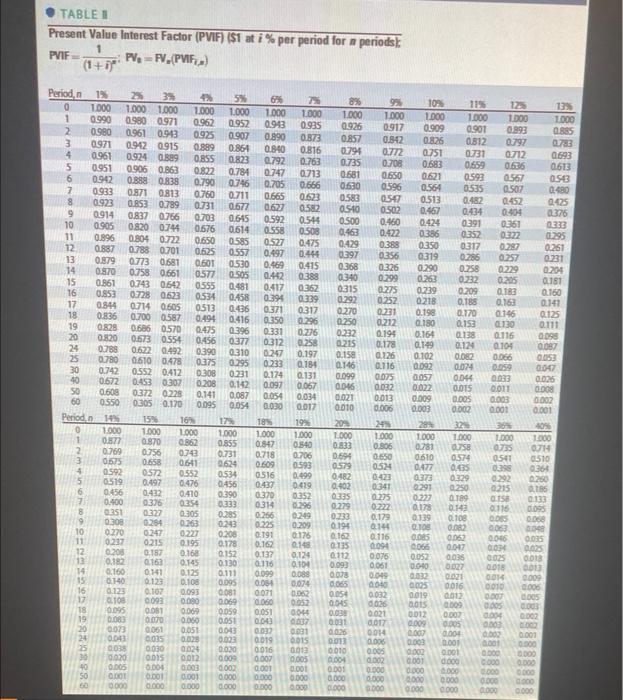

Present Value of an Annuity Interest Factor (PVTFA) (\$1 per period at ho per period for n periods): PVIFA=i1(1+1)x1;PVAN6=PMT(PVFPAi=e) Present Value Interest Factor (PVIF) i\$1 at i% per period for n periods): PVIF=(1+i)21,PV0=Pn(PFi,n)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started